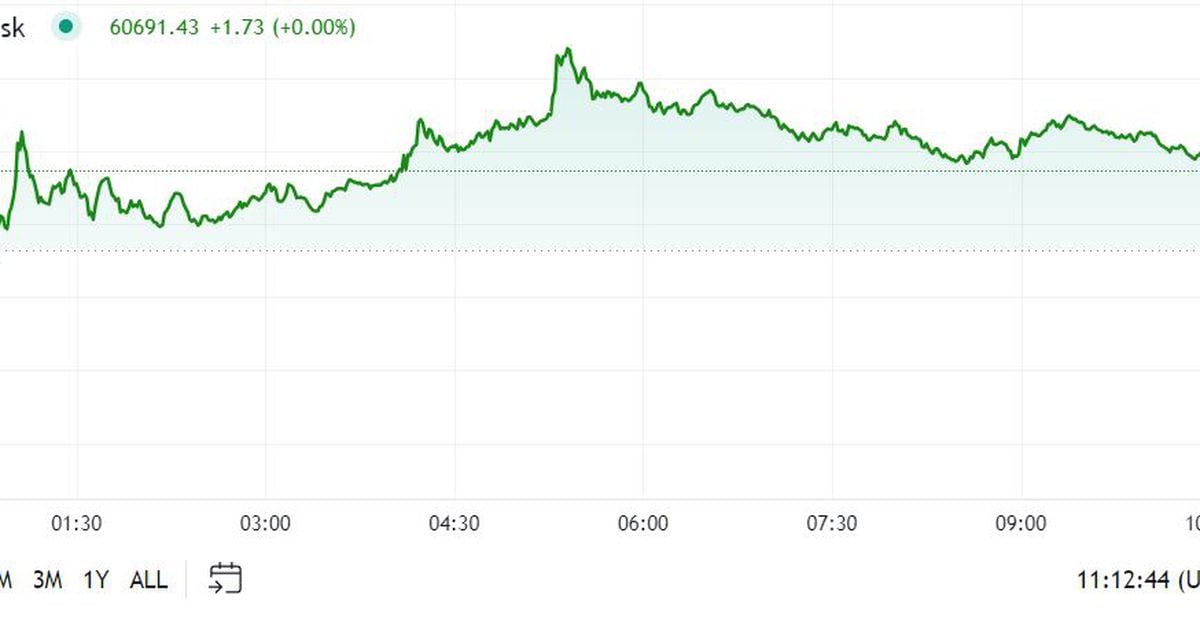

The latest price moves in crypto markets in context for Aug. 20, 2024.

Bitcoin rose past $61,000 early Tuesday, outperforming the broader crypto market and recording a second-highest daily ETF inflow of the month.

The price of BTC rose 4.6% over 24 hours to $60,800 at press time, while the broader crypto market rose 4% and the S&P 500 rose 1%. The CoinDesk 20 Index measures the performance of the top 20 cryptocurrencies.

Bitcoin ETFs recorded over $61 million in net inflows, the highest since $192 million on Aug. 8, according to data from SoSoValue. BlackRock's IBIT ETF led with $92 million of inflows, while Bitwise's BITB ETF recorded $25 million of outflows.

Japanese financial services firm Metaplanet said it completed a BTC purchase worth $3.4 million, bringing its total holdings to 360.368 BTC. The firm began purchasing bitcoin in March 2022.

Among other coins, the price of ether rose 3% over 24 hours to $2,650. XRP rose 4.2% to $0.51, while dogecoin rose 3.8% to $0.18. Litecoin rose 3.3% to $186, and solana rose 3.2% to $106.

Fear and Greed IndexNow at: 64Extreme GreedGet up to speed on crypto’s essential topics with ourBeginner’s Guides.

Bitcoin options traders are locking up millions of dollars in anticipation of the U.S. election. Deribit began trading election expiry options a month ago with a notional open interest, or the dollar value of the number of active options contracts, of $345.83 million, according to Amberdata.

Call options, which offer an unlimited upside payoff potential at the expense of limited loss, accounted for 67% of the total open interest. The rest came from put options, amounting to a put-call ratio of less than 0.50. In other words, twice as many calls were open as puts, reflecting bullish expectations from the outcome of the elections.

State Street is partnering with digital asset custodian Taurus for its tokenization plans with the intention of extending to crypto custody once the U.S. regulatory environment improves.

State Street, which has $44.3 trillion in assets under management, began planning for its tokenization efforts in 2021 and plans to go live with tokenized versions of traditional assets such as exchange-traded funds (ETFs) and fixed-income instruments this year. The firm is also working on tokenizing private assets.

The bank has been “very vocal” about the need to change SAB 121, which could force banks seeking to hold crypto to maintain an onerous amount of capital to compensate for the risk, Donna Milrod, chief product officer and head of Digital Asset Solutions, said in an interview. “While we're starting with tokenization, that's not where we're ending. As soon as the U.S. regulations help us out, we will be providing digital custody services as well."

The above is the detailed content of Bitcoin (BTC) News and Price Data. For more information, please follow other related articles on the PHP Chinese website!