Original title: "How do ETF issuers 'Buy' Bitcoin?"

Author: Julian Fahrer, Apollo

Compiled by: ChainCatcher

Bitcoin spot ETFs have emerged, but how do they actually work?

What exactly happens when people “buy” ETFs? Who will be involved? How does this relate to the buying and selling of the underlying asset (BTC)?

Here is a simplified step-by-step process:

Investor range includes individual investors seeking portfolio diversification to institutions seeking digital asset investments.

Their interest in Bitcoin ETFs drives market demand, influencing the creation and redemption of ETF shares.

Brokers act as a bridge between retail and institutional investors and the stock market where Bitcoin ETFs are traded.

Brokers reflect and amplify investor demand, directly affecting the trading volume and price of ETF shares.

For example, an investor could be a family office, institutional investor, or anyone with a 401k and looking to move to a Bitcoin ETF. Once an ETF is approved, these investors call their brokers with instructions to buy.

Investor to Broker

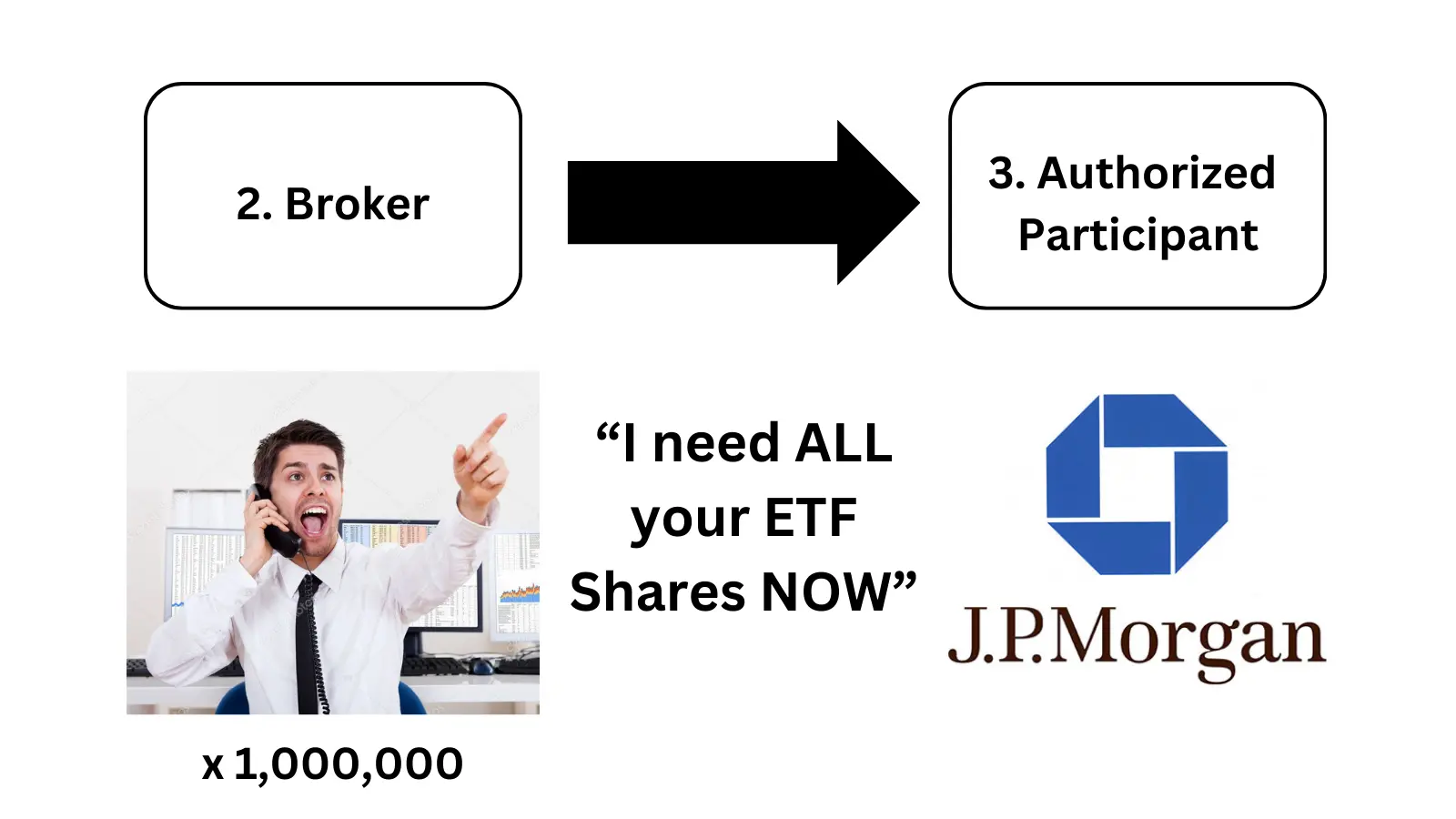

So, where do brokers get ETF shares to sell to investors? Obtained from an Authorized Participant (AP).

AP is a professional financial institution authorized to conduct share creation and redemption transactions directly with ETF sponsors. For example, the APs of the Blackrock/iShares ETF are Jane Street and JP Morgan.

You can think of a broker as a retailer of ETF shares and an AP as a wholesaler.

AP monitors the supply and demand of ETF shares and plays a key role in keeping share prices in line with their net asset values (more on this later).

Wholesale purchasing

Once AP knows how big the demand is, It's time to mint some new ETF shares.

To do this, AP will go to the ETF sponsor they are dealing with and deposit cash to create shares.

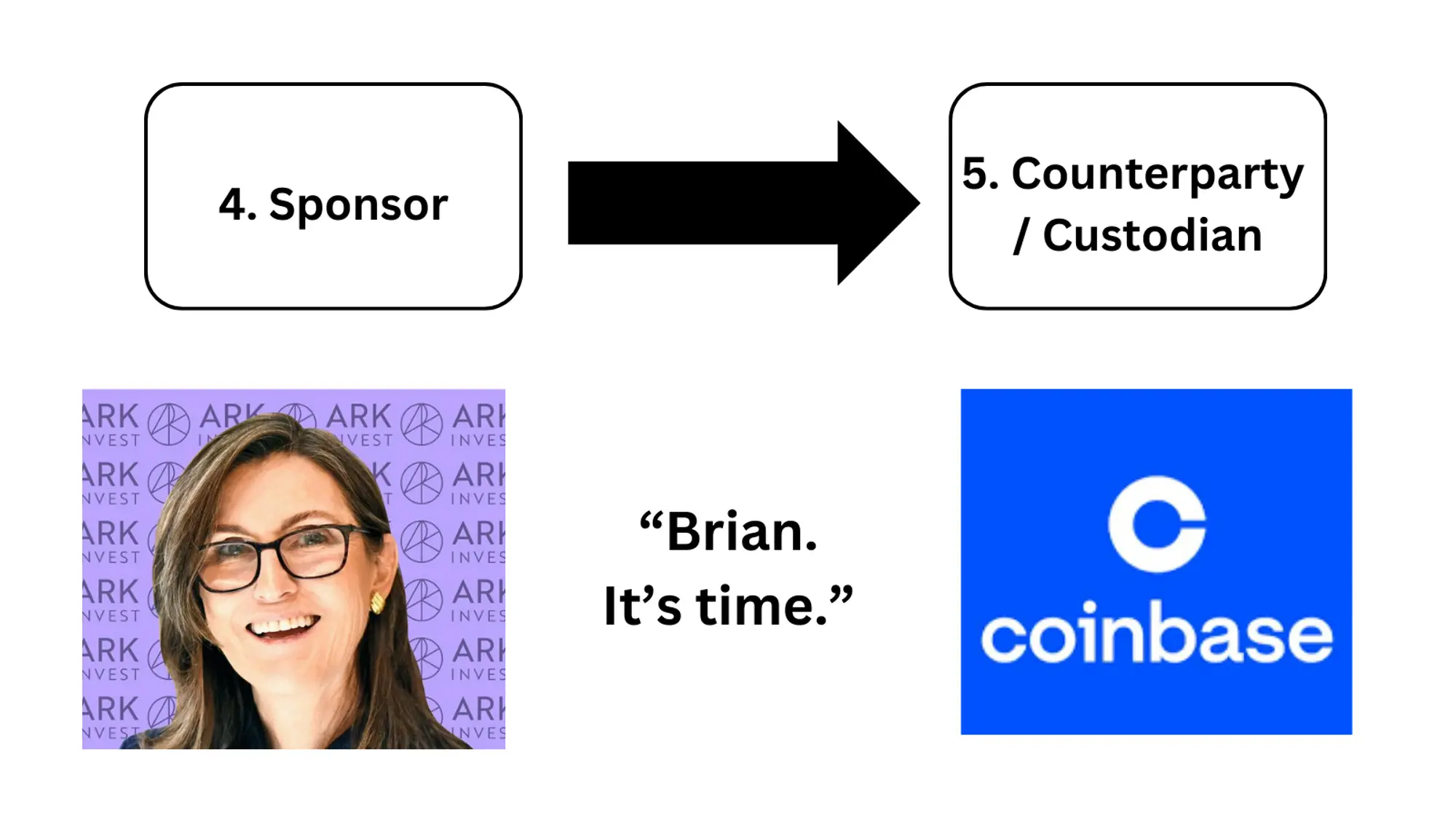

The sponsor is responsible for the overall management and compliance of the ETF. Sponsors are the big names you’ve heard of: Blackrock, VanEck, Fidelity, etc.

The originator coordinates with the Bitcoin counterparty the necessary Bitcoin transactions during the share creation and redemption process.

How it works: AP either creates new shares with sponsors (when demand is high) or redeems shares with cash (if demand is low).

This "demand" directly affects the premium or discount the ETF market price has relative to its net asset value. AP exploits this premium or discount and, in turn, this arbitrage tends to minimize the gap between market price and net asset value, subject to factors such as transaction costs.

For example, all the JPMorgan brokers are calling and asking them to buy more and more ETF shares from Ark/21 Shares. Then someone at JPMorgan (I personally think it was Jamie Dimon) called Cathie Wood and said, "We need to buy another billion ETF shares - that's all the cash we have."

ETF share creation

交易對手是像 Coinbase 這樣的實體,負責處理 ETF 比特幣的買賣。

根據發起人的指示進行操作,使 ETF 的比特幣持有量與其股票數量保持一致。

託管人(例如 Coinbase)負責 ETF 比特幣資產的安全儲存。

確保信託持有的比特幣資產的安全性和監管合規性。

發起人根據 AP 的活動(創建或贖回 ETF 股份)指示比特幣交易對手買入或賣出比特幣。

因此,在 Jamie Dimon 從 Cathie Wood 那裡訂購所有股票並儘可能多地創建股票後,Cathie 便打電話給 Coinbase 的 Brian Armstrong。

Cathie 對 Brian 說:「Jamie 的 FOMO 情緒正如我們所料。我需要立即買下你所有的 BTC。」這就是鏈上樂趣所在。

保薦人及交易對手

在 Ark 的案例中,Coinbase 既充當交易對手,也充當託管人。對於 Fidelity,他們將自行保管 BTC 並持有自己的密鑰。

購買比特幣

該 ETF 的份額價值基於 CME CF 比特幣參考利率——紐約變體,確保比特幣的估值能夠反映市場情況。

該指數反映了多個交易所的比特幣價格的總和,提供了標準化的基準。

?

這些費用並非由投資者直接支付,而是計入ETF 資產淨值的計算中

因此(簡單地說):由於費用降低了信託資產的總價值,因此它們的總價值會降低其資產淨值,而投資者的回報也會減少費用的金額。

The above is the detailed content of How do ETF issuers 'buy” Bitcoin?. For more information, please follow other related articles on the PHP Chinese website!