Michael Saylor's remarks on "selling kidneys must keep Bitcoin" fully demonstrates his firm belief in digital currency. Bitcoin prices have plummeted recently, and the market is concerned that Strategy (formerly MicroStrategy)'s huge Bitcoin investment is facing liquidation risks.

The Bitcoin market is sluggish and liquidity is tight, which has exacerbated the market selling. As a long-term holder of Bitcoin, Strategy's huge investments are facing the dual pressure of profit retracement and stock price decline. Data shows that as of February 28, Strategy held 499,096 Bitcoins, with a total cost of nearly US$33.12 billion and currently worth US$39.57 billion. Floating profits have shrunk significantly to US$6.45 billion, a significant gap compared with the previous peak of nearly US$20 billion. At the same time, Strategy's stock price also fell by more than 39.4% from its year-on-year high.

Markets are concerned that Strategy may be forced to liquidate its Bitcoin assets. Analysts point out that Strategy's market value and premium rate of its Bitcoin assets have dropped significantly, which has increased its financing difficulty. However, analysis agency The Kobeissi Letter believes that the possibility of liquidation is extremely low because Strategy has the special structure of convertible bonds, strong financing capabilities and the high proportion of voting rights held by Saylor, which together constitute an effective risk buffer. Even if the price of Bitcoin falls to $33,000, Strategy's assets will still far outweigh its debt.

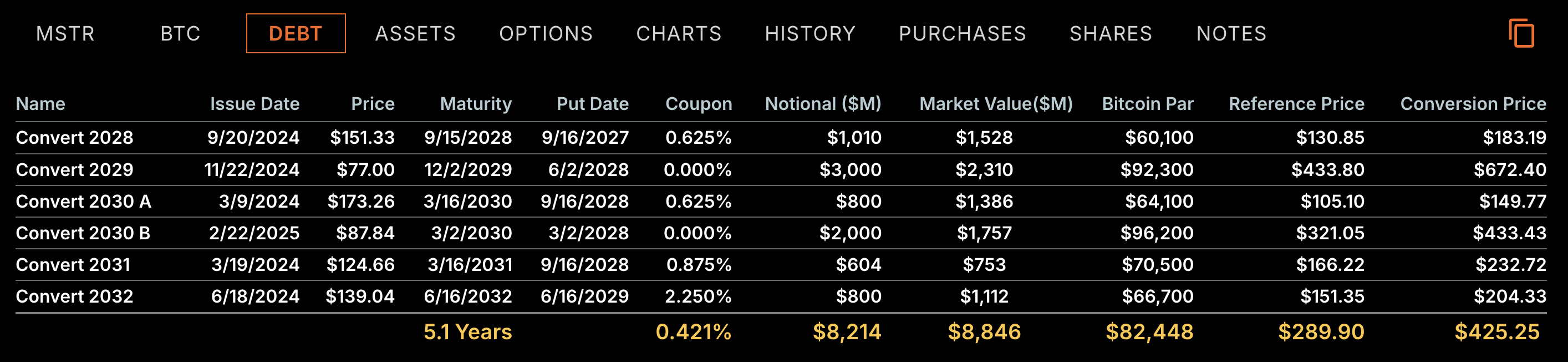

Strategy has $9.26 billion in unsecured debt, but most convertible bonds have extremely low interest rates, with maturity dates beyond 2028. Even if some bonds face pressure from market prices below the issue price, their maturity date is far away, giving the company sufficient time to deal with it. In addition, Strategy's Bitcoin is not directly used for mortgage loans, and its funds mainly come from external investors.

Strategy has a number of large institutional investors, which enhances its market credibility and capital support. Fintel data shows that it has more than 1,400 institutional investors, including well-known institutions such as Susquehanna International Group and Vanguard Group.

Despite the market sluggishness, Saylor is still firmly optimistic about the long-term value of Bitcoin and even continues to increase its holdings when prices fall. He believes Bitcoin will become a global reserve asset and predicts its market value will grow significantly in the coming years. He also announced that he would donate his personal shares to charities that support Bitcoin, further reflecting his confidence in digital currencies.

Strategy recently renamed "Strategy" and launched a new brand image and website to emphasize its Bitcoin-centric business strategy. The company actively participates in industry development, such as establishing a Bitcoin Hub co-working place and meeting with the SEC to make recommendations on digital asset supervision.

Strategy plans to adopt new accounting standards in the first quarter of 2025. If the price of Bitcoin is above $96,337 by then, its profitability will meet the S&P 500 inclusion criteria. The company sets a $10 billion Bitcoin earnings target in 2025 with an annualized rate of return of 15%.

The above is the detailed content of 'Selling kidneys must keep Bitcoin', Strategy's long bet is subject to liquidation doubts. For more information, please follow other related articles on the PHP Chinese website!

Formal digital currency trading platform

Formal digital currency trading platform

Top ten digital currency exchanges

Top ten digital currency exchanges

Top 30 global digital currencies

Top 30 global digital currencies

Digital currency quantitative trading

Digital currency quantitative trading

Top 10 most secure digital currency exchanges in 2024

Top 10 most secure digital currency exchanges in 2024

Introduction to dex concept digital currency

Introduction to dex concept digital currency

Ranking of the top ten digital currency exchanges

Ranking of the top ten digital currency exchanges

The most promising coin in 2024

The most promising coin in 2024