At present, artificial intelligence is ushering in the "iPhone moment", and its spread is faster than any technological revolution in history.

However, Morgan Stanley pointed out in the report that it is undeniable that the uncertainty of AI development is high. VCs have keenly discovered this and pointed out the following "three major focus issues."

The AI industry is developing rapidly, and the speed of "technology diffusion" exceeds that of the Internet revolution. Modularity is the key to achieving faster growth in AI.

"Tech Diffusion" (Tech Diffusion) is one of the most important themes in recent years. It is the process from when a technology is first commercialized, through vigorous promotion and widespread adoption, until it is finally eliminated due to backwardness.

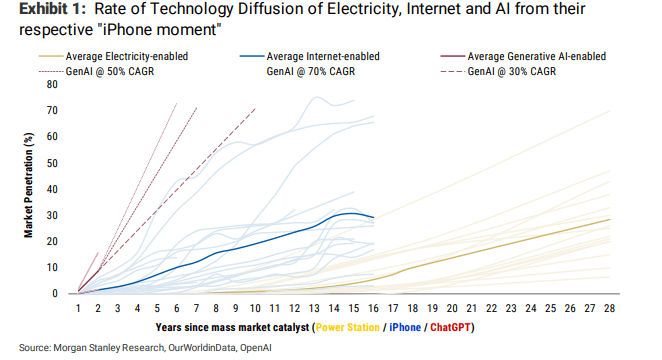

What is unprecedented is the speed and spillover effect of the diffusion of artificial intelligence technology into non-technical adjacent fields. To illustrate this point more clearly, the chart below compares the technology diffusion speed of the electricity revolution after 1885, the Internet revolution after 2007, and the artificial intelligence revolution after 2022.

Among them, modularity (Modularity sub-modules that specialize in different aspects of tasks) is the key to achieving faster growth and disruption through the innovation stack. The continued growth of AI depends on widespread internet access, which in turn requires cheap electricity to make possible. These large models of artificial intelligence will be based on modular forms and are equally applicable to areas of rapid growth and disruption in the future.

As more and more different tasks are encountered, the performance of AI is getting worse and worse, because model training cannot cover all scenarios. This is also the reason why most mainstream AI products rely on prompt words to give relatively logical answers. "Modularization", that is, dividing modules into specialized tasks to handle different aspects, is one of the solutions to the generalization problem. )

For example, open source plug-ins for companies with large models, such as OpenAI's newly released data analysis tool "Code Interpreter", will benefit from this modular expansion method and will create greater breadth, depth and stickiness of use. However, the rapid pace of adoption relative to any technology in history also means that Generative AI’s S-curve will only take months, rather than the years or decades expected in the past.

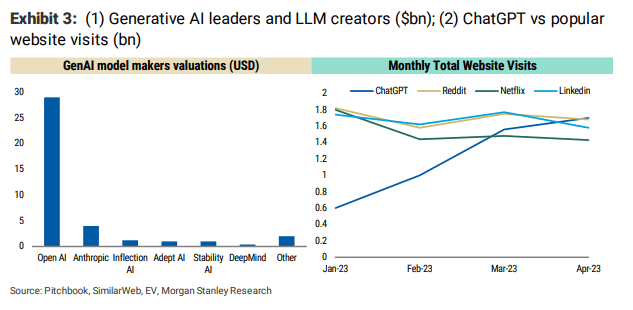

The 80/20 rule also exists in the financing and valuation of AI companies (80% of a company’s profits come from 20% of its projects). OpenAI recently raised another US$300 million, and its valuation is between US$27 billion and US$29 billion. . The company has raised a total of more than $11 billion in funding over the past seven rounds.

There is currently no competitor that can match OpenAI’s ChatGPT. Recent platform data shows that its number of monthly active users exceeds Reddit, Netflix and Linkedin, and is close to 2 billion.

However, on average, AI/ML company valuations are 60% lower than their valuation levels in January 2021, when AI/ML was in the midst of the hype cycle. Despite the clear growth in investment demand for AI (accounting for 10% of all venture capital investment), only a few private AI companies have passed the revaluation, and OpenAI is one such company.

The most heated question in recent weeks is how big is the moat of large model companies in the face of open source models?

As of 2023, investment funds in the AI field have exceeded US$12 billion, accounting for 10% of the total market venture capital. Despite re-achieving the Pareto point, 80% of the funding currently remains in the hands of large model owners rather than downstream APP manufacturers. The diffusion into non-tech industries has since accelerated.

Of course, there is a good reason - training larger and larger LLMs is expensive, and leveraging those models with APIs to create downstream applications is cheaper, and that seems to be the case now.

Will the emergence of open source LLM cause this capital deployment ratio to reverse at some point - whether in the public market or the private market, will financing be conducive to the emergence of low-cost open source LLM?

The above is the detailed content of How to invest in AI? 'Three major focus issues” faced by global first-tier VCs. For more information, please follow other related articles on the PHP Chinese website!

How to open mds file

How to open mds file How to use a few thousand to make hundreds of thousands in the currency circle

How to use a few thousand to make hundreds of thousands in the currency circle How to solve the problem that suddenly all folders cannot be opened in win10

How to solve the problem that suddenly all folders cannot be opened in win10 Solution to computer black screen prompt missing operating system

Solution to computer black screen prompt missing operating system Introduction to screenshot shortcut keys in win10

Introduction to screenshot shortcut keys in win10 curl_exec

curl_exec What are the cdn acceleration software?

What are the cdn acceleration software? WiFi is connected but there is an exclamation mark

WiFi is connected but there is an exclamation mark