web3.0

web3.0

Penetrating Eigenlayer Token Economics: A New Social Consensus Mechanism to Solve Where ETH Can't

Penetrating Eigenlayer Token Economics: A New Social Consensus Mechanism to Solve Where ETH Can't

Penetrating Eigenlayer Token Economics: A New Social Consensus Mechanism to Solve Where ETH Can't

The long-awaited Eigenlayer finally announced more details of its token economy today, and announced that it will allocate 15% of the EIGEN tokens to those who previously participated in the re-staking through linear unlocking. user.

Is there more value in the EIGEN token itself? What exactly is it used for? What impact can it have on re-staking and even the entire Ethereum ecosystem?

The answers are all in this more than 40-page token economy white paper released by Eigenlayer.

Different from a few hasty token release diagrams when general projects introduce the token economy, Eigenlayer spent a lot of pen and ink to explain the EIGEN token in detail, meticulously and even with some technical geeks. The role of , and its relationship with ETH tokens.

Shenchao’s research team has read through this white paper and organized the technical points into easy-to-understand words to help you quickly understand the role and value of EIGEN.

Quick overview of key points

EIGEN token functions and problems to be solved

Universality and Cross-TaskStaking(Universality and Restaking)

Traditional Block Chain tokens are usually only used for specific tasks, such as ETH which is mainly used for block verification on Ethereum. This limits the token’s scope of use and flexibility.

The re-pledge mechanism allows users to use their already staked ETH assets for multiple tasks and services without unlocking or transferring these assets.

Intersubjectively Verifiable

The white paper uses “Intersubjectively "(Between Subjectives) This word, which is very difficult to convert into Chinese, is used to describe some complex network tasks: they are often difficult to verify through simple automated procedures and require subjective consensus from human observers.

EIGEN token acts as a medium of “social consensus” in these tasks. In scenarios that require verification of different opinions, EIGEN can be used as a voting tool, and token holders can influence network decisions through voting.

Forking Tokens and Slashing

Network Disagreement on certain issues or decisions may arise in the network, and a mechanism is needed to resolve these disagreements and maintain the consistency of the network.

In the event of major disagreements, the EIGEN token may undergo a fork, creating two independent token versions, each representing a different decision-making path. Token holders need to choose which version to support, and unselected versions may lose value.

If a network participant fails to perform staking tasks correctly or behaves inappropriately, EIGEN staked tokens may be reduced as a penalty for their bad behavior.

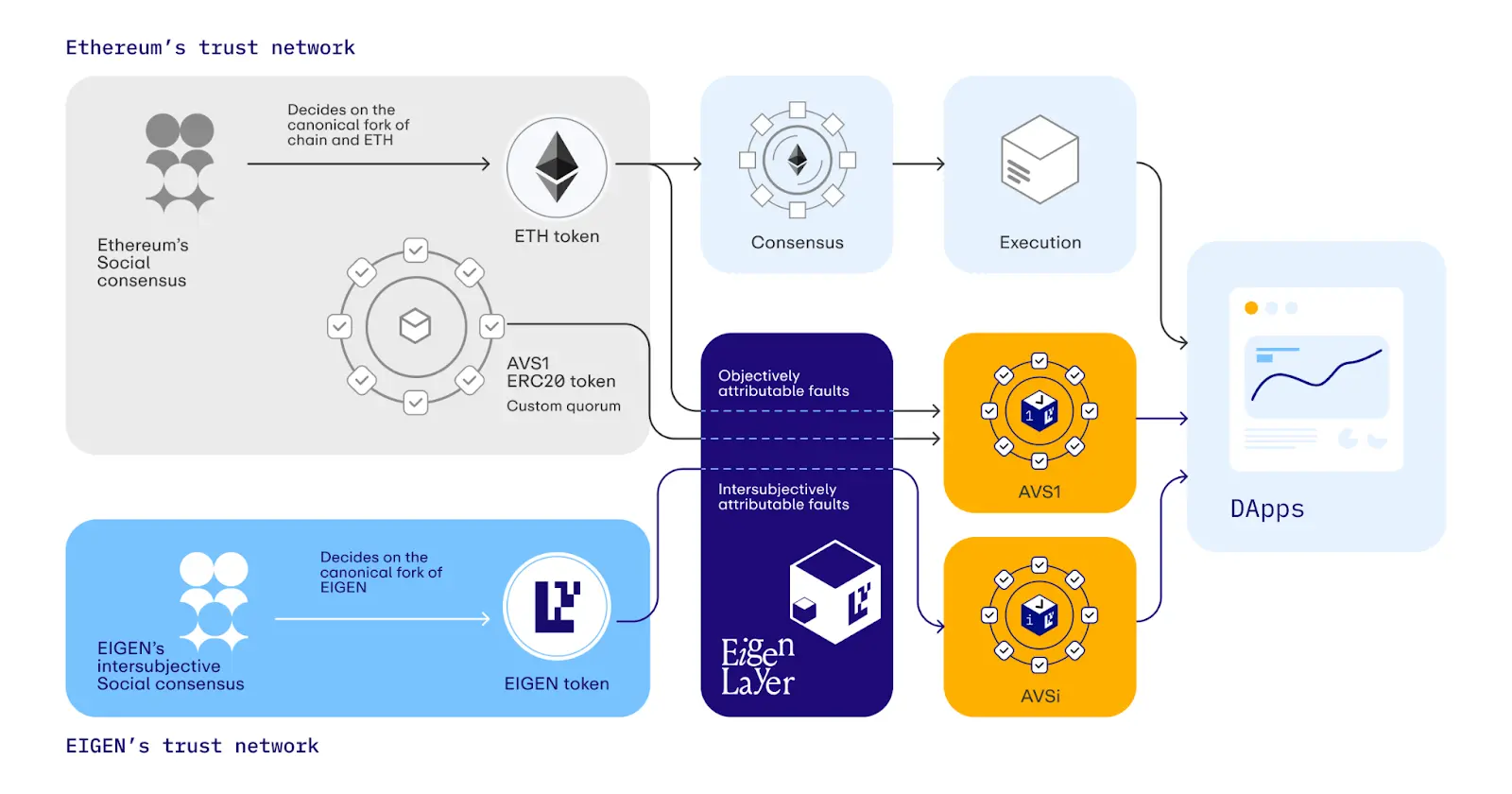

The relationship between EIGEN and ETH

Supplement rather than replace: EIGEN tokens are not intended to replace ETH, but are the basis for the existence of ETH Supplements are provided.

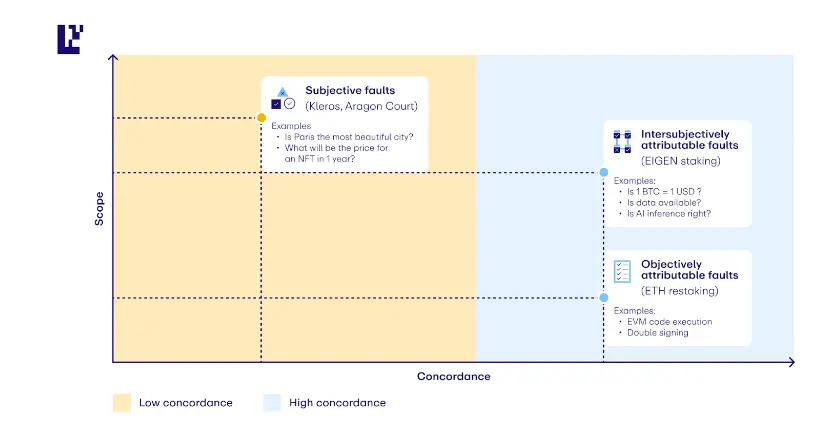

#ETH is primarily used for staking and network security as a general purpose work token. ETH staking supports the reduction of objective failures (for example, verification nodes will be punished if they verify incorrectly)

EIGEN staking supports the reduction of subjective failures (errors that cannot be verified on the chain, such as oracles) The price quoted to you is itself wrong), thereby greatly expanding the range of digital tasks that blockchain can safely provide users.

EIGEN Token: Provides a new social consensus mechanism that specifically handles subjective errors beyond the reach of ETH

If you want to know about EIGEN To understand what the token does, you must first know what the ETH token does.

Before there was the concept of Eigenlayer and re-staking, ETH could be regarded as a "working token with a specific purpose". In human terms:

ETH tokens are used to maintain the security of the network, generate new blocks, and perform tasks related to the maintenance of the Ethereum blockchain. They cannot be used for anything else.

In this case, the characteristics of ETH are:

has a very specific working purpose;

Extremely strong objectivity. For example, if there are double signature errors on the Ethereum chain or errors in Rollup summary, you can pass pre-written instructions on the chain. It is judged by objective rules and a certain amount of ETH will be punished to the verifier.

With Eigenlayer, ETH is actually converted into a "Universal Target" working token. In human terms:

You can take ETH and pledge it to various tasks, such as new consensus mechanisms, Rollup, bridge or MEV management solutions, etc., it is no longer limited to The pledge of Ethereum's own chain is also an important function of Eigenlayer.

However, in this case, although the usage scenario has changed, ETH still has the following characteristics:

“Objective” restrictions still exist, as slashing and slashing actions can only be applied to objectively verifiable tasks on the Ethereum chain.

#But you have to know that not all errors in the encryption world can be attributed on the chain, and not all arguments can rely on the consensus on the chain. algorithm to solve.

Sometimes, these non-objective, difficult to prove, and controversial errors and problems significantly affect the security of the blockchain itself.

As an extreme example, the oracle quotes 1BTC = 1 USD. This data is wrong from the source. You can’t identify it using any objective contract code or consensus algorithm on the chain; and if something goes wrong, it won’t help if you confiscate the validator’s ETH. To put it bluntly:

You cannot use an objective solution on the chain to sanction a subjective error off the chain.

What is the price of an asset, whether a data source is available, whether an AI interface program runs correctly... These issues cannot be agreed upon and solved on the chain, and more are needed A "social consensus" in which answers are arrived at through subjective discussion and judgment.

Eigenlayer calls this type of problem Intersubjectively attributable faults: All reasonably active observers of the system There is broad consensus among a set of faults.

Therefore, EIGEN tokens have a place to play ---- Provide a complementary new social consensus mechanism besides ETH to maintain network integrity and security. Specially designed to solve this "subjective" failure.

Specific method: EIGEN pledge, token fork

ETH is still a working token for general purpose, but EIGEN will be used as a general purpose The "subjective" work tokens are complementary.

If the verifier pledges ETH and some objective failure occurs, the pledged ETH can be reduced and forfeited;

You can also pledge EIGEN, when some subjective failures (which cannot be directly judged on the chain and require subjective judgment) occur, the pledged EIGEN can be reduced and forfeited.

Let’s take a specific scenario and see how EIGEN works.

Suppose there is a decentralized reputation system based on Eigenlayer, where users can rate service providers on the platform. Each service provider stakes EIGEN tokens to demonstrate their credibility.

Before starting this system, there are 2 phases that are necessary:

Setup phase: System benefits Coordination rules between relevant parties are encoded to give rules for how to resolve subjective disputes; Enforce pre-agreed rules metaphorically, preferably locally.

-

#In this system, users can enforce the conditions they have agreed to in advance.

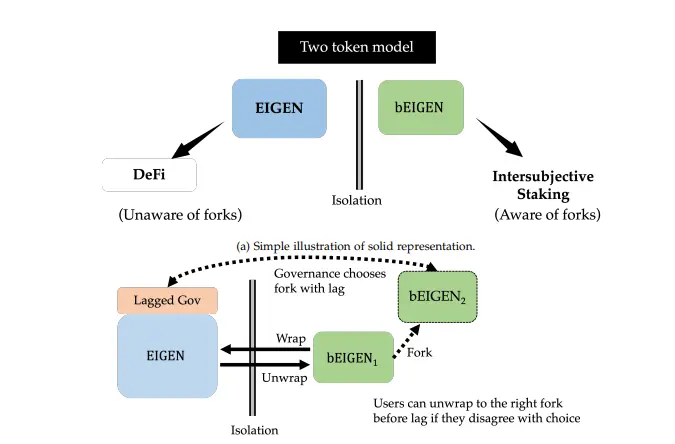

Then, if the service provider is considered to have provided false services or misled users, the community consensus mechanism of the platform may trigger a challenge, forming a forked token event, and then turning into two versions of the EIGEN token. Coins---EIGEN and bEIGEN.

Now users and AVS are free to decide which one to respect and value. If it is widely believed that the slashed stake holder acted inappropriately, then users and AVS will only value the forked tokens, not the original tokens;

Then, the malicious stakers’ The original EIGEN tokens will be reduced and confiscated through this fork.

So this is equivalent to a social consensus ruling system to resolve disputes that cannot be handled objectively on the ETH chain.

It’s also worth mentioning that for users and other stakeholders, you don’t have to worry about the impact of this “fork” at all.

Generally speaking, after a token forks, you must make an overall choice for it, which also affects the performance of your tokens in other However, EIGEN creates an isolation barrier between CeFi/DeFi use cases and EIGEN staking use cases. Even if bEIGEN is affected by inter-subject fork disputes, any use of it will EIGEN holders in non-staking applications also don’t have to worry, as it can redeem bEIGEN at any time in the future for the fork.

Through this fork isolation mechanism, Eigenlayer not only improves the efficiency and fairness of handling disputes, but also protects the interests of users who are not involved in the dispute, thereby providing powerful functions while , ensuring the overall stability of the network and the security of user assets.

Summary

It can be seen that EIGEN’s inter-subject pledge and dispute handling mechanism supplements what ETH cannot handle as an on-chain pledge mechanism. subjective disputes and failures, unlocking a large number of previously impossible AVS on Ethereum, with strong crypto-economic security.

This may open the door to innovation in: oracles, data availability layers, databases, artificial intelligence systems, game virtual machines, intent and order matching and MEV engines, prediction markets wait.

However, judging from the roadmap given in its white paper, the current use cases of EIGEN are still in a very preliminary start-up stage. It is more like the concept has been fully formulated but is far from practical. implement.

As users can officially receive EIGEN tokens after May 10, let us wait and see whether the use value envisaged by EIGEN can effectively carry the changes in the token market price.

The above is the detailed content of Penetrating Eigenlayer Token Economics: A New Social Consensus Mechanism to Solve Where ETH Can't. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

How to buy Bitcoin BTC? How to deposit and withdraw Bitcoin safest?

Aug 21, 2025 am 06:39 AM

How to buy Bitcoin BTC? How to deposit and withdraw Bitcoin safest?

Aug 21, 2025 am 06:39 AM

This article mainly explores the purchasing methods of digital asset Bitcoin (BTC), and provides detailed guidance and suggestions on the security issues of its storage and extraction, aiming to help users establish a safe and reliable asset management system.

What is Polkadot (DOT currency)? Future development and price forecast of DOT

Aug 21, 2025 pm 07:30 PM

What is Polkadot (DOT currency)? Future development and price forecast of DOT

Aug 21, 2025 pm 07:30 PM

What is the directory DOT (Poker Coin)? The origin of Polkadot DOT (Polkadot) The operating principle of Polkadot has 5 major features, aiming to establish the Polkadot ecosystem (Ecosystem) 1. Interoperability 2. Scalability 3. Community Autonomy 4. No Fork Upgrade 5. NPOS Consensus Protocol Polkadot Key Features DOT Ecosystem Polkadot Vision: Connecting Everything Polkadot's Future Development Polkadot Price Forecast Polkadot 2025 Price Forecast Polkadot 2026-203

Cryptocurrency IDO platform top5

Aug 21, 2025 pm 07:33 PM

Cryptocurrency IDO platform top5

Aug 21, 2025 pm 07:33 PM

The best IDO platforms in 2025 are pump.fun, Bounce, Coin Terminal, Avalaunch and Gate Launchpad, which are suitable for Meme coin speculation, community-driven auctions, high-return pursuits, Avalanche ecological investment and fair participation of novices. The choice needs to combine investment goals, risk tolerance and project preferences, and focus on platform review and security.

How to receive your first cryptocurrency? Step Guide

Aug 21, 2025 am 06:15 AM

How to receive your first cryptocurrency? Step Guide

Aug 21, 2025 am 06:15 AM

Before the directory starts Step 1: Add an account Step 2: Receive cryptocurrency Receive cryptocurrency on LedgerLive: Example You have just set up your Ledger device and start exploring cryptocurrency. Receiving cryptocurrencies on LedgerLive is very simple and straightforward. Navigate and coordinate your device and LedgerLive in just a few simple steps. Download and install the latest version of LedgerLive to your computer or mobile device before you start. Open LedgerLive and click "My" in the lower right corner

What is Bitcoin? How to trade and mine? The complete and latest guide to Bitcoin investment

Aug 21, 2025 pm 06:30 PM

What is Bitcoin? How to trade and mine? The complete and latest guide to Bitcoin investment

Aug 21, 2025 pm 06:30 PM

Bitcoin transactions need to be completed through the exchange, and the steps include registration and certification, recharge, selecting transaction pairs to place orders, setting risk control and withdrawing coins; pledge is used to participate in mining through ASIC equipment, mostly in the form of mining pools; investment advice is to learn the basics, choose a reliable platform, formulate strategies, control warehouses and disperse, and pay attention to market and security.

Ranking of mainstream Bitcoin trading apps, list of eight global users

Aug 21, 2025 am 08:54 AM

Ranking of mainstream Bitcoin trading apps, list of eight global users

Aug 21, 2025 am 08:54 AM

The crypto asset trading platform is a key hub connecting users and digital currencies. The article introduces mainstream global platforms such as Binance, OKX, gate.io, Huobi, KuCoin, Kraken, BITFINEX and Bitstamp. These platforms have performed outstandingly in terms of user volume, transaction volume, security, liquidity and service diversity, covering a variety of businesses such as spot, derivatives, DeFi, NFT, etc., meeting the needs of different users, and promoting the popularization and development of digital assets on a global scale.

Which coins do the top accounts in the currency circle pay attention to in August?

Aug 21, 2025 am 09:12 AM

Which coins do the top accounts in the currency circle pay attention to in August?

Aug 21, 2025 am 09:12 AM

DeFAI, DeFi and DeSci became the three mainstream narratives of the crypto market in August. Tokens such as GRIFT, LINK, and URO received KOL attention. DeFAI rose 45%, DeSci rose 78%, ARB, APT, and TAO were long-termed in real markets to make profits. MAGACOIN, XRP, and PEPE were popular among the community, and the market sentiment was positive but the risks remained.

Have wlfi tokens been on the exchange

Aug 21, 2025 am 09:18 AM

Have wlfi tokens been on the exchange

Aug 21, 2025 am 09:18 AM

WLFI tokens have not yet been confirmed to be launched on mainstream centralized exchanges. Investors need to verify their listing status through official channels or platforms such as CoinMarketCap and CoinGecko. If they are not launched, they may only trade on decentralized exchanges (DEXs) such as Uniswap and PancakeSwap. Users can connect to DEXs through Web3 storage such as MetaMask and enter the contract address obtained by the official to trade. Pay attention to slippage tolerance and security risks when operating; whether WLFI can be launched on a centralized exchange in the future depends on factors such as project fundamentals, community activity, liquidity and compliance. Project parties need to actively connect with the exchange and meet the review requirements, while Binance, OKX, Huobi