What is Swing Trade? Operational skills, trading strategies and beginner teaching

Table of contents

- What is Swing Trade?

- Swift trading vs. Flash vs. Long-term investment

- Operation cycle and characteristics of swing trading

- Complete analysis of swing trading strategies

- Breakthrough/breakthrough strategy (right trading application)

- Consolidation range operation (support and resistance application)

- Operation skills for reversing the market

- In-and-out judgment of retracement increase

- Swave trading operation skills and tools

- Judgment of support and resistance

- Commonly used technical pointers and applications

- Common errors in swing trading and risk control methods

- Comparison of advantages and disadvantages of swing trading

- advantage

- shortcoming

- Application of swing trading in different markets

- Stock band operation skills

- Forex and futures trading

- Cryptocurrency Band Trading and Automation Robots

- Frequently Asked Questions for Swift Trading

- Conclusion: Why choose swing trading?

Swing Trade is a medium-term operation strategy between fluctuations and long-term investment, and uses technical analysis to capture market volatility to make profits.

Compared to the need to watch the market throughout the market when rushing, or long-term holding requires to withstand huge fluctuations, swing trading is more flexible, and the investment cycle is usually several days to several weeks.

This article will take you to understand what swing trading is and the differences from other investment methods, and analyze the four common swing trading strategies and practical operation techniques.

Whether you are a stock market, forex or cryptocurrency investor, you can find the right method and high-end application that suits you.

What is Swing Trade?

Swing Trade is a common medium-term investment strategy. The core concept is to "grasp the main paragraphs of price fluctuations" and enter and exit the market through technical analysis and trend judgment.

Unlike when the market is required to be watched all day, or long-term investment takes months or even years to hold, the cycle of swing trading usually falls from days to weeks .

It can not only avoid the pressure of high-frequency operation, but also be more flexible in responding to market changes than long-term holding.

Therefore, many investors regard band operation as an investment method that takes into account both risk and efficiency.

Swift trading vs. Flash vs. Long-term investment

- Day Trade : The trading time is extremely short, usually completed within minutes to hours, and it requires extremely high technical response and market-oriented capabilities.

- Long-term investment (Buy and Hold) : Holding time is often months to years, and the kernel is fundamental analysis and patiently withstand market fluctuations.

- Swing Trade : Between the two, using the medium-term trend of prices, you don’t need to keep a close eye on the market like you are in a blast, nor do you need to endure long-term floating losses like long-term investment.

Operation cycle and characteristics of swing trading

The biggest feature of swing trading is "follow the trend" : Once you grasp the trend, you can make profits from a whole market in a few days or weeks.

This method is relatively friendly to office workers and novice investors who don’t have much time to watch the market.

Common operating cycles are:

- Entry : Buy based on support, resistance or technical pointers.

- Hold : Wait for the trend to develop, and do not need to enter and exit frequently.

- Appearance : At the end of the trend or reach the default target price to make a profit.

In other words, swing trading is a strategy of "for patience for efficiency", which not only reduces over-trading, but also improves the winning rate through technical analysis.

As mentioned above, swing traders focus on grasping market trends and market trends, because as long as they catch the right one, they can make a profit.

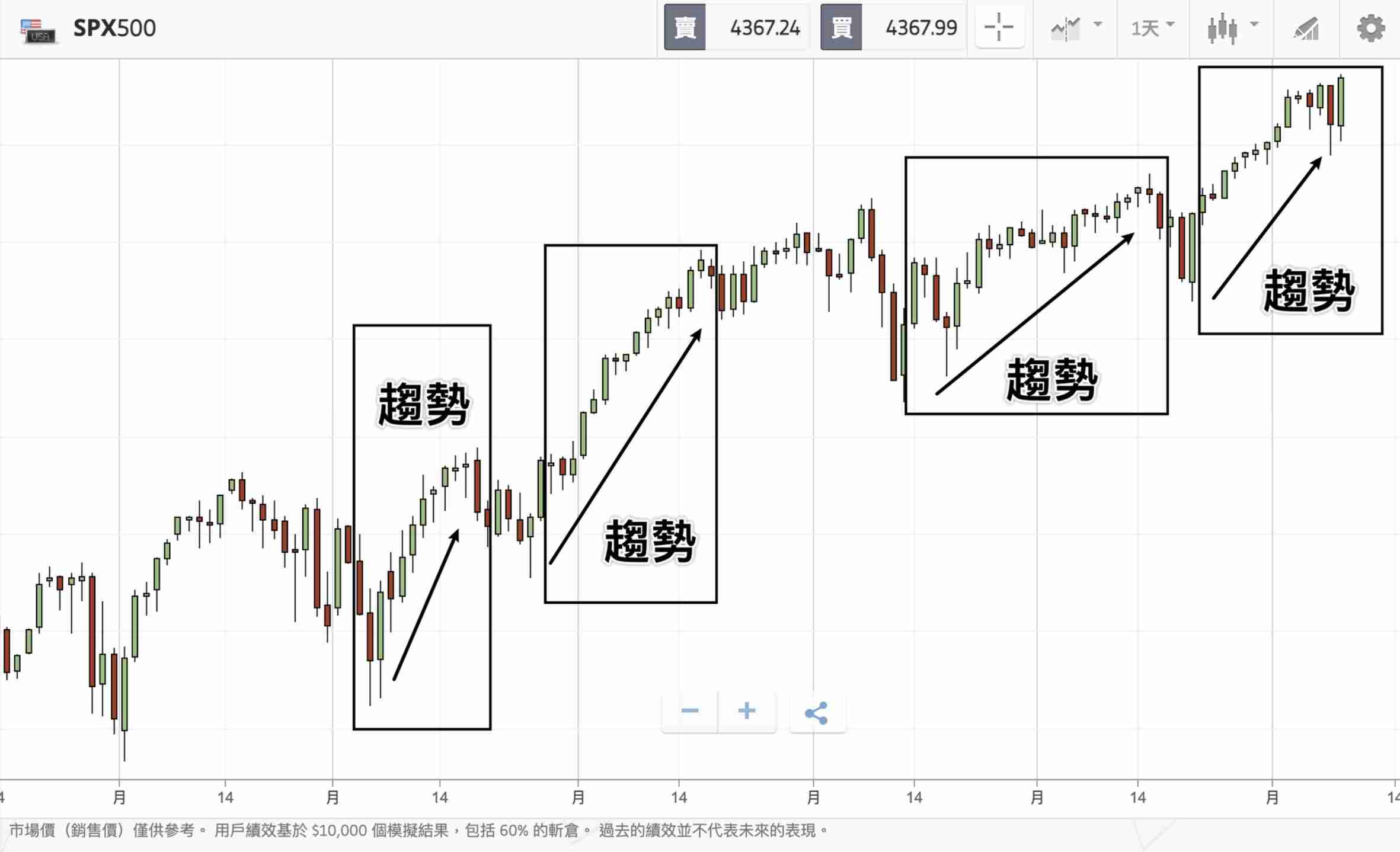

The following figure shows the trend of the S&P500 index in a certain year. The part that is framed along the way is the " upward trend ". Swave traders hope to grasp these buying points through technical analysis and trend analysis and then make profits.

Learn swing trading from the trend of SPX 500

Complete analysis of swing trading strategies

The core of swing trading is to "go with the trend", that is, to make profits by taking advantage of the market's main price fluctuations.

According to different market trends, the commonly used wave trading strategies by investors can be roughly divided into four types: breakout/fall, consolidation range, reversal, and retracement.

The following are analyzed one by one and matched with cases to help you understand quickly.

Breakthrough/breakthrough strategy (right trading application)

When the market price fluctuates in a certain range for a long time, once it "breaks through" the resistance level upward or "falls below" the support level downward, it often means the beginning of a new trend.

Take S&P500 as an example. The original price fluctuates back and forth within a range, but in the black area, the K-bars for several consecutive trading days broke through the resistance line, and then an upward trend was formed.

Therefore, the wave trader will enter the market at the breakout point (black box part) and will not appear until the trend ends.

Be careful of "false breakthroughs", such as breaking through the resistance briefly but falling back to the original range the next day. In this case, you should wait until the trend is confirmed before taking action.

For example, in the figure below, you can see a " false breakthrough " on the left, which means that the K-bar with only one trading day breaks through the resistance. The next day, a red K-bar immediately fell back to the resistance again, which means that the price is still fluctuating in the consolidation range.

This method is suitable for investors who are accustomed to "right-side trading" and reduce judgment errors by confirming the trend.

Breakthrough/breakthrough strategy (right trading application)

Consolidation range operation (support and resistance application)

But it does not mean that swing traders cannot make profits when they encounter volatile markets. Let’s continue to look at the second example.

When the market is in a volatile market, it means that the price will swing back and forth between the resistance line and the support line.

As mentioned earlier, swing trading is also called swing trading, and the reason is that it can make profits through trading methods such as oscillating range prices .

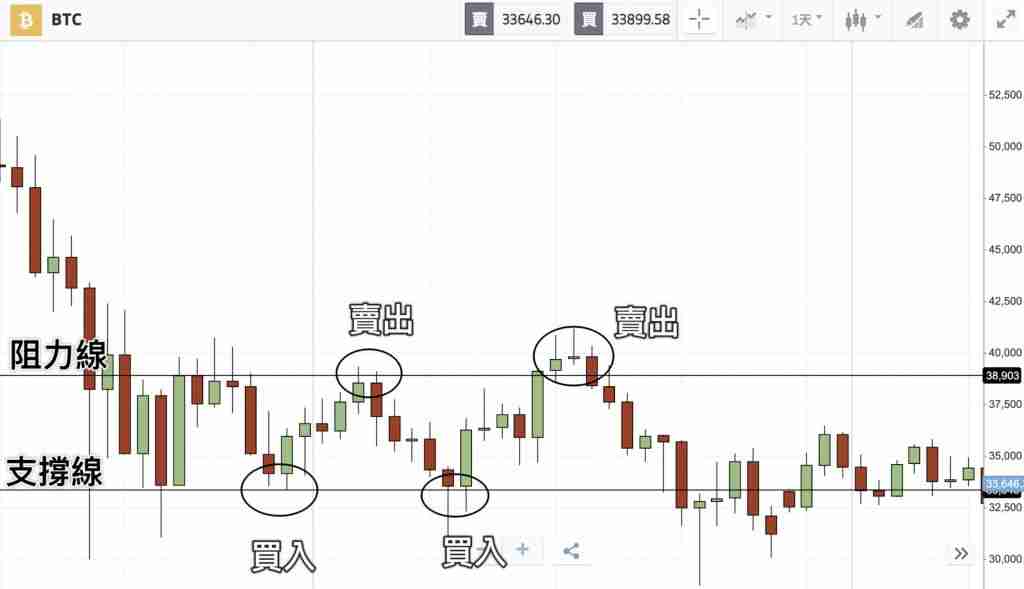

The following figure shows the trend of a certain range of Bitcoin BTC, where the support line is the bottom of the first decline, that is, 33,345; and the resistance line is the price high point that rebounds from the bottom, which is 38,903.

Swave traders can buy when the price is close to the support line (33,345) and sell when the price is close to the resistance line (38,903). This method can make round-trip profits in the consolidation market.

The profit margin of this method is limited by the size of the consolidation range, but it is relatively easy to judge and is very suitable for novices.

However, since the profit margin is limited by the range size, once the range is broken, the strategy needs to be immediately converted to a "breakthrough/breakdown" operation.

Because this method is relatively intuitive in judgment, it is very suitable for beginners to start band operations.

Consolidation range operation (support and resistance application)

Operation skills for reversing the market

Reversal means that the price changes from one trend to another. For example, it was originally an upward market, but after "reversal", it becomes a downward market.

Judging the reversal point requires accumulation of experience, which is relatively risky and difficult to implement.

My advice is that swing traders can wait until the trend is confirmed and then enter the market.

Although this will make less profits in the previous period, the risk will be relatively small (that is, the trading principle on the right is to enter the market when it rises and sell when it falls).

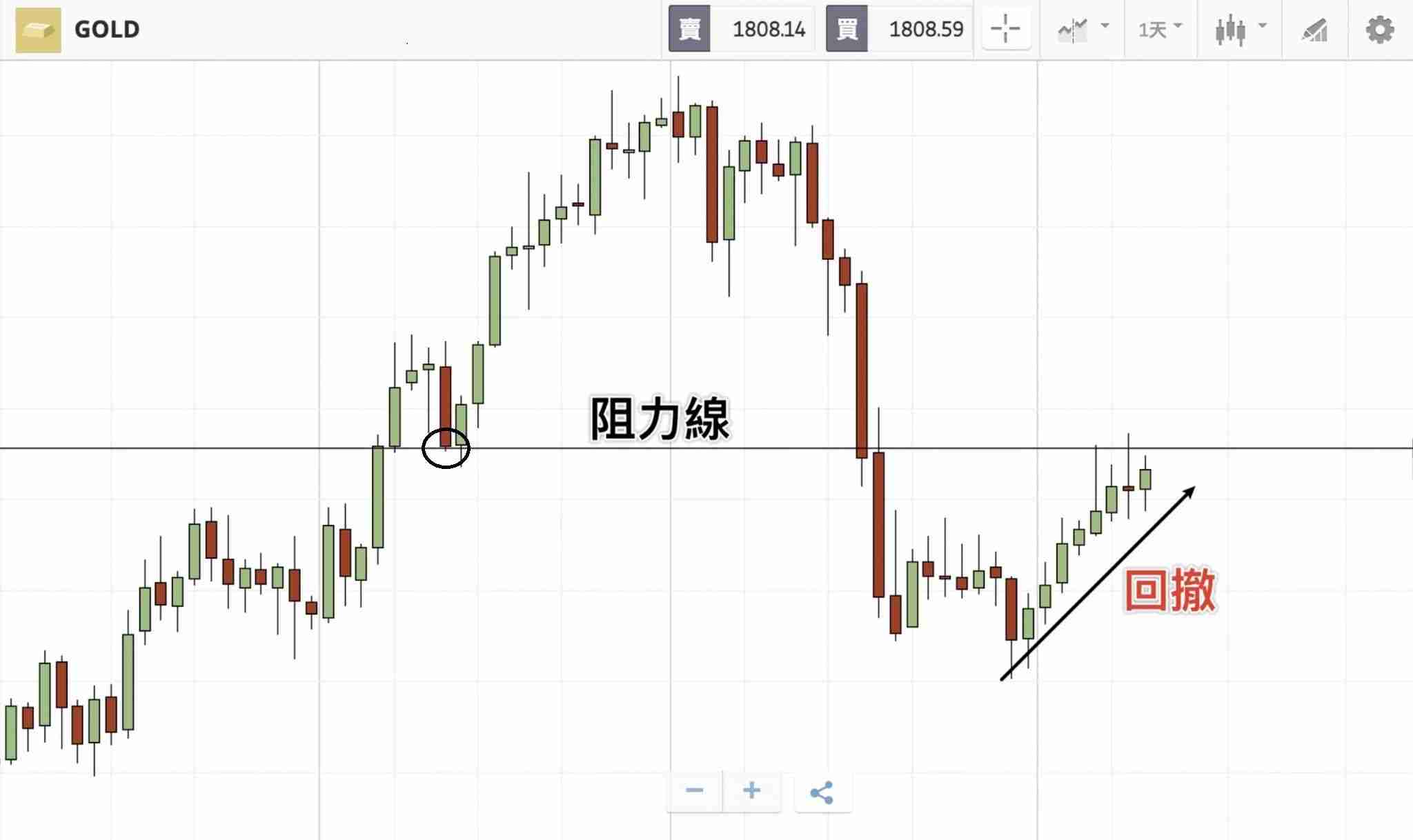

The gold trend in the following figure is an example. It was originally an upward trend, but we can find a red K-bar above, and there are many K-bars with upper and lower shadows, implying that the upward momentum is slowing down.

Then we can see that several big red K rods appeared in succession, establishing a downward trend, so that we can enter the market and short sell gold at this time.

However, when using this strategy, judging the reversal point requires experience. Entering the market too early may miss profits. It is recommended to wait until the trend is clear before operation.

Suitable for high-end investors, able to withstand certain risks and be familiar with technical analysis.

Operation skills for reversing the market

In-and-out judgment of retracement increase

Pullback refers to a small trend in which the market temporarily fluctuates in the main trend.

Although unlike a reversal, it will completely change the trend, it can provide opportunities to increase or re-enter.

The following figure also takes gold as an example. After the downward trend is established, it encounters a price pullback.

First of all, we need to determine the position of the resistance line. We can use the retracement point of the last upward trend and the breakthrough point of the downward trend as the resistance line.

Then this wave of gold price retracement is quite possible until this resistance line and then it will continue to fall, so we can place short positions at the resistance line and continue to make profits from the decline.

If a short order has been set in the third strategy, it can be regarded as an additional increase point!

The advantage of this strategy is that it can increase its investment in the middle of the trend and increase overall profits; but if misjudgment is made, it may lead to increased losses.

Suitable for investors who have certain trading experience and know how to strictly set stop loss.

In-and-out judgment of retracement increase

Overall, the four major strategies of swing trading have their own characteristics:

- Breakthrough/breakdown : Suitable for investors who like to follow the trend, but be wary of false breakthroughs;

- Consolidation range : most friendly to novices and can operate repeatedly in volatile markets;

- Reversal : The risk is high and requires more experience and judgment;

- Retracement : This is a high-end usage, which can increase profits in the middle of the trend.

The following table organizes the kernel concepts, application methods, cases, suitable objects and risk reminders of the four major strategies, so that you can quickly compare:

| Policy name | Kernel concept | Application method | Case description | Suitable for the object | Risk warning |

|---|---|---|---|---|---|

| Breakthrough/fall | Prices break through resistance or fall below support, which means new trends are formed | Wait for the K-line to stand firmly above resistance/support before entering the market | After the S&P500 index breaks through the previous high, enter the market and follow the trend. | Right-side traders who like to follow the trend | "False Breakthrough" is required, and it is recommended to confirm the trend before operating |

| Consolidation range | Price fluctuates between support and resistance | Buy near support level, sell near resistance level | When Bitcoin fluctuates between 33,000 and 39,000, buy low and sell high | Newbie investors like simple and clear operations | Profit space is limited by the size of the range, and the strategy needs to be changed once it breaks through. |

| Reversal | The trend ends and develops in reverse | K-line type or RSI overheating determines the kinetic energy becomes weak | After the gold rise ends, a continuous large negative line appears → judge the market reversal | High-end investors, good at technical analysis | Misjudgment and reversal are at high risk, and experience is required |

| Retreat | A small fluctuation temporarily reversed in the trend | Increase or enter the market when the retracement is close to support/resistance | Gold rebounds to resistance in a downward trend and then shorts | Experienced people know how to set stop loss | If the retracement is misjudged, it may increase losses |

Comparison table of four major strategies for swing trading

Swave trading operation skills and tools

To successfully conduct swing trading, in addition to understanding the strategy itself, you also need to master the correct analysis skills and operation tools.

The following will introduce three key points: the judgment of support and resistance, the application of common technical pointers, and the operational errors that are most likely to be ignored by novices.

Judgment of support and resistance

Support and resistance are the basic concepts of swing trading.

- Support level : During the decline, the price will often stop falling and rebound at a certain position, which is the support.

- Resistance level : On the contrary, when the price rises to a certain point and cannot break through and falls back many times, this position is resistance.

In actual operation, swing traders will use historical trends to observe which points the price has "stayed" and use this to judge the entry and exit positions.

For example, Bitcoin rebounded multiple times at $33,000, and investors would regard this as a support level and would be suitable for buying.

But I’ll remind you that support and resistance are not absolutely accurate numbers, but "range ranges" that require flexible judgment.

Commonly used technical pointers and applications

In addition to support and resistance, technical pointers can help investors grasp the trend more accurately.

Common swing trading tools include:

- Moving average (MA) : is used to observe long-term and short-term trends. When the short-term moving average breaks through the long-term moving average, it is usually a buy signal.

- RSI (relative strength pointer) : When RSI is above 70, it means that the market may be overheated; if it is below 30, it may be oversold.

- Bollinger Bands : used to judge the volatility range. When the price touches the upper or lower rail, it may rebound or pullback.

- Fibonacci Retracement : used to measure the retracement amplitude and help determine the potential reversal area.

For example, when the stock price rebounds on the lower track of the Boolean channel and the RSI is in the low-end oversold range, you can judge the "time of entry" with more confidence.

Common errors in swing trading and risk control methods

Many newbies make some typical mistakes when trading in swings:

- Overtrading : Frequent entry and exit not only increases the handling fee, but is also easily washed away by fake actions in the market.

- Ignore stop loss : Once the market reverses, failure to set a stop loss may lead to serious losses.

- Single pointer dependency : making decisions when looking at just one technical pointer, which is easy to misjudgment.

The correct way to do it is:

- Set "stop loss points" and "stop profit points" before each entry.

- Cross-verification with at least two or more technical tools.

- Stay patient and do not panic and adjust your strategy due to short-term fluctuations.

To achieve swing trading more successfully, the essence of it lies in "grasping the big but not the small", and not being led by those very fine rises and falls.

Comparison of advantages and disadvantages of swing trading

Although swing trading is both flexible and efficient, it is not without risks.

The following sorts out common pros and cons to help you quickly grasp the characteristics of this strategy:

advantage

- The trading pressure is less : the position is longer than the time of the rush, so there is no need to keep an eye on the market all the time, and it is relatively friendly to novices.

- The technical threshold is low : there is no need to pursue instantaneous reaction power, just master the basic technical analysis to get started.

- Low time cost : Usually profit is settled after the trend is over, and there is no need to wait for a long time.

- Lower transaction costs : Compared with frequent in and outflows, band operations can reduce handling fees.

shortcoming

- Overnight risk : If you hold a position for more than one day, you may encounter sudden news during the market closure, resulting in a price gap.

- News interference : Sudden market news may disrupt the original judgment trend.

- Cost is higher than long-term investment : Although it is cheaper than the rush, the number of incoming and outgoing is still more than long-term holdings, and the accumulated cost is relatively high.

Application of swing trading in different markets

Although the core principles of swing trading are consistent, the operating methods in different markets are still different.

Stocks, foreign exchange/futures, and band operations in the cryptocurrency market have different techniques and priorities.

Stock band operation skills

The stock market is the most common wave trading field. Since stocks have the influence of corporate fundamentals and news, investors should also pay attention to financial reports and industrial news in addition to technical analysis.

- Application method : When selecting stocks, select stocks with large trading volume and obvious volatility, and use the moving average and support resistance to determine entry and exit.

- Features : Suitable for office workers, because band operations usually do not require you to watch the market every day, just grasp the main trends.

Forex and futures trading

The foreign exchange and futures markets have high leverage and all-weather trading characteristics, which are very suitable for band operations.

- Application method : Use technical pointers (such as RSI, Boolean channels) to combine macroeconomic data to judge the trend.

- Features : Because the market operates almost 24 hours a day, swing traders must set stop loss and stop profits to avoid overnight risks amplifying losses.

For example, after the release of important economic data, EUR/USD often fluctuates significantly, which is the best time for swing trading.

Cryptocurrency Band Trading and Automation Robots

The cryptocurrency market is volatile and is the first choice for many swing traders.

- Application method : For example, Pionex band trading robot , which can track currency prices through processes, help users pursue unlimited profits within limited risks, and will automatically stop loss when a certain loss occurs.

- Features : High volatility means high risk and high reward, suitable for investors who can withstand large short-term fluctuations.

However, since the fluctuations in the currency market are very fast, it is recommended that novices start practicing from simulation orders or low amounts and gradually accumulate experience.

Whether it is stocks, foreign exchange futures or cryptocurrencies, the core of swing trading is always "grasping the main volatility trend."

However, when investors operate in different markets, they must match the characteristics and tools of the market to effectively control risks and improve their winning rate.

Frequently Asked Questions for Swift Trading

In the process of learning swing trading, investors often have some basic questions.

The following are three most common questions and answer them in table form to quickly grasp the key points.

| question | answer | Additional suggestions |

|---|---|---|

| Is swing trading suitable for beginners? | Suitable. Swave trading does not require long-term focus on the market like being a rush, nor does it require long-term fluctuations like long-term investment, and is more friendly to office workers and novices. | It is recommended to start practicing with "consolidation range operation" and "breakthrough strategy", which has lower risks. |

| How much money does it take to do a band? | There is no fixed threshold, depending on the market and product. Stocks usually cost more than tens of thousands of yuan, and cryptocurrencies or foreign exchange can start with small amounts. | Beginners can first use simulation accounts or low-cost tests, and then increase their funds after establishing a strategy. |

| Which rate of return is better, swing trading or long-term investment? | There is no absolute advantage in the rate of return, it depends on the market conditions and the investor's operating ability. The band can quickly make profits, but skills are required; long-term investment focuses on time and compound interest. | If you want to take into account stability and flexibility, you can use the combination method of "long-term investment of part of the kernel to make waves". |

Conclusion: Why choose swing trading?

Swift trading is an investment method that combines flexibility and efficiency. It does not require a long-term focus on the market like when you are on the rush, nor does it have to bear the long-term pressure of floating losses like long-term investment.

For most investors, swing trading strategies can balance risk and reward, seize the main market segments through technical analysis, and improve profit opportunities.

Whether you are a stock investor, foreign exchange operator, or cryptocurrency trader, band operation Jiaozuo can become your investment strategy pocket list.

It is recommended that novices start with simple "consolidation range" and "breakthrough strategy", gradually create judgment, and further try reversal and retracement operations.

Here is the article about what is Swing Trade? This is the article about operation skills, trading strategies and beginner teaching for beginners. For more complete related band trading strategies, please search for previous articles on this site or continue browsing the related articles below. I hope everyone will support this site in the future!

The above is the detailed content of What is Swing Trade? Operational skills, trading strategies and beginner teaching. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

ArtGPT

AI image generator for creative art from text prompts.

Stock Market GPT

AI powered investment research for smarter decisions

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1660

1660

276

276

Bitcoin (BTC) price cycle is 'increasingly longer”, with the latest forecast saying $124,000 is not the top

Sep 17, 2025 am 06:48 AM

Bitcoin (BTC) price cycle is 'increasingly longer”, with the latest forecast saying $124,000 is not the top

Sep 17, 2025 am 06:48 AM

Key points of the catalog: Bitcoin breaks through key resistance and strengthens the order book liquidity pattern suggests upward direction. Latest analysis shows that after Bitcoin (BTC) successfully breaks through and stands firm in the key resistance area, bulls are accumulating momentum to hit new historical highs. Key points: Data shows that after Bitcoin returns to $114,000, there is still room for this bull market to rise. Historical cycle comparison shows that if the current top appears at $124,000, this bull market will last too short and do not conform to the typical pattern. The order flow and liquidity distribution provide "structural guidance" for the direction of BTC prices. Bitcoin (BTC) is currently showing strong upward inertia, and analysts generally believe it is "difficult to easily reach the top." As key technical positions are broken, market sentiment turns to optimism. famous

What is USDH currency? How does it work? Full analysis of Hyperliquid new stablecoin

Sep 17, 2025 pm 04:39 PM

What is USDH currency? How does it work? Full analysis of Hyperliquid new stablecoin

Sep 17, 2025 pm 04:39 PM

Source: Polymarket On Friday, September 5, 2025, Hyperliquid, which currently occupies an absolute leading position in decentralized derivatives exchanges, announced that it is seeking to issue a "Hyperliquid-first, consistent with Hyperliquid's interests and compliant US dollar stablecoin" and invites the team to submit proposals. The launch of the new stablecoin USDH of Hyperliquid has triggered fierce competition among market makers. Major players such as Paxos, Sky and FraxFinance have all joined the competition to issue USDH, but the lesser-known NativeMarkets is at the forefront. As adoption increases, liquidity supply

What is Boundless(ZKC) coin? What is the future potential? ZKC token price forecast

Sep 17, 2025 pm 04:27 PM

What is Boundless(ZKC) coin? What is the future potential? ZKC token price forecast

Sep 17, 2025 pm 04:27 PM

In the active crypto market, the ZKC token issued by Boundless, a second-tier platform focusing on zero-knowledge proof technology, is expected to stabilize around $0.8 before and after listing. ZKC tokens launched WhalesPro's leading TGE pre-trading OTCDEX WhalesPro recently ushered in ZKC tokens, and its inflows continue to rise, with the cumulative total transaction volume exceeding US$307,000. The current ZKC quote on the platform is $0.705, a drop of nearly 12%. However, trading volume surged by more than 734% in 24 hours to $155,971. Buyer's orders are mainly large, with bidding ranges ranging from 0.8 to

What is Linea(LINEA) currency? Is it a good investment? LINEA's investment value and future prospects

Sep 17, 2025 am 06:39 AM

What is Linea(LINEA) currency? Is it a good investment? LINEA's investment value and future prospects

Sep 17, 2025 am 06:39 AM

Summary box (short facts) Stock code: LINEA Chain: Ethereum (Layer 2) Contract address: 0x1789e0043623282d5dcc7f213d703c6d8bafbb04 Circulation supply: approximately 15.48 billion LINEA. Maximum supply: 72.01 billion LINEA. Main example: Ethereum Layer 2 scaling solution. Current market value: approximately US$382 million. Availability on Phemex: Yes (spot, futures, LINEA listing feast) What is Linea? Linea is an Ethereum Layer 2 expansion solution launched by blockchain technology company Consensys, which is also well-known products such as MetaMask and Infura.

Why is the next reasonable target for Ripple (XRP) price $4.50? Learn about it in one article

Sep 17, 2025 pm 04:30 PM

Why is the next reasonable target for Ripple (XRP) price $4.50? Learn about it in one article

Sep 17, 2025 pm 04:30 PM

Table of Contents: Institutional Funds Return XRP Investment Tools Derivatives Market Releases Bullish Signals XRP Price is aimed at a record high Analysis points out that as institutional interest recovers and derivatives trading activity increases, XRP may usher in a strong rise, with the target price reaching US$4.50, or even higher. Key points: Upside potential stems from growing institutional demand and rising open contracts, which are expected to hit new highs. Analysts predict that XRP price may continue to rise, with a first attack of $3.12 and then challenged the key position of $4.50. In the past 24 hours, XRP price has risen by 1.7%, with a cumulative increase of 6% in the past seven days. On Thursday, the price successfully stood at the $3 mark. Many market observers believe that on-chain data and technology forms

Detailed analysis: Bitcoin (BTC)'s 'super cycle ignition' suggests its price may reach $360,000

Sep 16, 2025 pm 10:36 PM

Detailed analysis: Bitcoin (BTC)'s 'super cycle ignition' suggests its price may reach $360,000

Sep 16, 2025 pm 10:36 PM

Key points of the catalog: Technical analysis of BTC price indicates a target of $360,000. Institutional demand for Bitcoin is expected. Signs of recovery in Bitcoin (BTC) shows two reverse head and shoulders bottom patterns, suggesting that its upward trend may continue to $360,000. The driving force behind it comes from institutional investors' continued increase in positions through spot Bitcoin ETFs. Key points: Technical charts show that BTC's bull market target range is between 170,000 and 360,000 US dollars. Spot Bitcoin ETFs ushered in a large inflow of funds, and institutional demand rebounded significantly. BTC price technical analysis indicates that the target of $360,000 is expected to be expected inverse head and shoulders bottom pattern (IH&S) is a typical bullish reversal signal, consisting of three bottoms:

What is Binance Cryptocurrency Analysis Robot? How to use it? The ultimate guide for traders

Sep 16, 2025 pm 11:48 PM

What is Binance Cryptocurrency Analysis Robot? How to use it? The ultimate guide for traders

Sep 16, 2025 pm 11:48 PM

Key points: You can obtain real-time market, AI analysis and chart information of more than 300 crypto assets on the Binance platform without switching applications. With the help of kinetic signals generated by artificial intelligence and market sentiment analysis (such as open contracts, capital rates, support/resistance levels), it assists in rapid decision-making and supports multilingual interaction. Supports command input (such as /price, /analyse, /chart, /event) or start the graphical button interface through /start, which is convenient to operate. What is Binance Cryptocurrency Analysis Robot? Binance Cryptocurrency Analysis Robot is an AI-driven tool integrated into Telegram, integrating real-time data from Binance platform to provide users with instant price updates.

What is Boundless(ZKC) coin? Is it worth investing? Boundless technology architecture, token economics and future prospects

Sep 17, 2025 pm 04:45 PM

What is Boundless(ZKC) coin? Is it worth investing? Boundless technology architecture, token economics and future prospects

Sep 17, 2025 pm 04:45 PM

Directory What is Boundless? Vision and Positioning Target Users and Value Technology Architecture Proof Network: Off-chain Generation Aggregation and Settlement: On-chain Verification PoVW Incentives: Pay for Verified Job Development and Interoperability Integration Path Performance and Security Discussion ZKC Token Economics Supply and Inflation Utility and Value Acquisition Ecosystem Partnership and Latest Progress Recent Milestones and Market Signals Developers and Infrastructure Responds Future Roadmap Verifier Capacity and Geographic Distribution Standardization and SDK Deepening Frequently Asked Questions Key Points Boundless aims to build "verifiable computing" into a cross-chain public service: