However, PYUSD has been difficult to gain a foothold in the stable currency field. In order to improve its liquidity, PYUSD began to seek to enter the DeFi field.

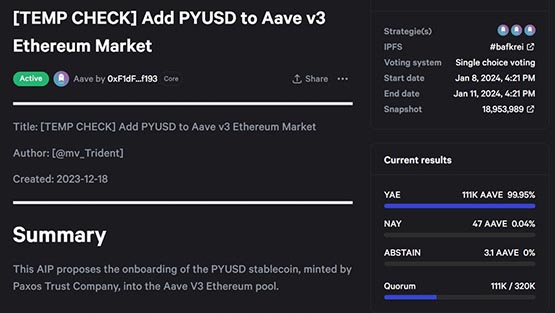

At the end of December last year, PYUSD was launched on Curve, and now PYUSD is considering deploying it on the lending protocol Aave. Aave is currently conducting a community vote on whether to add PYUSD to the Aavev3 Ethereum pool, and the first vote will end on January 11th. Currently, 99.95% of the votes are in favor, but the voting threshold has not yet been reached.

Paxos has been cooperating with the digital asset company Trident Digital since the end of last year, aiming to Increase PYUSD’s on-chain liquidity. Trident successfully helped PYUSD go online on Curve and played an important role in the Aave proposal.

According to Trident’s governance proposal, if the Aave proposal is passed, “Paxos and other parties” will inject $5 million to $10 million in liquidity into the fund pool.

Trident co-founder Anthony De Martino pointed out that the deployment between Aave and Curve is a "symbiotic" relationship. This is because the two protocols face different risks, and higher yield demand on Curve will increase the interest rate for PYUSD borrowing on Aave. This incentive mechanism will encourage low-risk investors to deposit PYUSD into Aave. In this way, Aave and Curve can promote each other and achieve better collaborative effects.

Since its inception last year, the PYUSD stablecoin has gradually developed, but there is still a large gap compared with its competitors. According to CoinGecko data, PYUSD currently ranks twelfth in the market value of stablecoins, with a market value of US$274 million, and its issuance has increased by 63% in the past month.

According to DeFillama data, USDT currently accounts for approximately 70% of the market value of stablecoins. Clara Medalie, head of growth at DeFi research firm Kaiko, said that considering that most cryptocurrency liquidity is denominated in USDT, it will be difficult for Paypal to compete with USDT.

At the same time, PayPal has also encountered regulatory obstacles. PayPal admitted in a document last November that it had received a subpoena from the U.S. Securities and Exchange Commission (SEC) requesting documents related to PYUSD. .

The above is the detailed content of PayPal stablecoin PYUSD plans to enter the Aave lending protocol in the DeFi field. For more information, please follow other related articles on the PHP Chinese website!