What is the PPMT function in Excel?

If you want to know exactly how much of your monthly payment is principal payment, you can use the PPMT function in Excel. This feature will calculate your repayments on a principled basis from your first to your last loan. However, you need to provide it with some key information.

The syntax of the PPMT function is PPMT(rate, per, nper, pv, [fv], [type])where:

-

Interest rate (required) is the interest rate for each period.

-

Each (required) is the payment period you want to focus on, such as the second month.

-

Nper (required) is the total amount paid.

-

Pv (required) is the present value, which for a loan is how much you originally borrowed.

-

Fv (optional) is the future value you wish to retain after the last payment. Default is zero.

-

Type (Optional) Indicates whether payment is due at the beginning (1) or end (0) of each period. Default is zero.

How to use the PPMT function in Excel

The easiest way to use the PPMT function in Excel is to enter all the information about the loan into cells in a spreadsheet. You can then reference these cells in formulas. By tagging each piece of information you enter, you can easily keep track of what each value represents.

To use the PPMT function in Excel:

- Open your Excel spreadsheet.

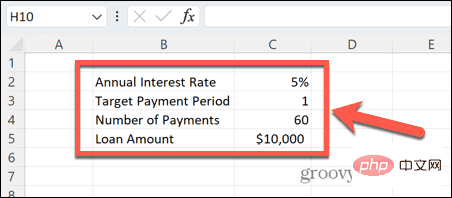

- Enter the interest rate, target payment term, number of payments, and loan amount in the spreadsheet.

- Select the cells where you wish to display principal payments.

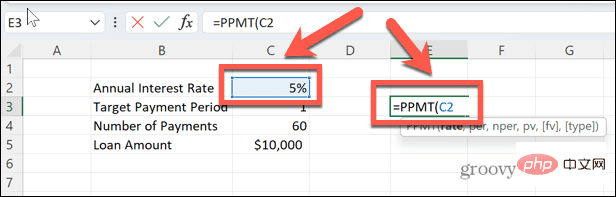

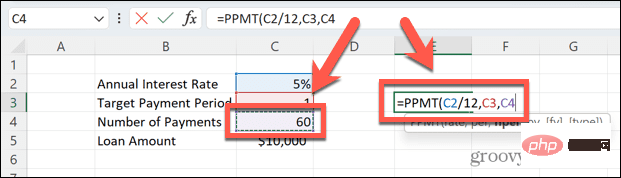

- Type =PPMT( and select the cell that contains your interest rate.

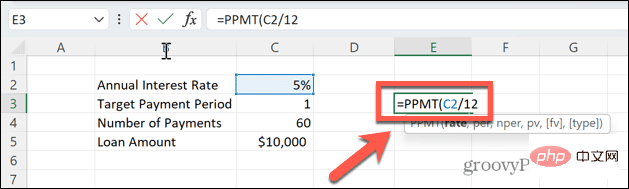

- If this is the annual rate and your payment is by For monthly payments, type /12 to use a monthly interest rate.

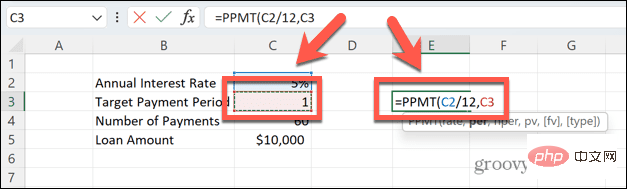

- Type a comma and click the cell that contains the target payment period. For example, the value 1 will calculate the principal payment for your first payment. The value 12 will calculate the principal payment for your twelfth payment.

- Type a comma and select the cell that contains the total payment. If you make monthly payments, this will be the number of months rather than the number of years of the loan.

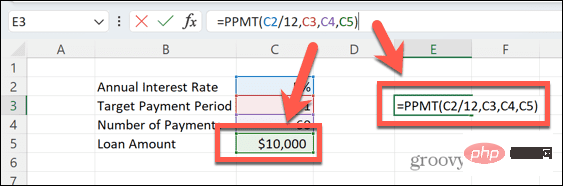

- Enter another comma and select the loan amount.

- Type the closing bracket to complete the formula.

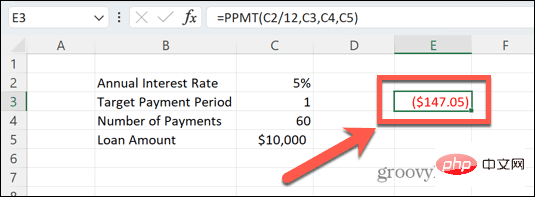

- Press Enter key, and the formula will calculate the current month of the month you specify. loan payment amount. In this example, in the first month, the original loan amount of $147.05 would be paid off, with the remaining monthly payment used to cover accrued interest.

- Results is red and in parentheses, indicating that it is a payment.

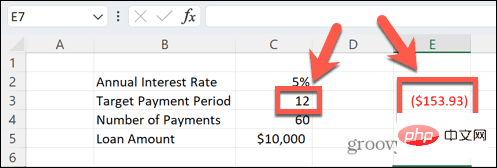

- Since our formula refers to a specific cell rather than a value, to find the principal payment for month 12, we simply Change the value of this cell and the results are automatically recalculated.

- The principal payment increases because the monthly payment to cover interest decreases.

Tracking Your Finances with Excel

Learning how to use the PPMT function in Excel allows you to perform complex calculations quickly and easily. Once you know how to use this function, you can calculate how much you will pay for your loan The exact amount of principal repaid for any month outstanding.

There are many other useful Excel functions that can save you time and effort. You can use the TRUNC function in Excel to quickly convert decimals to integers. If you are working with text, you can use the UPPER and LOWER functions to convert text to uppercase or lowercase, or the PROPER function to convert text to standard uppercase.

The above is the detailed content of How to use the PPMT function in Excel. For more information, please follow other related articles on the PHP Chinese website!