Linux open source brother Red Hat has been acquired by IBM for US$34 billion

The acquisition of Red Hat for US$34 billion has become the largest gamble in the history of the "century-old company" IBM. Facing strong competitors such as Amazon, Microsoft, and Alibaba, IBM chose Red Hat as its trump card. Can IBM win this "turnover battle" in cloud computing?

With the US$34 billion acquisition of Red Hat, Big Blue is expanding its territory in the open source world.

On July 9, IBM announced the completion of the acquisition of all issued and outstanding common shares of Red Hat for $190 per share in cash, with a total equity value of approximately $34 billion.

This transaction is also IBM's largest acquisition to date, and it can also be ranked among the top in U.S. history.

After the acquisition, Red Hat will operate as an independent business unit of IBM and will be included in the financial statements of IBM's cloud computing and cognitive software business. IBM is committed to maintaining Red Hat's open source legacy of independence and neutrality.

IBM said this is a landmark acquisition that will define the future of open hybrid cloud. IBM and Red Hat will jointly launch the next generation hybrid multi-cloud platform.

The rise of the public cloud is changing the open source software market. Dr. Chen Xu, Alibaba Cloud Intelligent Technology Strategic Architect, believes that public cloud vendors are becoming leaders in open source. Open source is not a zero-sum game. The rapid development of public cloud vendors is not an obstacle to open source, but can also promote the rapid growth of open source software companies.

So traditional IT companies are eyeing the fertile land of open source. Following Microsoft's successful acquisition of GitHub for US$7.5 billion, the blue giant IBM used the price of "34 billion" to convey its iron-clad determination to acquire Red Hat, the "biggest brother" in the open source industry.

As early as October last year, IBM claimed that it would acquire all Red Hat shares in cash at a price of US$190 per share (equivalent to a 63% premium). IBM will maintain Red Hat's headquarters in Raleigh, North Carolina, as well as its facilities, brands and practices, and Red Hat will become part of IBM Hybrid Cloud and operate as an independent division within IBM.

Red Hat’s existing management team remains in place, and CEO Jim Whitehurst joins IBM, reporting directly to IBM CEO Ginni Rometty. Rometty also promised not to cut staff or cut budgets.

As soon as the news came out, S&P Global Ratings immediately downgraded IBM's rating from "A" to "A" and predicted that after the transaction is completed, IBM's debt leverage will be 1 times from September 30, 2018. Increased to about 2.4 times.

After more than eight months since the announcement on October 28 last year, IBM has finally completed the acquisition; at the same time, IBM closed at $139.33, down 0.9%.

This transaction is the biggest gamble in the history of the "century-old company" IBM! It is destined to be written into the history of IBM and the open source industry.

Why Red Hat? Why is Red Hat so valuable?

First of all, let’s briefly review the history of Red Hat:

Red Hat was established in 1993. Revenue relies primarily on providing telephone support to customers. Later, it turned to the business model of "providing enterprise customers with solutions based on open source technology and providing software for free"

In 2012, Red Hat's revenue exceeded US$1 billion, unrivaled in the open source industry

In 2014, it accounted for 60% of the Linux enterprise market share; nearly 6,500 employees worldwide, with annual revenue of nearly 1.6 billion US dollars

In 2016, Red Hat’s revenue reached 2 billion

2019 In 2017, Red Hat achieved 66 consecutive quarters of profitability

Red Hat is an open source solutions provider that has gained significant influence by contributing to the open source community. Extract the upstream technology products of the open source community, test them, integrate and package them, and finally sell a complete solution to corporate users for support service fees. The software is basically free.

According to the 2019 second fiscal quarter financial report, Red Hat achieved revenue of US$823 million in the quarter, a year-on-year increase of 14%, and has achieved 66 quarters of uninterrupted revenue growth. It can be said that the business model based on open source created by Red Hat is by far the most successful and difficult to imitate.

Let’s look back at IBM. IBM's revenue has been declining since 2012. The financial report for the third fiscal quarter of fiscal year 2018 showed that revenue fell by 2% year-on-year and profit fell by 1% year-on-year.

It is also since 2012 that IBM CEO Ginni Rometty has been pulling IBM away from traditional hardware products and focusing on the cloud.

While overall revenue is declining, revenue from the cloud business segment is growing rapidly. Since 2013, cloud revenue has accounted for 25% of total revenue, a proportion that has increased 6 times! Cloud revenue exceeded US$19 billion in the first quarter of fiscal year 2019.

Faced with strong competitors such as Amazon, Microsoft, Google, and Alibaba, IBM needs a trump card, and what they are looking for is Red Hat.

Rometty told the media that the acquisition of Red Hat meets the hopes of IBM customers and can help the company move critical work to the cloud. Red Hat will provide a next-generation hybrid multi-cloud platform based on open source technologies such as Linux and Kubernetes.

There is no need to reinvent the wheel or consider cross-platform. Customers can use a mix of public cloud and private cloud applications and reach any cloud directly through one platform.

IBM said that Red Hat will continue to "build and expand its partnerships, including with major cloud providers such as Amazon AWS, Microsoft Azure, Google Cloud and Alibaba, etc." and expects Red Hat will contribute approximately two points of compound annual revenue growth over five years.

Cultural genes may be mutually exclusive and may be the biggest risk

Although IBM claimed after acquiring Red Hat that Red Hat could still maintain its original genes and operate as an independent department. However, given the lessons learned from SUSE’s four changes of ownership, it remains to be seen what the final effect of the merger between IBM and Red Hat will be.

Industry insiders believe that the biggest risk lies in cultural friction. The corporate cultures of IBM and Red Hat are completely different.

Jason Bloomberg, a Forbes commentator and president of ZapThink, believes that IBM’s culture is too focused on profits and has long been performance-focused while ignoring things more important than profits; while Red Hat’s culture is quite different. , focusing on open source and openness in various forms.

He believes that if this key gene of Red Hat culture can be transmitted to IBM, then the merged company will have hope. To this end, he also gave three suggestions:

The first step: Abandon all WebSphere products

The second step: Rename the company

The third step: Also The most difficult move is to adopt Red Hat culture, at least in IBM's software organization

In the past 20 years, IBM has invested heavily in Linux, and the ecosystem may change

This acquisition first affects the Linux ecosystem System has a huge impact.

Red Hat is an enthusiastic supporter of several major Linux projects, playing an important role in the development of Libre Office and GNOME, as well as the kernel itself. In 2016, Red Hat was the second-largest contributor to the Linux kernel project, behind Intel.

Over the past 25 years, Red Hat has invested heavily in a variety of enterprise-facing technologies, ranging from containers to serverless computing, storage and big data file systems. With this acquisition, IBM is going all out to gain a foothold in these areas.

Historically, IBM has also been a staunch supporter of Linux-related projects. IBM first announced support for the free operating system in 1999, at a time when Microsoft Windows was gaining steam on desktops and servers and Linux was nowhere near the maturity it is today.

In 2008, IBM employed approximately 600 developers working on more than 100 Linux projects, including Xen, the Linux tool chain, Apache, Eclipse and the Linux kernel project itself, and all modern IBM systems Support for Linux, more than 500 IBM software products run natively on Linux.

In short, Linux has been the lifeblood of IBM for a long time. Over the past 19 years, the company has spent millions, if not billions, of dollars supporting the Linux ecosystem through financial donations and developer offerings.

It is undeniable that IBM has had a positive impact on Linux. Going forward, time will tell what this acquisition means for IBM, Red Hat, and the broader Linux ecosystem.

In the battle to turn over the cloud computing market, IBM is surrounded by opponents

This acquisition may be the most correct decision IBM has ever made.

In the past ten years, IBM has been studying artificial intelligence and blockchain technology, but it has not shown many results so far. IBM's Watson was reported to be providing "unsafe and incorrect" cancer treatment recommendations to clinicians. The Watson Health department also laid off 50% to 70% of its staff, and the heavily invested blockchain business did not see more returns. .

Now, IBM is returning to its traditional field-enterprise services. This is a very correct decision.

IBM, which has a market capitalization of $114 billion, has seen revenue fall by nearly a quarter since Rometty became CEO in 2012. While some of this is due to divestitures, much of it comes from declining sales of existing hardware, software and services products.

The 107-year-old blue giant has been working hard to compete with young technology companies, and the most important battleground is cloud computing.

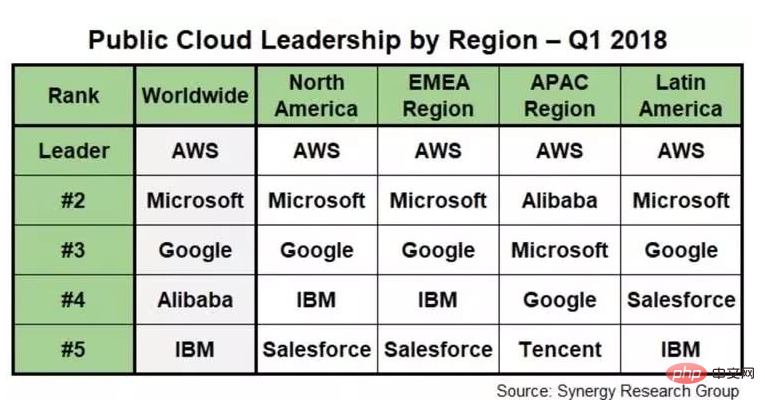

In the U.S. cloud computing market, Amazon AWS, Microsoft Azure and Google Cloud occupy the top three in the market, while IBM occupies a small share. According to the public cloud data in major global regions in the first quarter of 2018 released by Synergy Research, a U.S. market research organization Vendor rankings show that AWS alone occupies nearly 40% of the market share, and Amazon AWS, Microsoft Azure and Google Cloud together account for more than 60% of the market share.

IBM is under a lot of pressure.

Bloomberg mentioned in a comment that IBM and Red Hat will adopt hybrid cloud technology, which is a cloud computing method that integrates company computer data with its own data center. However, whether hybrid cloud computing Will it prove to be an enduring technology? The combined IBM and Red Hat will need to make a strong case for why companies should choose them instead of trusting Microsoft, Oracle or others who also adopt hybrid cloud?

Yes For IBM, it is not easy to make a comeback in the cloud computing market.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

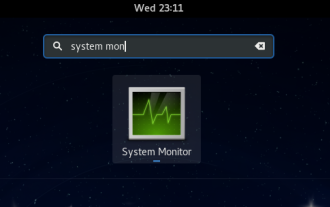

Using Task Manager in Linux

Aug 15, 2024 am 07:30 AM

Using Task Manager in Linux

Aug 15, 2024 am 07:30 AM

There are many questions that Linux beginners often ask, "Does Linux have a Task Manager?", "How to open the Task Manager on Linux?" Users from Windows know that the Task Manager is very useful. You can open the Task Manager by pressing Ctrl+Alt+Del in Windows. This task manager shows you all the running processes and the memory they consume, and you can select and kill a process from the task manager program. When you first use Linux, you will also look for something that is equivalent to a task manager in Linux. A Linux expert prefers to use the command line to find processes, memory consumption, etc., but you don't have to

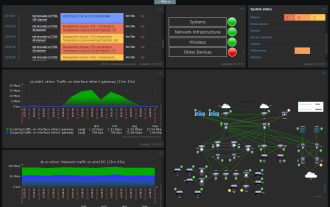

Solve the problem of garbled display of graphs and charts on Zabbix Chinese monitoring server

Jul 31, 2024 pm 02:10 PM

Solve the problem of garbled display of graphs and charts on Zabbix Chinese monitoring server

Jul 31, 2024 pm 02:10 PM

Zabbix's support for Chinese is not very good, but sometimes we still choose Chinese for management purposes. In the web interface monitored by Zabbix, the Chinese under the graphic icon will display small squares. This is incorrect and requires downloading fonts. For example, "Microsoft Yahei", "Microsoft Yahei.ttf" is named "msyh.ttf", upload the downloaded font to /zabbix/fonts/fonts and modify the two characters in the /zabbix/include/defines.inc.php file at define('ZBX_GRAPH_FONT_NAME','DejaVuSans');define('ZBX_FONT_NAME'

7 ways to help you check the registration date of Linux users

Aug 24, 2024 am 07:31 AM

7 ways to help you check the registration date of Linux users

Aug 24, 2024 am 07:31 AM

Did you know, how to check the creation date of an account on a Linux system? If you know, what can you do? Did you succeed? If yes, how to do it? Basically Linux systems don't track this information, so what are the alternative ways to get this information? You may ask why am I checking this? Yes, there are situations where you may need to review this information and it will be helpful to you at that time. You can use the following 7 methods to verify. Use /var/log/secure Use aureport tool Use .bash_logout Use chage command Use useradd command Use passwd command Use last command Method 1: Use /var/l

Teach you how to add fonts to Fedora in 5 minutes

Jul 23, 2024 am 09:45 AM

Teach you how to add fonts to Fedora in 5 minutes

Jul 23, 2024 am 09:45 AM

System-wide installation If you install a font system-wide, it will be available to all users. The best way to do this is to use RPM packages from the official software repositories. Before starting, open the "Software" tool in Fedora Workstation, or other tools using the official repository. Select the "Add-ons" category in the selection bar. Then select "Fonts" within the category. You'll see the available fonts similar to the ones in the screenshot below: When you select a font, some details will appear. Depending on several scenarios, you may be able to preview some sample text for the font. Click the "Install" button to add it to your system. Depending on system speed and network bandwidth, this process may take some time to complete

What should I do if the WPS missing fonts under the Linux system causes the file to be garbled?

Jul 31, 2024 am 12:41 AM

What should I do if the WPS missing fonts under the Linux system causes the file to be garbled?

Jul 31, 2024 am 12:41 AM

1. Find the fonts wingdings, wingdings2, wingdings3, Webdings, and MTExtra from the Internet. 2. Enter the main folder, press Ctrl+h (show hidden files), and check if there is a .fonts folder. If not, create one. 3. Copy the downloaded fonts such as wingdings, wingdings2, wingdings3, Webdings, and MTExtra to the .fonts folder in the main folder. Then start wps to see if there is still a "System missing font..." reminder dialog box. If not, just Success! Notes: wingdings, wingdin

Centos 7 installation and configuration NTP network time synchronization server

Aug 05, 2024 pm 10:35 PM

Centos 7 installation and configuration NTP network time synchronization server

Aug 05, 2024 pm 10:35 PM

Experimental environment: OS: LinuxCentos7.4x86_641. View the current server time zone & list the time zone and set the time zone (if it is already the correct time zone, please skip it): #timedatectl#timedatectllist-timezones#timedatectlset-timezoneAsia/Shanghai2. Understanding of time zone concepts: GMT, UTC, CST, DSTUTC: The entire earth is divided into twenty-four time zones. Each time zone has its own local time. In international radio communication situations, for the sake of unification, a unified time is used, called Universal Coordinated Time (UTC). :UniversalTim

How to connect two Ubuntu hosts to the Internet using one network cable

Aug 07, 2024 pm 01:39 PM

How to connect two Ubuntu hosts to the Internet using one network cable

Aug 07, 2024 pm 01:39 PM

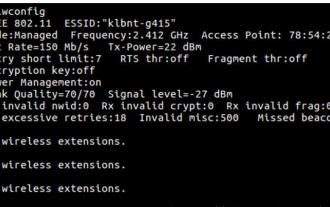

How to use one network cable to connect two ubuntu hosts to the Internet 1. Prepare host A: ubuntu16.04 and host B: ubuntu16.042. Host A has two network cards, one is connected to the external network and the other is connected to host B. Use the iwconfig command to view all network cards on the host. As shown above, the network cards on the author's A host (laptop) are: wlp2s0: This is a wireless network card. enp1s0: Wired network card, the network card connected to host B. The rest has nothing to do with us, no need to care. 3. Configure the static IP of A. Edit the file #vim/etc/network/interfaces to configure a static IP address for interface enp1s0, as shown below (where #==========

toss! Running DOS on Raspberry Pi

Jul 19, 2024 pm 05:23 PM

toss! Running DOS on Raspberry Pi

Jul 19, 2024 pm 05:23 PM

Different CPU architectures mean that running DOS on the Raspberry Pi is not easy, but it is not much trouble. FreeDOS may be familiar to everyone. It is a complete, free and well-compatible operating system for DOS. It can run some older DOS games or commercial software, and can also develop embedded applications. As long as the program can run on MS-DOS, it can run on FreeDOS. As the initiator and project coordinator of FreeDOS, many users will ask me questions as an insider. The question I get asked most often is: "Can FreeDOS run on a Raspberry Pi?" This question is not surprising. After all, Linux runs very well on the Raspberry Pi