There are three main aspects when looking at the K-line chart: 1. Check whether it is a positive line or a negative line. The positive line and the negative line represent the trend direction. The positive line indicates that there is an opportunity to continue to rise in the future, while the negative line indicates that there is a continued downward trend; 2. Look at the size of the entity. The column represents the price, and the size of the entity contains the internal power of the stock. 3. Look at the length of the shadow line. The shadow line has turning information about the direction change. That is, the longer the upper shadow line, the less likely it will be. Conducive to rising stock prices.

First of all, we must first understand what a K-line chart is. The K-line is a columnar line, which contains entities and shadow lines. The entity It is divided into Yang line and Yin line, also known as red (Yang) line and black (Yin) line. The record of a K-line is the price change of a certain stock in one day. The K-line graphically represents the increase, decrease, transformation process and actual results of the power of buyers and sellers. Above the entity is the upper shadow line, and below it is the lower shadow line.

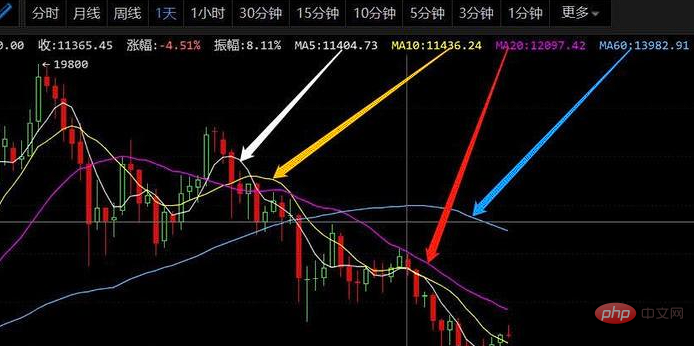

In the stock market, the positive line and the negative line represent the trend direction, and the positive line indicates that there will be opportunities to continue to rise in the future. The negative line indicates that there is a continued downward trend. Take the Yang line as an example. After a period of long and short struggle, the closing price is higher than the opening, indicating that the bulls have the upper hand. According to Newton's mechanical theorem, the price will still run in the original direction and speed without external force, so the Yang line indicates the next stage. It will continue to rise, and at least it can ensure that it can surge upward in the early stages of the next stage. Therefore, the positive line often indicates continued rise, which is also very consistent with one of the three major assumptions in technical analysis: stock prices fluctuate along the trend, and this kind of following the trend is also the core idea of technical analysis. In the same way, the negative line can continue to fall.

The column in the K-line chart represents the price, and the size of the entity contains the internal power of the stock. The larger the entity, the greater the upward or downward trend. is obvious, but the opposite trend is not obvious. Taking the Yang line as an example, its real body is the part where the closing price is higher than the opening. The larger the real body of the Yang line, the more powerful it is to rise. Just like the physical principle that the greater the mass and the faster the speed of an object, the greater its inertial impulse. , the larger the real body of the Yang line is, the greater its internal rising power will be, and its rising power will be greater than that of the Yang line with a small real body. In the same way, the larger the Yinxian entity is, the stronger the downward momentum will be.

The shadow line in the K-line chart has turning information of direction change. The longer the shadow line in one direction, the less conducive it is for the stock price to move in that direction. Changes, that is, the longer the upper shadow line, the less conducive to the rise of the stock price, and the longer the lower shadow line, the less conducive to the fall of the stock price. Take the upper shadow line as an example. After a period of long-short struggle, the bulls were finally defeated late in the day. Once bitten by a snake, they will be afraid of ropes for ten years. No matter whether the K line is Yin or Yang, the upper shadow line has been It constitutes the upper resistance in the next stage, and the probability of downward adjustment of stock price is high. In the same way, the lower shadow line indicates that the probability of the stock price attacking upward is high.

1. Bald Yangxian. It shows that the long side is dominant. Generally speaking, the longer the positive line, the stronger the power of the long side, and the greater the possibility of price rise in the future. Such graphics mostly appear in K-line graphics that are less than 15 minutes.

2. Bald Yinxian. It shows that the short side is dominant. Generally speaking, the longer the negative line, the stronger the power of the short side, and the greater the possibility of price decline in the future. Such graphics mostly appear in K-line charts of less than 15 minutes.

3. Inverted tapered positive line. It shows that bulls have an advantage. If the upper shadow line is longer, it can reflect greater pressure on the rise, and the market outlook may fall; if the upper shadow line is shorter, the market outlook may consolidate and rise.

4. Inverted tapered negative line. It shows that the short side has the advantage, the price first rises and then falls, and there is a possibility of a fall in the market outlook.

5. Yang line with upper and lower shadow lines. It shows that after the long-short dispute, the bulls have a slight advantage, but the upward momentum is insufficient, and there is a possibility of a correction in the market outlook.

6. Yinxian with upper and lower shadow lines. It shows that after the long-short dispute, the short side has a slight advantage, but the decline has encountered resistance, and there is a possibility of a rebound in the market outlook.

7. Grand Cross Star. Most of them appear before the market reverses, indicating that the long and short sides are evenly matched and the price trend is facing a breakthrough. If the upper shadow line is longer, a downward breakthrough is more likely; if the lower shadow line is longer, an upward breakthrough is more likely.

8. Small cross star. The upper and lower shadow lines are shorter, indicating that both bulls and bears are not willing to enter the market, and the market outlook is mostly consolidation. I. Tapered positive line. It shows that bulls have the advantage, and if the lower shadow line is longer, the market outlook may rise more.

9. Tapered negative line. It shows that the short side has the advantage. If the lower shadow line is longer, the market rebound may be greater. If the lower shadow line is shorter, it may continue to fall.

10. Inverted T shape, also known as "tombstone shape". It shows that the stock price is weak and there is a risk of falling in the market outlook.

11. T-shaped. It shows that the decline in the exchange rate is blocked and there is a possibility of rising in the market outlook.

The above is the detailed content of How to read K-line chart. For more information, please follow other related articles on the PHP Chinese website!