On April 15, China Asset Management, Boshi Capital and other applicants posted on the social media platform WeChat that they had been approved to list Bitcoin and Ethereum ETFs in Hong Kong. Following the news, Bitcoin prices surged to over $66,000.

However, the announcements appear to precede an official statement from the Securities and Futures Commission (SFC), which has yet to publish the list of approved issuers. Some posts have been deleted.

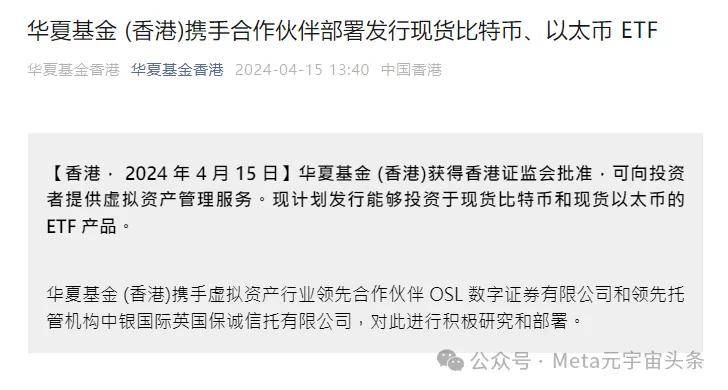

Major Chinese asset manager China Asset Management said its Hong Kong subsidiary has received in-principle approval from the Hong Kong Securities and Futures Commission to offer funds related to spot cryptocurrency ETFs. Retail asset management services. It plans to launch spot Bitcoin and Ethereum ETFs in partnership with OSL and BOCI. OSL said it will serve as the “first virtual asset trading and sub-custodial partner” for China Asset Management’s upcoming ETF.

Harvest Global Investments said in a statement that the company’s two spot crypto ETFs have also received in-principle approval from the Securities and Futures Commission. It added that the two ETFs will be issued in cooperation with OSL, which can effectively solve problems such as excessive margin requirements. OSL said in a statement: "In this cooperation, OSL leverages its powerful infrastructure to provide a secure trading environment necessary for ETF operations and manage underlying assets accurately and reliably."

China Large Assets The management company’s Hong Kong subsidiaries Boshi Asset Management and HashKey Capital also told The Block on Monday that regulators have conditionally approved two spot crypto ETFs jointly managed by the two companies. The pair did not immediately clarify what "conditional approval" meant.

Just three months ago, the United States launched the first U.S.-listed ETFs tracking Bitcoin spot. The U.S. rollout attracted about $12 billion in net inflows.

The above is the detailed content of The national team enters! Hong Kong approves Bitcoin, Ethereum ETFs for first time. For more information, please follow other related articles on the PHP Chinese website!