Solana (SOL) price plummeted: from $295 to $181, encrypting the crisis in the cold winter

In early 2025, Solana (SOL) briefly hit a high of $295, but just one month later, it plummeted to $181 on February 17, a drop of nearly 40%. This is not only a fluctuation in numbers, but also indicates that SOL is facing severe challenges in the future development. Why did SOL, once regarded as a strong competitor to Ethereum, face such a dilemma?

The aftermath of FTX bankruptcy and the sharp drop in market confidence

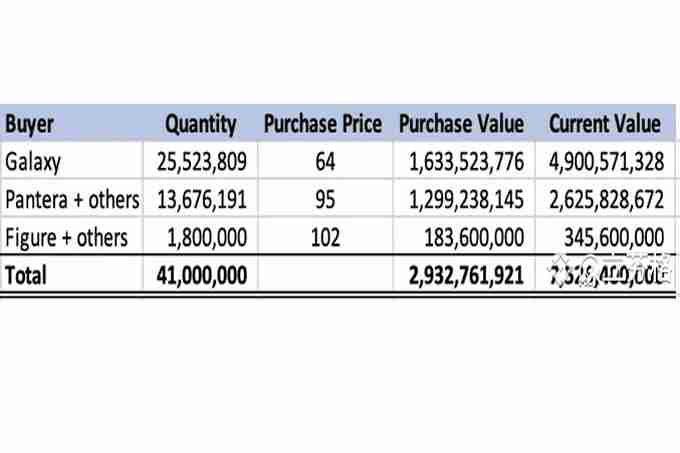

The impact of FTX bankruptcy liquidation cannot be ignored. On March 1, the 11.2 million SOLs auctioned by FTX are about to be unlocked, worth up to US$2.06 billion, accounting for 2.29% of the total SOL circulation. Previously, many institutions purchased a large number of SOLs at low prices, and now they are facing huge profits. Once sold, it will put huge pressure on the market. Solana's current trading volume and on-chain activity continue to be sluggish, and the lack of sufficient buying support further exacerbates the price decline. At the same time, the expected destruction mechanism has failed due to the decline in on-chain activity, which cannot effectively alleviate the pressure of selling.

The Meme coin craze has receded and the double blow to the LIBRA incident

The previous Meme coin fanaticism has driven up trading volume and prices on Solana, but the outbreak of the LIBRA incident has brought a heavy blow. In this incident, the team behind the scenes accurately ditched the investment and arbitrage, causing a large amount of retail investors to lose, triggering a crisis of trust in the Solana ecosystem, and questioning its project operation and profit distribution mechanism. Since then, Solana's on-chain liquidity and DEX trading volume have shrunk sharply, and the market has reassessed its long-term value.

On-chain data, technical aspects and regulatory pressures work together

On-chain data clearly reflects Solana's recession. After the Meme bubble burst, Jupiter trading volume plummeted from a peak of $1.9 billion on January 19 to $282 million in mid-February, a drop of more than 85%. The overall transaction volume on-chain of Solana's main network has also dropped significantly. At the same time, the rise of the Ethereum Layer2 ecosystem has weakened Solana's transaction fee advantages, and its technological advantages are no longer accelerator of price declines.

In terms of technical indicators, the SOL daily chart shows a downward trend, MACD dead cross, RSI is below 40 for a long time, and market sentiment is extremely pessimistic. On-chain position data shows that long-term holders are accelerating their positions reductions, and the growth rate of new addresses is slowing down. In addition, after the LIBRA incident, Solana may face stricter regulatory scrutiny, and its risks will be further increased in the context of stricter supervision of the crypto market.

At present, SOL price continues to fall, falling below $140, the technical pattern further weakens, and may continue to fluctuate and adjust in the short term, and the bottom has not yet appeared. Solana urgently needs to find new growth momentum and rebuild market confidence, otherwise future development will face huge challenges.

The above is the detailed content of Behind the SOL price plunge: Encryption crisis under the interweaving of multiple difficulties. For more information, please follow other related articles on the PHP Chinese website!