Cosmos in recovery

If I were asked to choose a blockchain project that I feel most sorry for, I would choose Cosmos.

Cosmos was the first to propose and promote the concept of interconnection of ten thousand chains, aiming to break the silos between different chains. Together with Polkadot, it is known as the duo of cross-chain technologies. Its cross-chain technology enables different blockchain networks to communicate with each other. This grand vision and mature and open development environment make Cosmos quickly become the first choice for developers. Today, the Cosmos ecosystem is second only to the Ethereum ecosystem in the number of developers.

The development of things is always full of twists and turns, and Cosmos is no exception. The LUNA thunderstorm incident had a huge impact on $UST, almost reducing its value to zero. Prior to this, there had been no native stablecoins in the Cosmos ecosystem, so exchanges across the network were conducted through encapsulated stablecoins. Until Terra connected to IBC, $UST became a widely used stablecoin in the Cosmos ecosystem. Therefore, the LUNA thunderstorm event caused huge trauma to the Cosmos ecosystem. The total value locked (TVL) of Osmosis, the most active Dex protocol, has dropped from its peak of $1.75 billion in April 2022 to less than $100 million currently. This decline reflects investor concerns about the Cosmos ecosystem and concerns about the impact of the LUNA incident.

At present, fortunately, the popularity of the Cosmos ecosystem is gradually recovering, although the price is still within a lower valuation range. However, some leading protocols such as DYDX have begun to be deployed in the Cosmos ecosystem, and developers who started entering the Cosmos ecosystem last year have gradually made some achievements in the second half of this year.

The following is a new lending project Hover based on Kava. I want to share it to briefly look forward to the development of the Cosmos ecosystem and think about how "new players" in the lending field should move forward.

The reason I initially paid attention to Hover was because Tether deployed USDT on Kava. Although Tether has USDT deployed on many other blockchains, it has yet to appear in the Cosmos ecosystem. I believe that with the recovery of Cosmos, once various trading platforms begin to support the Cosmos-USDT network for deposit and withdrawal operations, it will bring a large amount of native liquidity to the entire ecosystem.

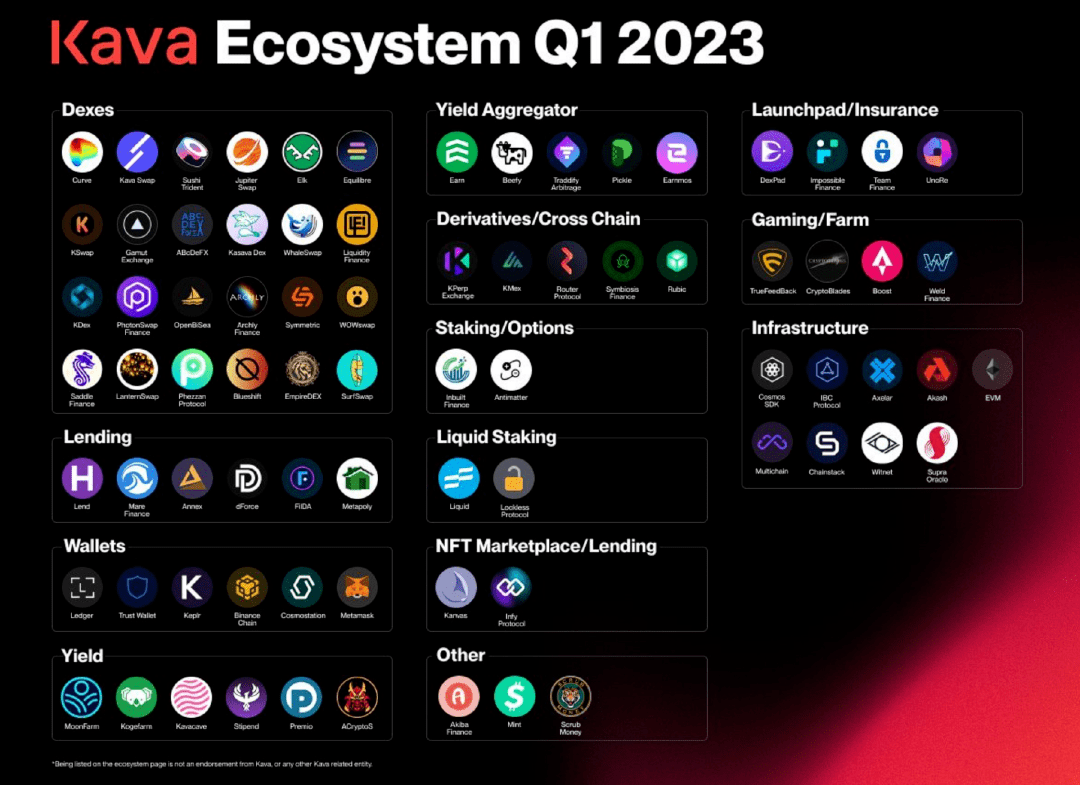

After the launch of the Kava10 mainnet, Kava not only activated the EVM, but also linked to the Cosmos ecosystem through the IBC protocol. The advantage of this co-chain architecture is that it combines the flexibility of Ethereum smart contract development with the interoperability of the Cosmos SDK. This allows Kava to easily deploy various mainstream liquidity protocols, revenue aggregators, DEX and other applications. Through its connection with the Cosmos ecosystem, Kava achieves seamless integration of cross-chain transactions and asset transfers, providing users with more convenient and diversified financial services. At the same time, Kava also provides developers with greater innovation space and development tools through interoperability with the Ethereum ecosystem, promoting the further development of DeFi.

We can further pay attention to new projects in this ecology and look for potential stocks in order to look forward to the opportunities of the next round of bull market.

The picture above is an overview of the Kava ecosystem (as of the first quarter of 2023, Hover has not yet been launched and is not included)

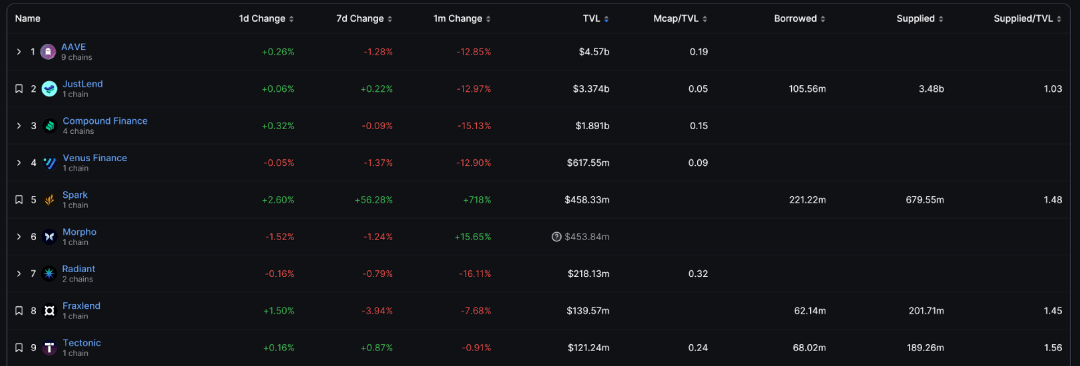

For entrepreneurs, the network scale effect on Ethereum is very strong. Latecomers in the lending field face direct comparison and competition with Aave and Compound. Since the lending platform in the capital pool model is a typical two-sided market, its network Once the effect is established, it is difficult to overcome. The leading lending protocol has been used by a large number of other protocols on Ethereum, and it is difficult for emerging lending protocols to replace its status.

This makes it difficult for other new lending projects to come out. It is a good choice to choose other potential chains as a starting point. For example, Venus on BSC, Benqi on Avalanche, Radiant on Arbitrum, and even Anchor on Terra are all relatively successful cases of "seizing the sinking market".

The picture above shows the ranking of DeFi lending platforms (data: DefiLlama)

At present, the application ecosystem on the Kava network has exceeded 100, and even Curve and Layerzero’s head project Stargate are deployed in Kava. In the future, Kava is expected to become the center of the native stable currency of the entire Cosmos ecological application chain. As a member of Kava EVM, Hover can naturally enjoy Kava's liquidity, and can also cover the entire Cosmos ecosystem through IBC technology, which gives Hover a huge potential user base.

Choose a chain for encryption project deployment, just like choosing a storefront for a business. I judge the reason why Hover chose Kava. In addition to avoiding direct competition with large-scale projects on Ethereum, Hover may also see the advantages and potential of Kava. By basing itself on Kava, it can well radiate to the entire Cosmos ecosystem.

The way to learn from each other’s strengths

Hover adopts a fund pool model similar to Aave and Compound. Unlike traditional peer-to-peer lending, the fund pool model does not require matching individual lenders and borrowers, providing higher capital utilization because funds can be borrowed immediately by anyone who needs them without waiting for a specific lender or borrower. Borrower. This approach has already proven its merits in other successful cases.

In order to better balance the supply and demand relationship in the market, Hover has launched a dynamic jump interest rate model. When liquidity in the pool is plentiful, interest rates are lower, encouraging more borrowing; and when liquidity becomes tight (borrowing reaches 80%), interest rates rise sharply, encouraging repayments and more deposits. .

For new projects, the management team needs to create opportunities to build a user base in order to benefit from the gradually growing network effects. A common approach is to use periodic token incentives to attract participation from the initial user group. But it’s crucial to maintain the right balance in the process, both to fully motivate early users until the product matures to a stage where it can appeal to a wider audience, and to avoid problems associated with an unsustainable economic model.

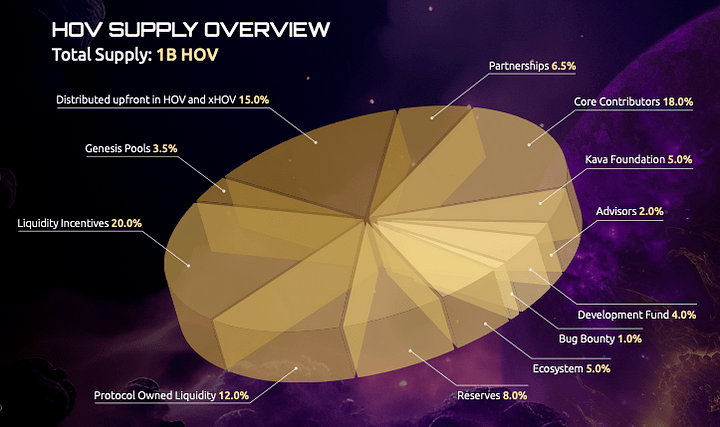

Stones from other hills, can learn. Hover will provide additional incentives to liquidity providers in the early stages, which account for 20% of the entire token allocation. This is enough to ensure that the platform can always provide users with competitive incentives in the early stages and attract more funds to be injected into the pool. middle.

Hover Genesis Pool is about to be launched. Although the official has not disclosed much information yet, I judge that it is similar to the "head mine" of other DeFi projects, and it quickly acquires users and liquidity for the platform through high APY. Generally speaking, the first-miner rewards are good, but they also bear more risks (such as mining coin crashes, product technical problems, security issues, etc.). More information will be shared after it goes online.

As far as the product itself is concerned, Hover draws on the experience of mature lending projects such as Aave, and is quite satisfactory compared to other lending projects. And functions such as flash loans, which frequently cause problems with small and medium-sized lending agreements, have not been opened for the time being. Hover is technically supported by Rome Blockchain Labs, the same company that provides technology for BENQI and Moonwell. The well-known on-chain risk management platform Ledger Works assists in risk control, and WatchPug also provides contract audits. The security is relatively stable.

Analysis of Hover economic system: How to achieve long-term growth?

In the encryption market, a successful project not only needs strong product support, but also an excellent economic model to drive the sustainable development of its ecosystem.

I believe that the design purpose of the economic model should first be to put the long-term development of the agreement first, rather than to satisfy the individual interests of any of the many agreement participants. This is to make the pie bigger first. Only when the protocol achieves rapid and stable growth without major accidents, then from a long-term perspective, for all participants, especially currency holders, the benefits gained will be maximized. of.

Most of the past DeFi projects and economic models were limited by history. Many old project tokens are used to raise funds for the project through ICO, and the actual application scenarios of the tokens are almost non-existent. And after a few years, the chips have been dispersed, and even if you want to add some new application scenarios in the future, you will be unable to do so. Compared with old DeFi projects, new projects like Hover have certain late-mover advantages.

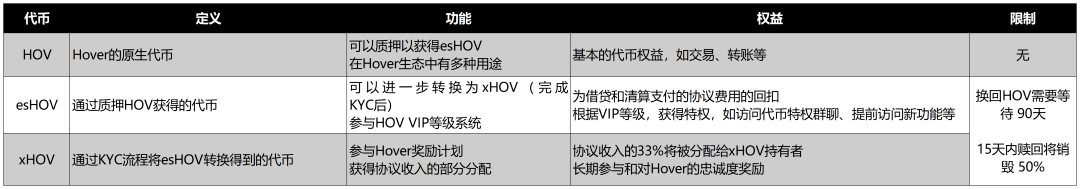

Hover’s token economy consists of three tokens and two plans (Staking and Reward). HOV is the eco-tradable core token. By staking HOV, users can convert it to esHOV to participate in the Hover staking program and enjoy benefits such as discounts on borrowing fees, liquidation rebates, and governance voting rights. Additionally, users have the option to pass KYC in order to convert xHOV, thereby participating in the Hover Rewards Program, which offers all of the above benefits plus the ability to charge a portion of the protocol fees. Both esHOV and xHOV are non-transferable and powered by HOV.

The picture above shows Hover token distribution

Through careful analysis of Hover’s economic model, I believe that Hover’s economic system mainly revolves around two cores:

1. Make the cake bigger and divide the cake well. Subsidies can be used to absorb more liquidity into the pool in the early stages and help the ecosystem grow rapidly. The rights and benefits enjoyed by participants must be as equal as possible to their contributions to the protocol (such as trust and holding). Encourage users to participate deeply and hold for a long time, and distribute more benefits to long-term holders who are optimistic about the ecology.

2. Compliance. The project side has not yet made it clear that it wants to operate in compliance with regulations, but the higher rights and interests of KYC users have confirmed this. As cryptocurrency is adopted by more and more people, supervision is constantly increasing, and compliance operations are inevitable.

From the perspective of lending itself, the audience for future lending will no longer be limited to on-site leverage. Users outside the crypto world will inevitably be welcomed, and non-crypto assets will be introduced as collateral, such as tokenized securities and real estate. Wait, the currently popular RWA track is a good try. These will bring potential business increases to the existing crypto lending market.

Therefore, it is a great choice for Hover to actively embrace compliance in the early stages.

The picture above shows the Hover token function

HOV:

HOV, as the native token of the Hover ecosystem, is not only a trading medium, but also the basis for participating in the HOV ecosystem. Users need to participate in Hover by staking HOV, and there will be more uses in the future.

esHOV:

esHOV is a reward for users to hold HOV for a long time. Users can obtain esHOV by locking and staking HOV, and esHOV represents the user's rights and interests in the Hover protocol. This design encourages users to hold HOV for the long term instead of short-term trading.

Staking plan and VIP level: By staking Hover tokens, users can join the HOV VIP level. These tiers offer users a range of benefits, such as rebates on protocol fees paid for lending and clearing. In addition, different levels will also provide users with privileges such as access to token privileges and early access to new features to ensure that the most active users can obtain the most benefits.

xHOV:

Hover has partnered with Quadrata and users can convert their esHOV to xHOV after completing the KYC process to further participate in the Hover reward program. I think this step ensures the compliance and security of the protocol, and also demonstrates the vision of the Hover team, which should be working towards compliance.

xHOV holders can participate in the Hover rewards program, where 33% of protocol revenue will be distributed to stakers who complete KYC and convert their esHOV to xHOV. This not only provides additional revenue for users, but also further encourages long-term participation and loyalty to Hover from real users.

Redemption and Liquidity:

Users may wish to unstake under certain circumstances, at which point they can trigger the redemption process to convert their esHOV and xHOV back to HOV. This process has certain time limits, such as redemption which usually takes 180 days. But if users choose to redeem within 15 days, they must destroy 50% of the redeemed tokens as a penalty for early redemption. This mechanism is designed to encourage users to hold for the long term while providing stable liquidity to the protocol.

This is a very clever design, which increases the lock-up amount of HOV, strengthens the responsibility of HOV token holders, and of course adds benefits.

Summarize

If we only look at it from a speculative perspective, fully embracing and enjoying changes is a mentality that we must develop in this industry. When looking at projects in different ecology and different tracks, we should use different standards to judge them.

Take lending as an example. Liquidity on Ethereum has been sucked away by leading projects. Have new projects found the right market segment, or can the mechanism solve the problems of older generation products? It is a key factor that we need to examine. What we need to consider is whether it has enough innovation points, rather than blindly competing with Aave and Compound.

As for projects like Hover deployed on other chains, the focus we need to consider is the potential of the ecosystem, because project development is limited by the scale of the ecosystem itself. To decide whether to invest in a new public chain lending project, you must first predict the future development of the ecology where the project is located, in which the public chain party's support for the project is also very important.

Judging from Kava’s performance in the past year, it has been relatively smooth in the Cosmos ecosystem. With the injection of stable coins, Kava is expected to continue to occupy a higher position in the Cosmos ecosystem. Hover has a high development ceiling in Kava, a network with great potential. Judging from the incentive plan officially launched by Kava and the frequency of interaction with Hover, Hove is also expected to receive key support from Kava after it goes online.

Taken together, the Hover team has its own insights in terms of differentiation of product positioning and innovation of models and solutions. Technically it relies on external partners, and whether it is safe or stable needs to be tested by the market after it goes online.

The above is the detailed content of Reaching a balance between experience and innovation: Hover helps new forces rise. For more information, please follow other related articles on the PHP Chinese website!