After hitting a maximum of $65,722 at noon yesterday (19th), Bitcoin started to fluctuate and decline again. It only started to fall again after reaching a low of $64,666 at around 4 o'clock this morning (20th) After a rebound, the current price at the time of writing is $65,109, trying to hold on to the 65,000 level.

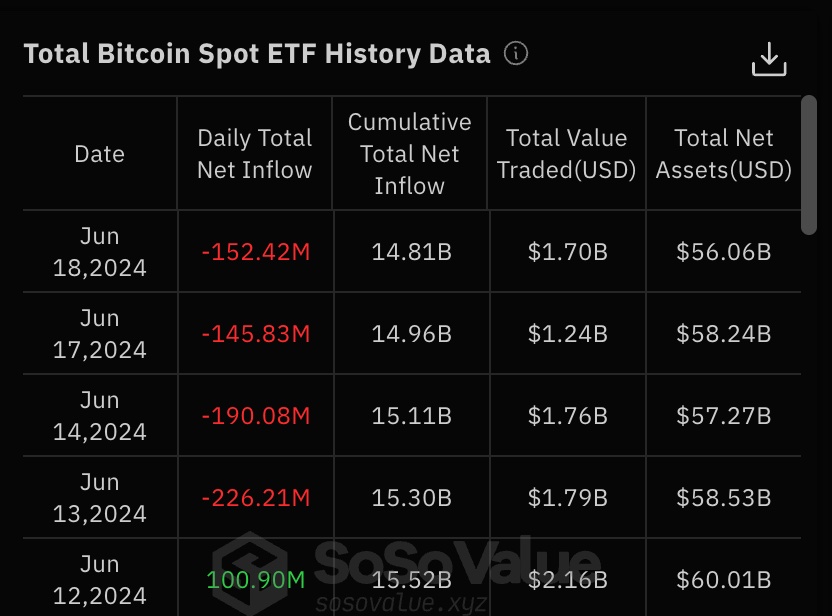

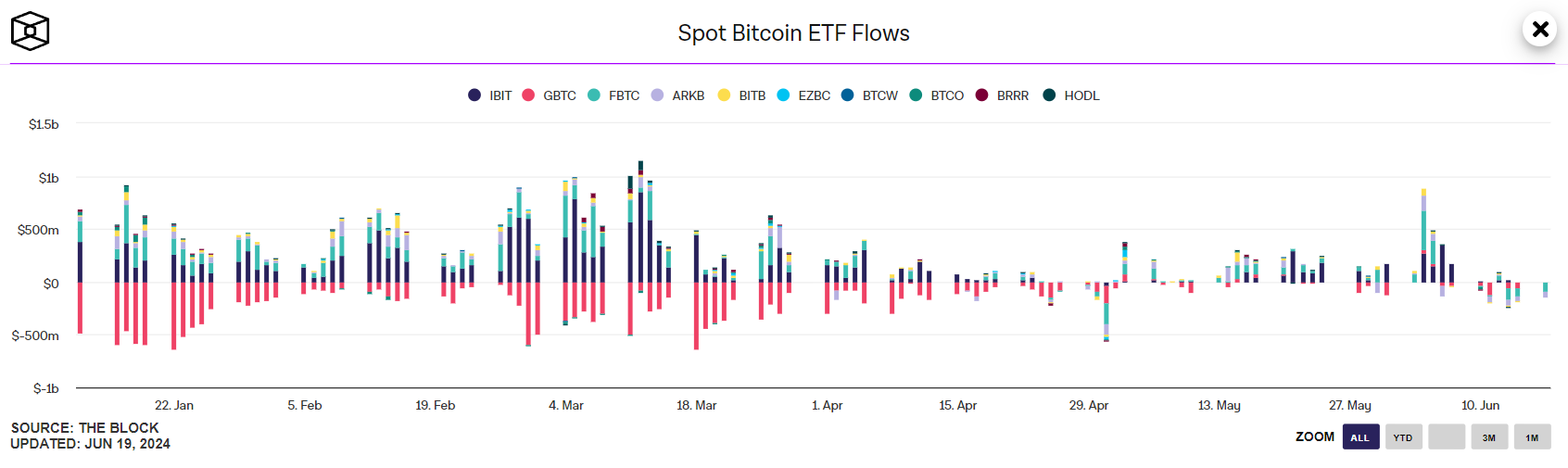

On the other hand, the buying performance of the U.S. Bitcoin Spot ETF was also poor. According to Sosovalue data, as of June 18, it was the fourth consecutive day of net outflows.

Bernstein, a well-known Wall Street investment bank, also pointed out in a report on Tuesday (18) that with the release of the earlier 13F institutional position report, analysts believe that Bitcoin spot ETF funds currently still mainly come from retail investors, with institutional investors accounting for only 22% of the overall share.

And 36% of institutions mainly participate in "futures arbitrage", that is, while buying one Bitcoin, they also choose to short one Bitcoin in the futures market to obtain price difference arbitrage, which is not Pure Bitcoin bulls.

Bernstein: Large institutions are expected to enter the Bitcoin spot ETF in the second half of the year

However, Bernstein analysts Gautam Chhugani and Mahika Sapra also proposed a positive factor, that is, large securities companies and private banks. Bitcoin spot ETFs will be officially included in the investment portfolio in the third or fourth quarter of this year: after "spot arbitrage", institutional investors will gradually begin to evaluate whether they will turn to long Bitcoin. In addition, 13F documents also show that the share of Bitcoin spot ETFs in the investment portfolios of most small and medium-sized investment advisers only accounts for 0.1% to 0.3%. We believe that the further growth of Bitcoin spot ETFs will be driven by large investment institutions starting to place bets and existing investment institutions expanding their investment space.

In addition, new financial accounting standards will also stimulate corporate demand for Bitcoin: Another factor is that new financial accounting standards will be more conducive to companies holding Bitcoin on their balance sheets We predict that in 2024, there will be new additions in enterprises, such as micro-strategy companies.

Where is the bargain hunting point?

In view of this, although the Bitcoin spot ETF has recently experienced four consecutive days of net outflows, Bernstein still expects that capital inflows will accelerate again soon, and investors should focus on buying at the moment. Opportunity is $60,000 low and $50,000 high: We expect Bitcoin ETF inflows to accelerate again in Q3 and Q4, with the current volatile market providing new buying opportunities and further institutional demand thereafter Pull up. Strategically speaking, Bitcoin's low of $60,000 and high of $50,000 are both buying points worthy of attention at the moment.

This bull market is still early

Last week, Bernstein predicted that due to the huge demand that Bitcoin spot ETFs will bring and miners after the halving Output, they raised their price target for Bitcoin at the end of 2025 from $150,000 to $200,000, and ultimately expected Bitcoin to reach an unprecedented $500,000 in 2029 and hit the $1 million mark in 2033.

In Tuesday’s report, Bernstein not only re-emphasized these predictions, but also added that Bitcoin’s current price of $60,000 to $70,000 is still at the low level of this bull market, due to potential buying demand from institutions. This bull market may still be in its early stages: the current price of $60,000 is equivalent to the price of $10,000 during the same period after Bitcoin’s halving in June 2020. Despite Bitcoin’s massive 53% rise from $42,000 at the start of the year, it may still be in the early stages of this cycle. This change will mainly be driven by the demand for ETFs. BlackRock’s ETF scale has reached US$20 billion. We are likely to see a scale of US$80-100 billion in this cycle.

The above is the detailed content of Bitcoin holds on to $65,000! Bernstein: Large institutions are expected to enter the market in the second half of the year. For more information, please follow other related articles on the PHP Chinese website!