Home >Technology peripherals >AI >Leverage AI! PCB global giant, does it have the potential to explode?

Author/Guobaorou under the Starry Sky

Editor/Spinach’s Starry Sky

Typesetting/Carrots under the Starry Sky

In 2023, we have fallen into a strange circle of "everything is AI". PCB (Printed Circuit Board), this is a critical but quite basic component in electronic products, and it has also been given to follow AI servers and AI products The potential for a big explosion.

According to Prismark, an authoritative consulting agency in the printed circuit board industry, in the next five years, 5G, artificial intelligence (AI), Internet of Things, Industry 4.0, cloud servers, storage equipment, automotive electronics, etc. will become new drivers of PCB demand growth. direction, and will continue to upgrade towards high-end technology.

On this track, our country still has quite a say. In 2021, China will account for 7 of the top ten PCB manufacturers in the world. Among them, Pengding Holdings (002938, a subsidiary of Zhending Co., Ltd.) ranked first, and Dongshan Precision (002384) ranked third.

However, looking at the financial reports, although the leading company is definitely ahead in scale, it is by no means a smooth road.

1. Competition in the industry is fierce and the downstream market is sluggish

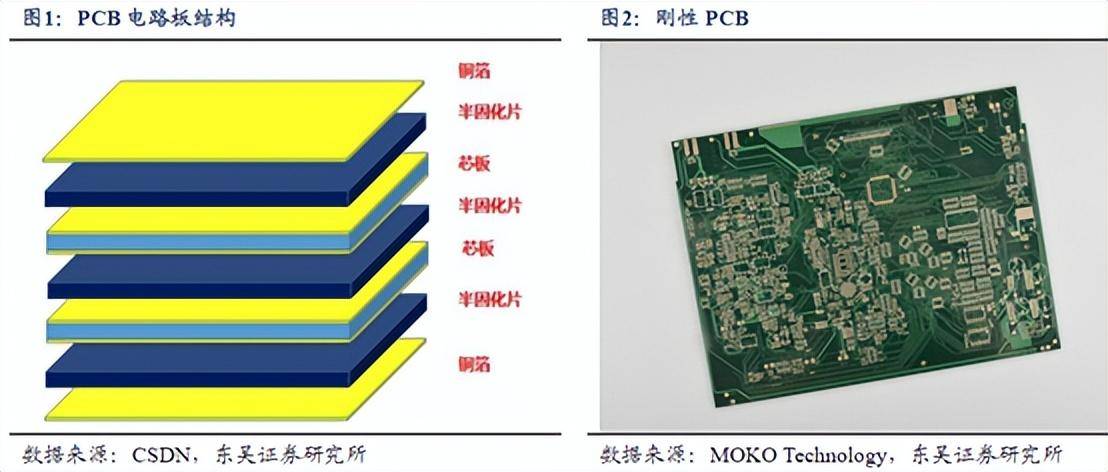

Let’s briefly introduce what PCB is. PCB (Printed Circuit Board), that is, printed circuit board, refers to a printed board that forms point connections and printed components on an insulating base material according to a predetermined design.

Simply put, PCB is the small green board commonly seen in electronic products. Its function is to carry various electronic components and realize electrical connection and electrical insulation between components.

In terms of importance, although the technical barriers of PCB may not be higher than components, it is definitely an essential component of electronic products. Nowadays, electronic products are everywhere. Logically speaking, PCB should be a quite huge field.

However, judging from the data of the world's two leading players: Pengding Holdings and Dongshan Precision, their individual revenue scale is not that impressive, and revenue growth is obviously weak.

1►The market structure is fragmented and the industry competition is fierce

Data show that the global printed circuit board market size in 2022 will be approximately US$81.741 billion. Pengding Holdings’ total revenue is 36.211 billion (almost all from the PCB business), and Dongshan Precision’s electronic circuit product revenue is 21.819 billion (revenue accounting for 69%. This article only analyzes Dongshan Precision’s PCB business).

Rough calculation shows that the market share of these two top players in the world is only single digits. It can be seen that the market structure of this industry is quite dispersed.

The reason is that there are large differences in PCB application scenarios, products, performance, materials, etc., resulting in the entire industry having obvious customization characteristics. So there are many players in the industry that even only serve a single customer.

This industry characteristic also shows that the barriers to entry into the PCB track are not high, and small players also have a good living space, which in turn leads to a large number of companies in the market and competition. Very intense. 2►The downstream market is sluggish and demand growth is weak

Under fierce competition, companies that can survive have basically formed a stable customer structure. Even for leading companies, it may not be easy to seize other people's markets.

For enterprises, the driving force for performance growth may only be the hope that the pie of the industry as a whole will grow bigger and bigger. However, judging from the data, the total output value of the global PCB industry in 2022 is US$81.741 billion, a year-on-year increase of only 1.0%

.In comparison, Pengding Holdings and Dongshan Precision still outperformed the industry, but their year-on-year growth rates were only 8.69% and 6.46% (PCB business).

In the final analysis, it is because the PCB downstream market has continued to be depressed in recent years. The printed circuit boards produced by Pengding Holdings are mainly targeted at communications, consumer electronics, automobiles/servers and other sectors. Among them, the communications sector is mainly in the field ofsmartphones

. Dongshan Precision's electronic circuit products are also widely used in mobile phones, computers and other products.

Nowadays, the market for mobile phones, computers and other electronic products is gradually saturated. In the long run, being able to maintain positive growth is already a good achievement.

2. Relying on a single major customer, high risk and low gross profit

In addition to sluggish revenue growth, leading companies also face considerable pressure on profitability.

As mentioned before, PCB is a highly customized product, so companies in the industry usually mainly serve one or a few large customers. Even companies the size of Pengding Holdings and Dongshan Precision are no exception.

Pengding Holdings 2022 Annual Report

Pengding Holdings 2022 Annual Report

From the perspective of customer structure, in 2022, Pengding Holdings' top five customers will have a total sales of 31.773 billion yuan, accounting for 87.84% of the revenue. Among them, single major customer Company A (it is not difficult to guess that it should be Apple) sold 28.393 billion yuan, accounting for as high as 78.41%.

The same is true for Dongshan Precision.

The sales volume of the largest customer in 2022 is 16.295 billion, and the revenue proportion is as high as 51.60% (This customer structure is the company’s overall data, of which PCB revenue accounts for 69%. It is speculated that the customers of its PCB business concentration may be higher).

Source: Tonghuashun 2022 annual data, Pengding Holdings (left) Dongshan Precision (right)

Source: Tonghuashun 2022 annual data, Pengding Holdings (left) Dongshan Precision (right)

It can be seen that these two companies are very dependent on large customers.

The advantage of binding large customers is that when the downstream eats meat, the upper reaches can also drink soup. It is precisely for this reason that Pengding Holdings and Dongshan Precision can achieve the world's top business scale.

But the price to pay for this is: first, you have to bear the risk of being eliminated from the supply chain by a big customer; secondly, in front of big customers, you usually don’t have too high bargaining power.

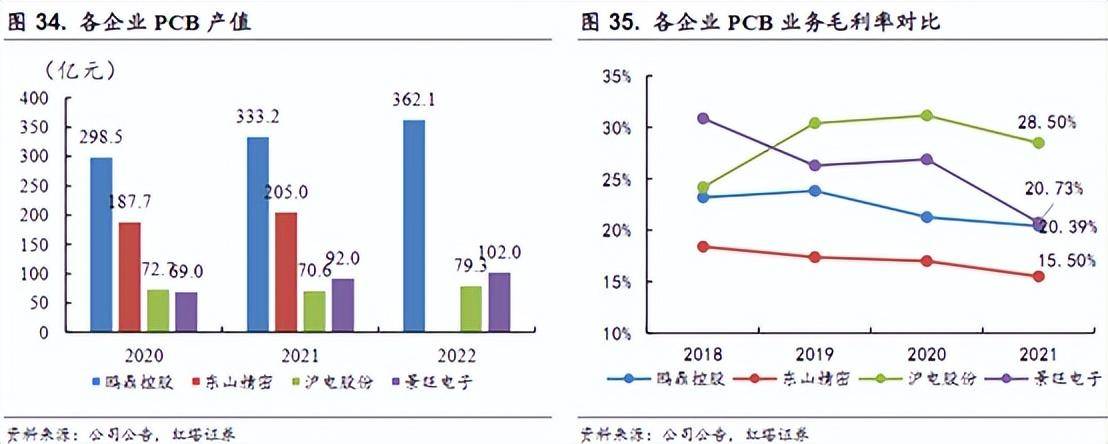

Especially when compared with peers, Pengding Holdings and Dongshan Precision have higher output values, but compared to their younger brothers, gross profit margins are lower (as shown below ↓ However, gross profit margins are also affected by other factors Impact, such as product structure, here is for reference only).

In addition, this gross profit margin level also shows that the economies of scale of the leading company are not reflected at all.

The so-called economies of scale mean that usually the larger the scale, the lower the diluted fixed production costs and the higher the gross profit margin. But for the PCB industry, perhaps due to the existence of customized production, the scale advantage of Pengding Holdings and Dongshan Precision does not seem to be converted into a profit advantage.

3. Iterative upgrading of technology is both an opportunity and a risk

In the future, the biggest attraction of PCB lies in the iterative upgrade of products. Especially now, the massive computing power demand in the AI era has also put forward higher requirements for PCB as the basic support.

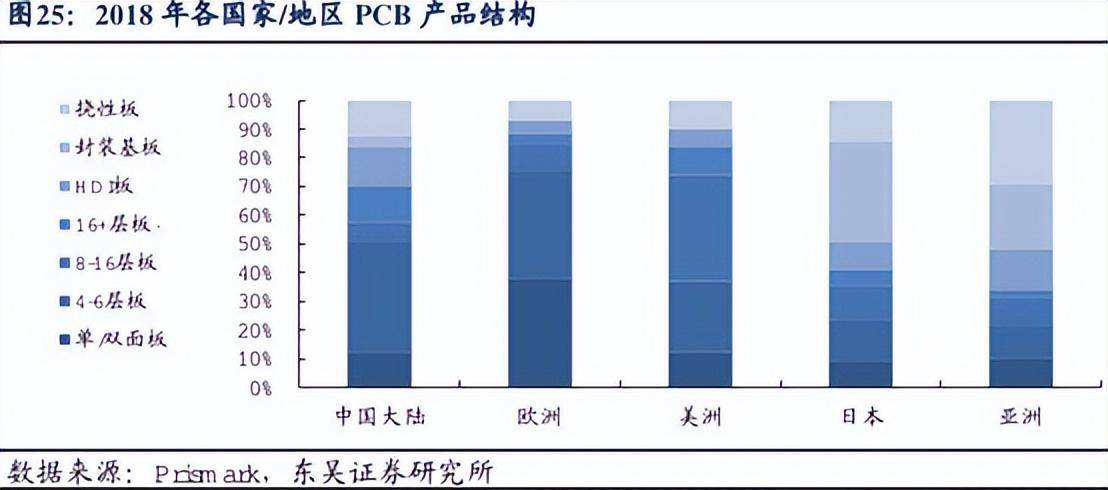

However, although my country is a country with a large PCB production capacity, its production capacity is mostly concentrated in mid-to-low-end products (single/double-sided panels, 4-6 layer boards), and high-end products mainly come from Europe, the United States, Japan and South Korea.

Therefore, in the long run, whether it is from the perspective of market demand upgrading or domestic substitution, in this track that does not seem to have too high technical barriers, establishing technical barriers is the key.

The premise of technological progress is research and development. In 2022, the R&D investment of Pengding Holdings and Dongshan Precision (both 100% expensed) will be 1.672 billion and 940 million respectively, accounting for 4.62% and 2.98% of revenue respectively, with year-on-year growth of 6.37% and -8.6%# respectively. ##.

Comparing the two companies, Dongshan Precision’s R&D investment is obviously not as strong as Pengding Holdings. Moreover, its total investment also includes the research and development of other product lines (PCB accounts for 69%).In addition, compared to Pengding Holdings, Dongshan Precision has another risk point. Dongshan Precision entered the electronic circuit industry through two overseas mergers and acquisitions. Therefore, as of the end of the first quarter of 2023, Dongshan Precision has a

goodwill of up to 2.408 billion on its books, and the asset-liability ratio is still above 60%.

To sum up, overall, the competitive landscape of PCB track is scattered. Leading companies have scale but fail to achieve economies of scale. Although it has scale, it still relies on a single large customer and has no growth potential.Perhaps in the future, iterative upgrades in technology will drive demand for high-end PCB products. But for enterprises, it may be an opportunity or a risk.

Note: This article does not constitute any investment advice. The stock market is risky, so be cautious when entering the market. There is no harm without buying and selling.

The above is the detailed content of Leverage AI! PCB global giant, does it have the potential to explode?. For more information, please follow other related articles on the PHP Chinese website!