Compiled by: Felix, PANews

Good token economics can help a token grow hundreds of times within a year, while bad token economics may cause a token to fall by 90%. Understanding token economics is the most important skill in crypto. If you don’t understand token economics, it’s difficult to be a successful investor. Learning is crucial, don't trade blindly, otherwise you may suffer losses. Crypto KOL cyclop gave an overview of token economics, here is a complete guide to token economics.

When you first find a potential coin, for example on CMC, you will see the following:

These are the basic supply metrics:

Understanding these metrics allows you to evaluate a coin’s potential. But to do that, you need to understand more than just the nominal concepts. You also need to understand how they work and how they affect prices.

Start with supply first. There are two paths for a token:

Inflation Token: The supply of a token can increase, which is called a release.

Release is a negative factor as it usually results in a decrease in value. However, if the release is slow and in small amounts, it will not have a significant impact on value.

Deflationary Token: A situation where the supply of a token decreases over time. This happens when a project buys back tokens and burns them. In theory, reducing supply should increase value, but that's just theory.

Now discuss the main factors that determine the issuance and lifespan of a token: allocation and distribution.

There are two methods:

Most projects adopt the pre-mining method .

Why is this approach important?

Because if TGE is 100% and 50% of the tokens are allocated to investors, then investors can sell tokens at any time, and retail investors may become the takers of exit liquidity. That’s why you need to know:

Token allocations usually have the following reception types:

How do they sell tokens?

The day the token is issued is called TGE.

Recently, some projects have adopted a method with a smaller TGE percentage (up to 20%), followed by a few months of cliff and more than 12 months of vesting.

This approach is more suitable for the long-term success of the project, so it is important to verify all these details before investing.

Another key factor for any coin to be successful today is demand. This is why projects incentivize retail investors to purchase specific tokens. For example, despite severe inflation, people still buy dollars because they need it to live.

Generally, there are 4 factors that drive demand for a token:

Store of Value

Cryptocurrencies can serve as value means of storage. Many people buy cryptocurrencies just to put money in them, such as Bitcoin, which is often compared to gold.

Community Driven

As this cycle has shown the public, communities can strongly drive demand. The rise of Memecoins is all about community. People will buy things they think they can make money from.

Utility Effect

Demand is stimulated when holding a token provides some utility. For example, in order to stake tokens, you need tokens from a certain network, etc.

Value accumulation

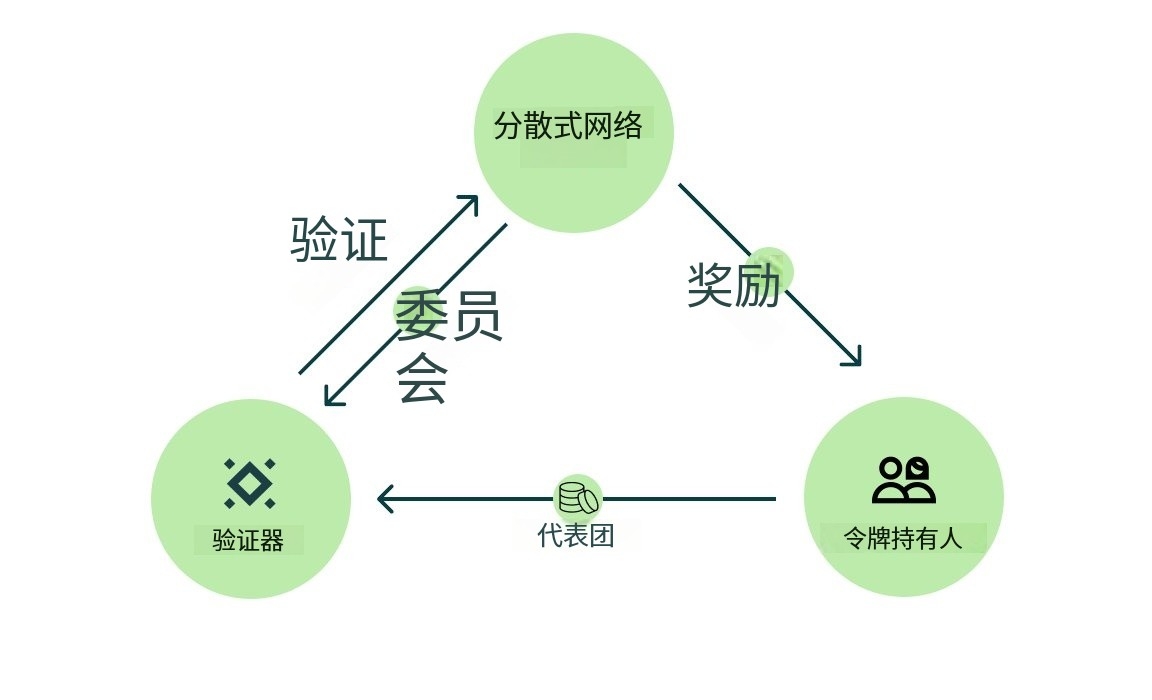

People also hope that the token can provide some value. This is a pledge. You can lock up your positions to receive regular rewards. This benefits all parties and is relatively low risk.

Value accumulation

Another option is to hold. Projects usually provide rewards/airdrops etc. to holders, which is good for everyone. There are many ways to reduce selling pressure by holding:

VeToken

Mining

Also understand that no matter how high the demand is, it is important to understand who is holding. A strong community or a dumper. It's more challenging to figure this out. You need to engage with the project's community and analyze it.

Also, despite the bad token economics, it is still possible for the token to rise and vice versa. Always consider this possibility. Here is a list of things to check before investing:

After such analysis, You can basically determine whether the project is worth investing in.

The above is the detailed content of Token Economics Overview: What Metrics to Look at Before Investing?. For more information, please follow other related articles on the PHP Chinese website!

How to check for plagiarism on CNKI Detailed steps for checking for plagiarism on CNKI

How to check for plagiarism on CNKI Detailed steps for checking for plagiarism on CNKI

How to open php file

How to open php file

Check friends' online status on TikTok

Check friends' online status on TikTok

NTSD command usage

NTSD command usage

How to solve the problem that mysql link reports 10060

How to solve the problem that mysql link reports 10060

WeChat restore chat history

WeChat restore chat history

The difference between anchoring and aiming

The difference between anchoring and aiming

What is the difference between Douyin and Douyin Express Edition?

What is the difference between Douyin and Douyin Express Edition?