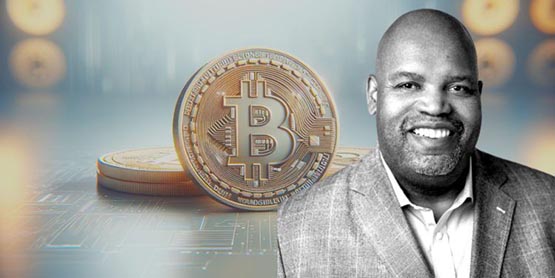

The launch of a Bitcoin spot ETF appears to be about to become a reality. Bitcoin prices rose all the way last night, with the highest price today reaching $47,248, a 21-month high. Reggie Browne, known as the "Godfather of ETFs," shared his views on Bitcoin spot ETFs in an interview with Bloomberg.

Reggie Browne, head of ETF trading and sales at Global Trading Strategies (GTS), pointed out that if the spot Bitcoin ETF is approved, the initial price is likely to be Trading at a premium above the spot price.

This premium occurs in part because of current restrictions on how U.S. institutions can trade cryptocurrencies. Since most U.S. brokers are unable to trade Bitcoin directly with cash within their brokerage operations, they have to hedge their trades with futures trades and trade Bitcoin at a premium before choosing to close the position, which increases the complexity of the operation. Complexity.

This complexity, combined with the fact that Bitcoin futures trade at a premium to spot prices, will cost investors significant fees, with 8% being proposed as a possible reference point.

According to Reggie Browne, despite some trading complexities, market liquidity is very strong, which allows spreads to remain stable within a competitive and tight range.

He further emphasized that market makers are ready to provide liquidity for the new trading structure and build resilience, and investors do not need to worry too much about price differences.

Reggie Browne’s views have attracted the attention of many analysts. Bloomberg ETF analyst James Seyffart said he was shocked. He pointed out that Reggie Browne is a very experienced ETF market maker, not someone who makes casual comments.

Overall, James agrees with the view that brokers cannot have direct exposure to Bitcoin and use futures for hedging, which he believes can cause trouble. However, he believes that the 8% premium seems too high and needs time to be verified.

It is understood that Reggie Browne plays a core role at the godfather level in the ETF industry. He has been providing liquidity to new and existing ETFs since the launch of the SPDRS & P500 ETF Trust (SPY) in 1996. Prior to joining GTS, Browne held senior leadership positions at Cantor Fitzgerald, Newedge USA, Susquehanna International Group and O'Connor Associates.

His achievements in the ETF field include serving as the designated market maker for many first-of-its-kind ETFs and developing multiple international ETF markets. In 2019, he received the Lifetime Achievement Award from ETF.com.

The above is the detailed content of Bitcoin spot ETF could trade at 8% initial premium: ETF father. For more information, please follow other related articles on the PHP Chinese website!