Subscribe now to Forbes' CryptoAsset & Blockchain Advisor and "uncover blockchain blockbusters poised for 1000% plus gains" in the aftermath of bitcoin's halving earthquake!

Bitcoin has rocketed higher this week after Federal Reserve chair Jerome Powell dramatically announced the ‘time has come’ for interest rate cuts (though some are more focused on a China bazooka).

The bitcoin price has surged to over $64,000 per bitcoin, climbing sharply from lows of under $50,000 earlier this month as U.S. dollar collapse fears suddenly reemerge.

Now, as Donald Trump’s sons plot a radical plan to ‘shake up’ the world of banking and finance, a widely-respected analyst has predicted this week could be one of ‘the most important’ in years for tech stocks and the closely correlated bitcoin and crypto market.

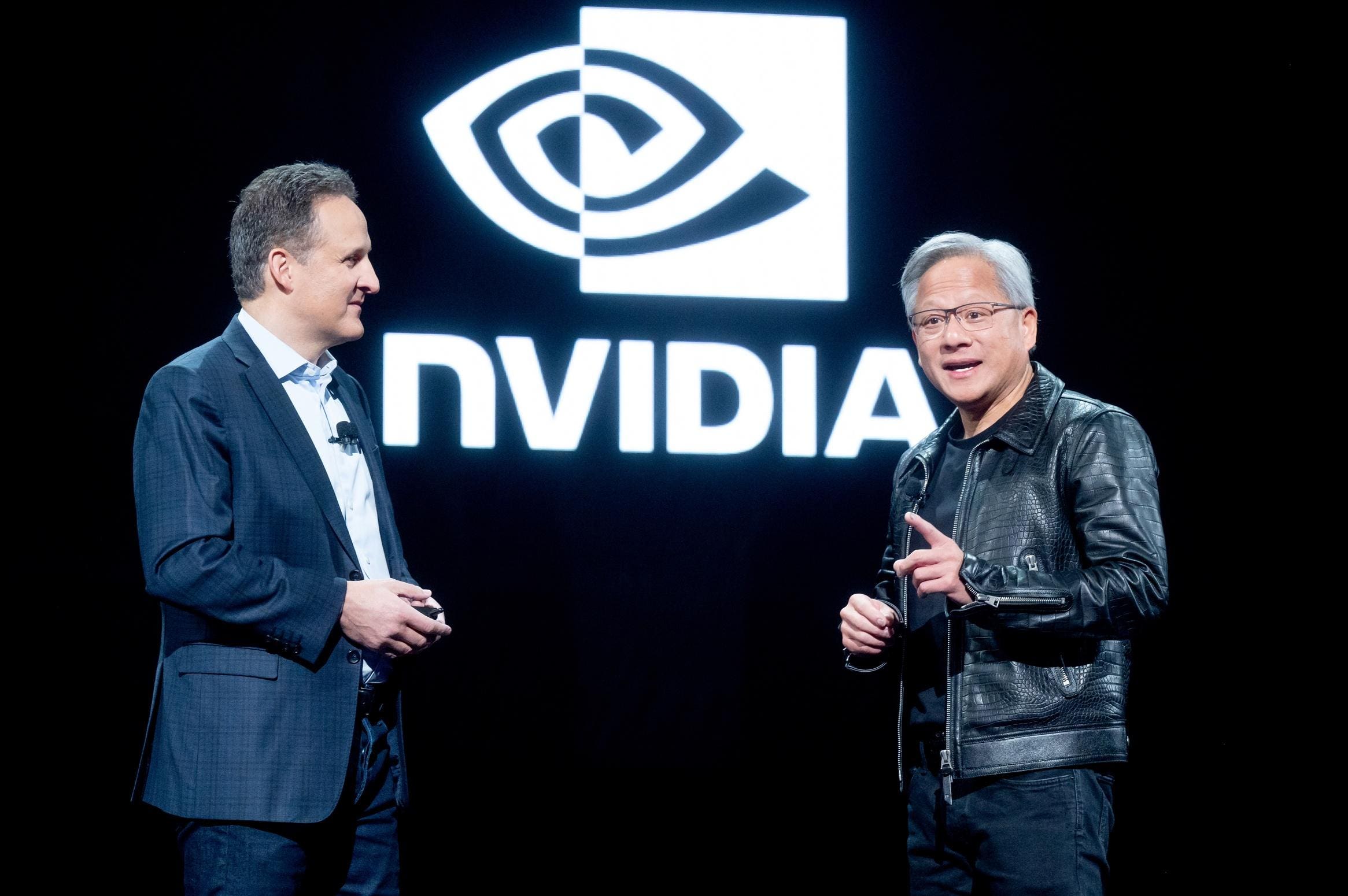

Nvidia chief executive Jensen Huang, right, is poised to deliver ‘the most important tech earnings ... [+] in years’ next week, potentially sparking bitcoin and crypto price chaos.

‘We believe the most important week for the stock market this year and potentially in years for the Street will be next week as the godfather of AI [chief executive] Jensen [Huang] and Nvidia have earnings on deck,’ Wedbush Securities tech analyst Dan Ives wrote in a note to clients seen by Fortune.

Ives expects Nvidia, which has seen its stock rocket to make it the world’s second most valuable company behind iPhone maker Apple over the last year, will post a ‘mic drop’ second quarter on Wednesday as it solidifies its position as ‘the only game in town’ for companies looking to buy artificial intelligence chips and GPUs.

Technology stocks more broadly could be boosted by a robust reassurance from Nvidia that the AI-led boom this year isn’t overdone.

‘The stage is set for tech stocks to move higher,’ Ives added, predicting ‘another masterpiece quarter’ from Nvidia, with analyst consensus of earnings per share of $0.64 on $28.67 billion in revenue for the second quarter, according to estimates compiled by Factset.

Ives believes the market better resembles ‘a 1995 (almost 1996) start of the internet moment and not a 1999 tech bubble-like moment,’ as Nvidia’s chips, hotly in demand at the world’s biggest technology companies to train generative AI models, are the ‘new oil and gold in this world.’

The bitcoin price and wider crypto market could be set to ride Nvidia’s coattails if it beats expectations—or plunge if it disappoints.

Bitcoin, often touted as digital gold, remains far more closely correlated to the stock market—and specifically technology stocks—than gold, which has hit an all-time high this month.

In June, a bitcoin price downturn that saw $500 billion wiped from the combined crypto market in just over a month, foreshadowed a brief stock market correction.

‘Since July, we’ve seen the correlation between bitcoin and equities turn negative, suggesting that bitcoin might not follow traditional markets during downturns. If this trend holds, a recession could boost crypto prices as investors look for alternative stores of value,’ Andrea Barbon, a professor of finance at the University of St. Gallen and crypto expert, said in emailed comments.

‘That said, the bitcoin-equity relationship has been volatile, so any change in the broader economic landscape could quickly shake things up.’

Federal Reserve chair Jerome Powell this week primed the market for a September interest rate cut, saying during a speech at the Jackson Hole, Wyoming, meeting of central bankers that ‘the upside risks to inflation have diminished, and the downside risks to employment have increased.’

However, Barbon thinks former U.S. president Donald Trump’s embrace of bitcoin and crypto means the bitcoin price is now more closely aligned to the U.S. November presidential election than to tech stocks like Nvidia.

‘While bitcoin has often been viewed as a hedge against economic turmoil, its future performance could hinge on the upcoming U.S. elections. So far, Donald Trump has been more supportive of crypto, and a return to the White House could bring regulatory shifts that favor digital assets,’ Barbon said.

The above is the detailed content of Bitcoin Price Rockets Higher This Week as Jerome Powell Announces the 'Time Has Come' for Interest Rate Cuts. For more information, please follow other related articles on the PHP Chinese website!