ESG is the abbreviation of Environmental, Social, and Governance. It is an investment philosophy and corporate evaluation standard that focuses on corporate environmental, social, and corporate governance performance rather than traditional financial performance. .

The operating environment of this tutorial: Windows 10 system, DELL G3 computer.

What is ESG?

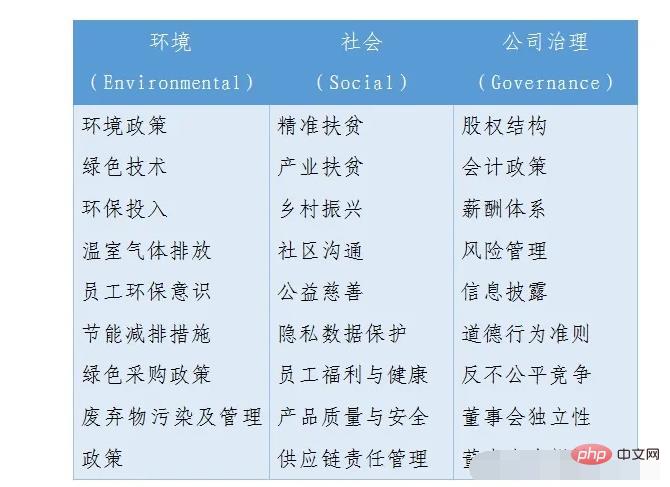

ESG is the abbreviation of Environmental, Social, and Governance. It is an investment philosophy and investment philosophy that focuses on corporate environmental, social, and corporate governance performance rather than traditional financial performance. Enterprise evaluation criteria. Environment refers to considering the impact of enterprises on the environment, such as corporate environmental policies, employee environmental awareness, production waste discharge measures, etc.; Society refers to considering the impact of enterprises on society, such as corporate community relations, employee health, gender equality in the workplace, etc.; Governance It refers to considering the corporate governance of enterprises, such as internal power struggles, effective supervision of management, executive corruption, etc. Investors can evaluate the contribution of investment objects in aspects such as green environmental protection and fulfillment of social responsibilities by observing corporate ESG ratings, and make judgments on whether the company is suitable for long-term investment.

The current international ESG concept and rating system mainly includes three aspects: the ESG disclosure and reporting regulations of various international organizations and exchanges, the corporate ESG ratings of rating agencies, and the ESG investment guidelines issued by investment institutions. In the corporate ESG rating system, different rating agencies focus on different indicators. Some common ESG indicators are shown in the table below.

The development of ESG internationally and domestically

Concepts similar to ESG were born in the last century as ethical investments. At that time, investors Investment concepts based on one's own beliefs or creating positive value for society. As the rapid economic growth has caused more and more negative impacts on society and the environment, investors' environmental awareness has gradually increased under the influence of the environmental movement. Environmentally related laws and regulations have been continuously improved. Responsible investment and ESG concepts have entered experts, governments, and institutions. and investors’ attention. At present, the information disclosure standards and evaluation standards issued by international organizations, regulatory authorities of various countries, and investment institutions have deepened and improved the ESG concept system. ESG investment has become one of the mainstream strategies in the international market, and international investment companies are gradually launching ESG investment products. According to the third quarter report of UN-PRI (United Nations-supported Principles for Responsible Investment, United Nations Responsible Investment Principles Organization) in 2019, more than 2,450 institutions around the world have become signatory members, and the total assets owned or managed by members exceed US$82 trillion. , and is still growing rapidly.

Unlike internationally, domestic ESG promotion is still in its early stages. Currently, there are 30 institutions in China that have joined UN-PRI, 25 of which joined after 2017. However, with the country’s vigorous promotion of green development and green finance, and MSCI’s requirements for ESG disclosure of A-share companies after A-shares were included in the MSCI index in 2018, ESG-related institutional rules have also been gradually introduced, such as the China Securities Regulatory Commission’s revised Code of Governance for Listed Companies. ” clarified the basic framework for ESG information disclosure; China Asset Management Association released the “Research Report on the ESG Evaluation System of Chinese Listed Companies” and the “Green Investment Guidelines (Trial)”, etc. As China's economy gradually transforms, concepts such as ecological environmental protection and green finance will become the inherent needs and general consensus of the whole society, and ESG-related systems will also be gradually improved, promoting the rapid development of ESG concepts in the country.

For more related knowledge, please visit the FAQ column!

The above is the detailed content of What is ESG. For more information, please follow other related articles on the PHP Chinese website!

Find files quickly

Find files quickly

The difference between injective and surjective

The difference between injective and surjective

What are the common secondary developments in PHP?

What are the common secondary developments in PHP?

Python return value return usage

Python return value return usage

Introduction to input functions in c language

Introduction to input functions in c language

The role of conceptual models

The role of conceptual models

What are the common tomcat vulnerabilities?

What are the common tomcat vulnerabilities?

What should I do if the web video cannot be opened?

What should I do if the web video cannot be opened?