Written by: David Han, David Duong

Compiled by: DAOSquare

Key Points

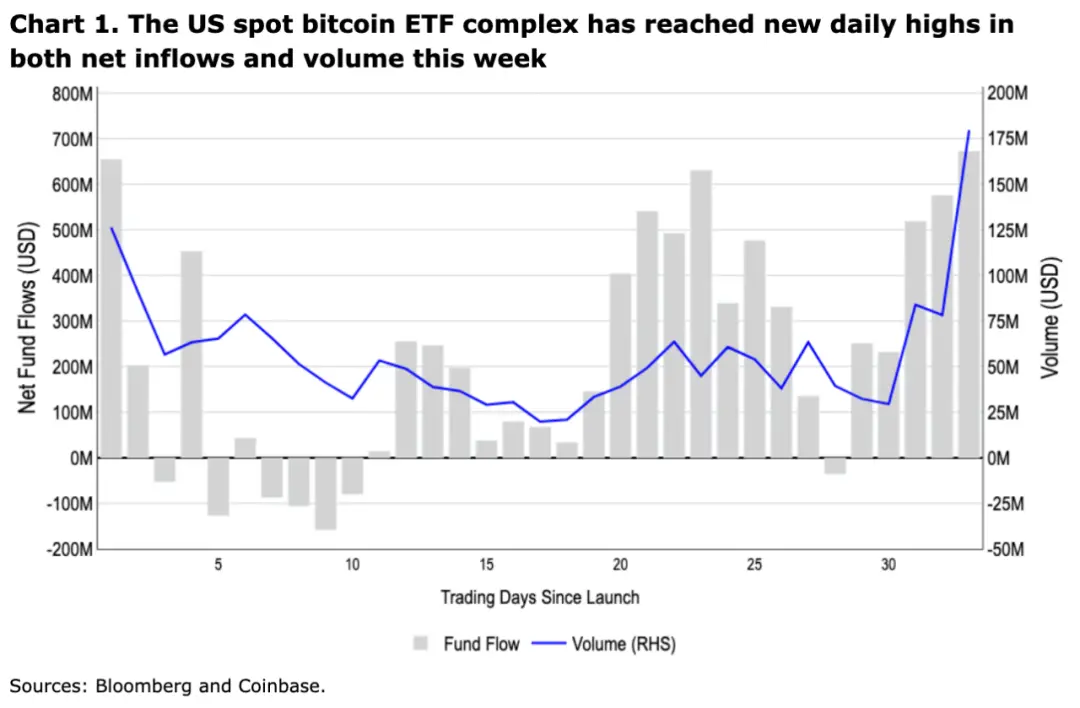

This week, the cryptocurrency market has shown an impressive rebound, Mainly benefiting from the influx of large amounts of funds into U.S. spot Bitcoin ETFs and leveraged derivatives, which caused short positions to be squeezed and provided overall support for the market. Spot Bitcoin ETFs attracted nearly $1.8 billion in net inflows earlier this week, with BlackRock’s iShares Bitcoin ETF (IBIT) accounting for 70% of that (see chart 1 for details). While large brokers like Morgan Stanley are still conducting a cautious review of these products, which is a prerequisite for offering them to clients, this week's performance is certainly encouraging.

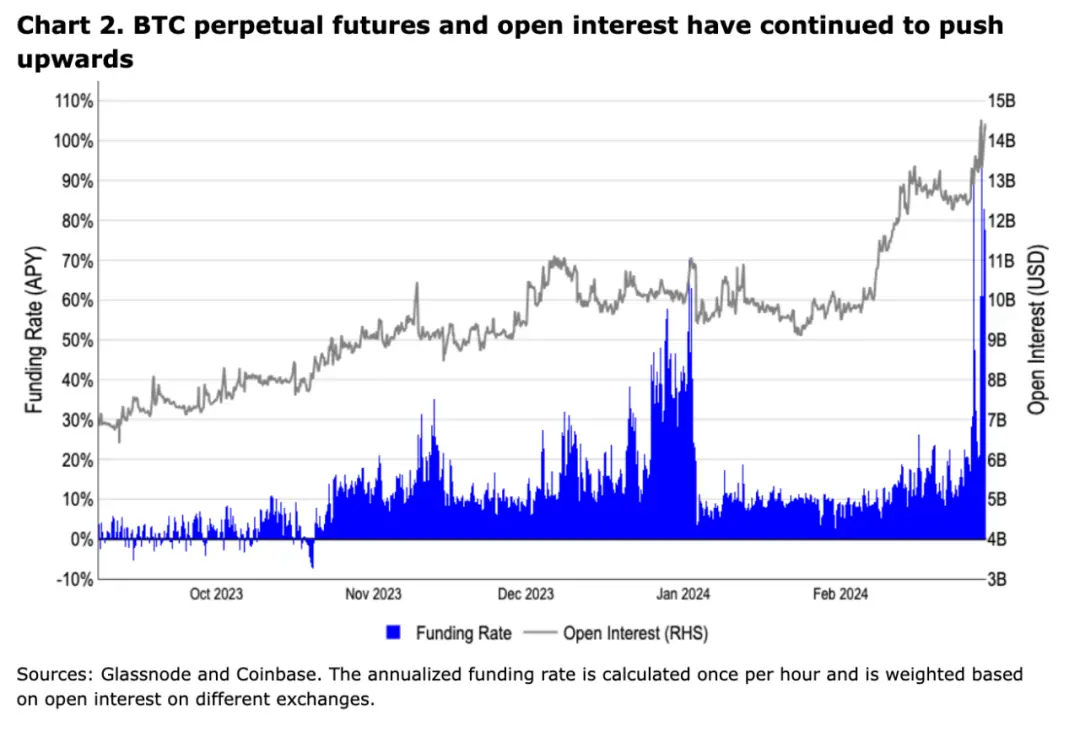

Bitcoin price momentum has fueled a short squeeze in recent days, with BTC perpetual futures open interest at the highest level since January 2022 highest level ($14.2 billion). The weighted average funding rate for open interest reached an annualized rate of 109% on February 28, the highest level since April 2021, according to Glassnode data. Subsequently, the rate dropped to approximately 70% (see Figure 2). Nearly $750 million of shorts were liquidated between February 25 and 28, setting new highs for the number of shorts liquidated year-to-date. At the same time, we believe that short covering based on the futures long-short ratio may be coming to an end but is not yet fully complete.

The recent performance is consistent with the constructive outlook we issued in early February, but we are cautious about some negative seasonality that may still emerge in March. For example, traditional assets tend to be affected by drivers such as tax payments, which can cause some temporary downward pressure. Large and sustained positive moves in funding rates and open interest could also have an impact on the market if the liquidation of funding rates and open interest results in a cascade of long liquidations. Nonetheless, we remain generally constructive on the outlook for the coming months, as a large number of wealth managers will also continue to include spot ETFs, with such net inflows clearly absorbing the circulating supply of liquidity faster than Bitcoin miners can produce it. Faster.

On February 23, the Uniswap Foundation (UF) announced a proposal to upgrade the Uniswap V3 protocol governance to achieve Part of the transaction fees are awarded to UNI token delegators and stakers. However, it should be noted that the proposal itself does not enable fee conversion, but rather sets out a technical mechanism for how to implement fee conversion. If the proposal passes, the initial fee parameter will be set to 0, but a range of 10% to 20% of transaction fees can be used for reward programs in future proposals.

In our opinion, the biggest concern about enabling protocol fees is the impact on liquidity providers, as any such fees will be deducted from their revenue. This may result in a reduction in Total Value Locked (TVL) and MEV-based traffic. A detailed analysis by Gauntlet (involved with UF) addresses this question and suggests that the impact on core non-MEV volumes is likely to be minimal, with annual revenue estimates ranging from a conservative $10 million to an optimistic $72 million based on historical activity. If this initial proposal passes, the Gauntlet team will also be responsible for coming up with a fee rollout plan.

We believe this proposal is likely to be implemented given that it has been proposed by UF’s governance leaders and has received broad support in the forum. In fact, in the previous fee proposal that was rejected in June 2023, most participants expressed approval, but the voting differences between different fee levels ultimately made "no fee" the majority. Given that the proposal has not yet changed any revenue structures and does not present the same vote distribution issues, we do not see any significant obstacles. Interestingly, the proposal also links revenue to governance (through staking and delegation), which we believe could incentivize more active community participation by UNI holders. The voting period for the proposal is expected to take place between March 1 and 7.

The widespread attention to the proposal has also led several other projects to consider following suit, such as Frax. If this trend develops in other mature DeFi protocols, we think it may start to bring previously speculative token valuations into a clear and actually supported valuation model, especially for those that can generate sustainable Fee tokens and protocols. At the same time, this shift also represents a change in the protocol's value accrual mechanism, as it rewards agents and stakers directly with wETH (the current proposed payment token), unlike other protocols such as MakerDAO that use native token buyback and destruction. The mechanics contrast.

Additionally, we would like to discuss the growing field of rollups on Ethereum, which has given rise to A new kind of rollup as a service (RaaS) product that allows you to create and deploy rollups with just a few clicks. The development of modular blockchains has accelerated with the emergence of various technologies and is used to deploy Layer2 (L2) and other application-specific chains. The aforementioned Frax protocol plans to launch its own L2 Fraxtal, which will make it part of the Optimism superchain. Other major protocols, such as decentralized perpetual contract exchange GMX, currently the top TVL protocol on Arbitrum, are also considering deploying their own chains (it is currently known that the GMX protocol will remain on Arbitrum and Avalanche C-Chain superior).

As more and more L2s are born, we believe that there will be more scrutiny in the field of cross-chain bridges and interoperability, and the complexity of the entire ecosystem will also increase, Different solutions have their own considerations in terms of security assumptions, validation time, development timelines and costs, which can also cause certain obstacles for non-technical end users. In addition, the fixed cost of Rollup (the cost of gas for the Layer1 infrastructure layer) is also a factor to consider. In a world where L2 proliferates, monetization may become increasingly difficult and will likely push applications further into Layer 3, which in turn will lead to a reshuffling of profitable L2 chains. This fragmentation of the execution environment has led some critics to argue that the shared state provided by a single or integrated blockchain enables more use cases and better cross-application security.

The discussion of both approaches to scalability, with both the arguments for and against, has far-reaching implications, although we believe these technical trade-offs are actually essential to building a smooth user experience. is secondary. In our view, widespread adoption of any application will ultimately require the abstraction of technical complexity from the consumer, just as the underlying technology stack (and design trade-offs) of a large web2 platform are largely user-agnostic. With this in mind, we believe technology that enables users to protect their wallets with passkeys, such as Coinbase’s wallet solution, is even more important to growing the Crypto market. While these tools are often overlooked in the scalability debate, we believe these innovations could ultimately have a huge impact on user adoption and new acquisitions, especially if scalability solutions converge to similar performance over the long term.

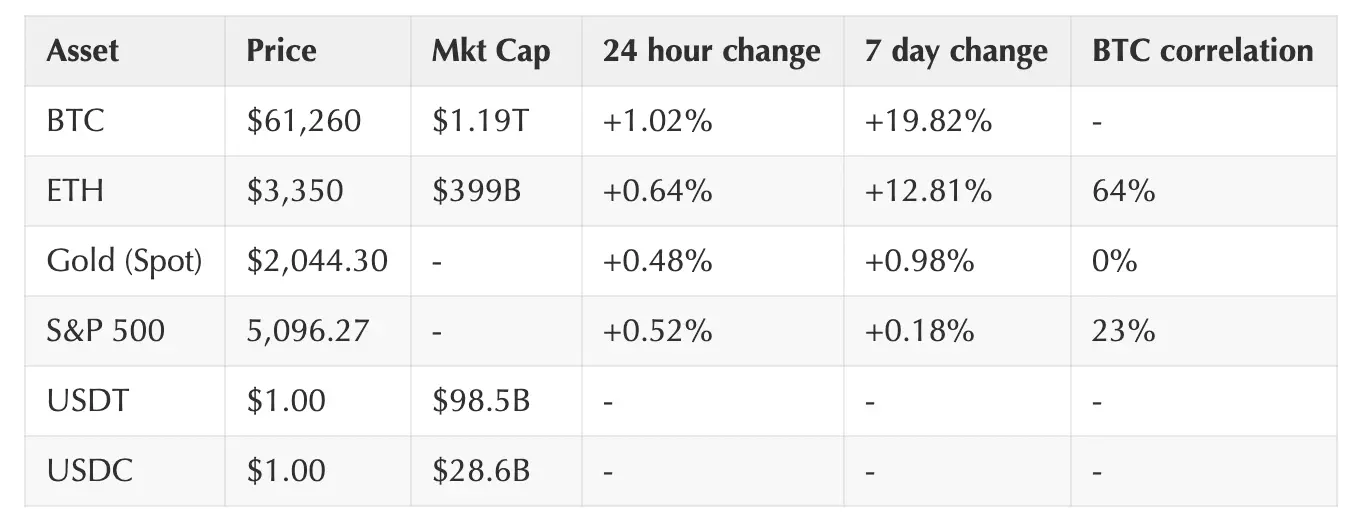

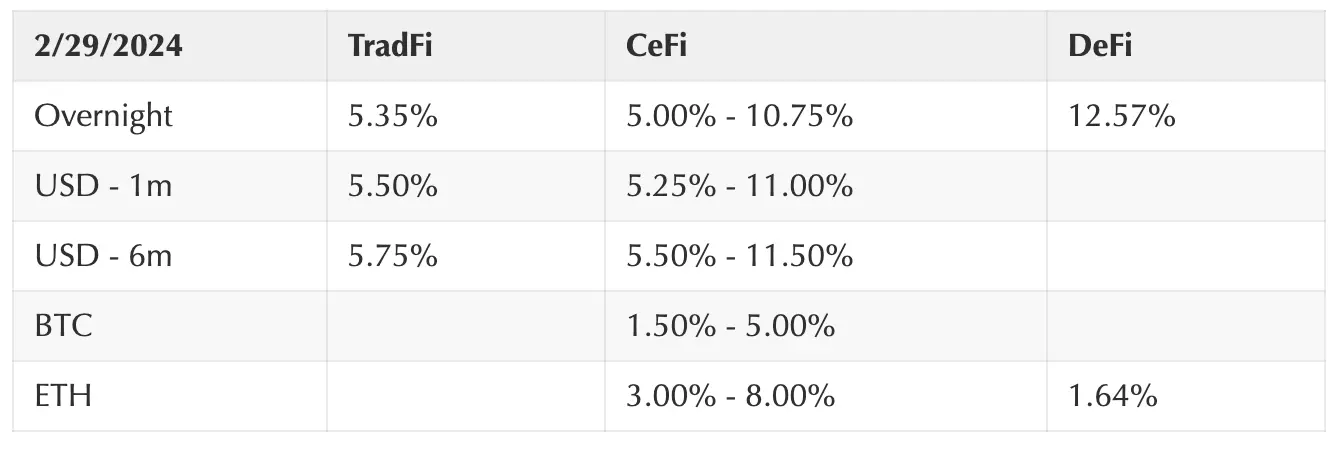

(As of February 29, ET 4 p.m.)

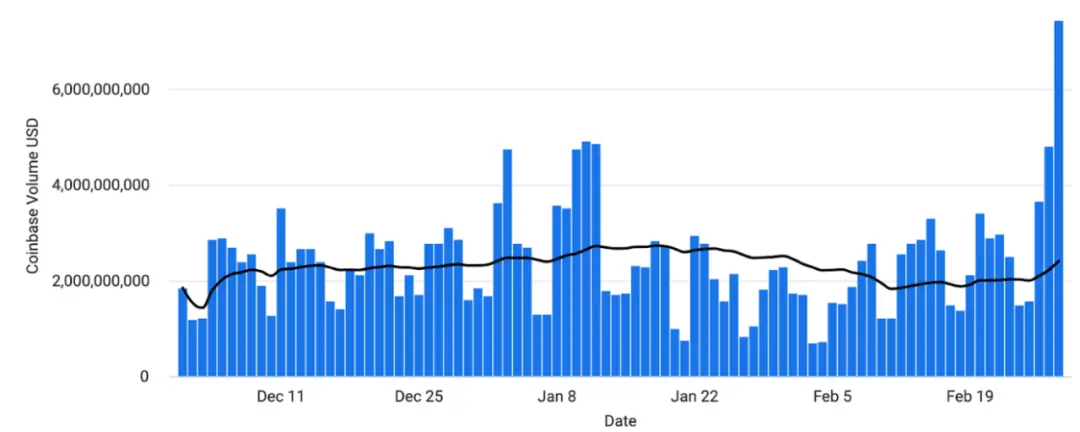

BTC’s rally continues to have many markets participating with its strength were surprised. Long holders are benefiting from this momentum, as more than $2 billion in new money entered ETF products over the past week. Still, high funding rates and rising open interest in perpetual futures products could pose risks to the rally. Over the past seven days, funding rates have averaged over 30%, making it costly to hold long exposure. Altcoin flows have shown a closer correlation with investor trading behavior around sectors and narratives.

Coinbase platform trading volume (USD)

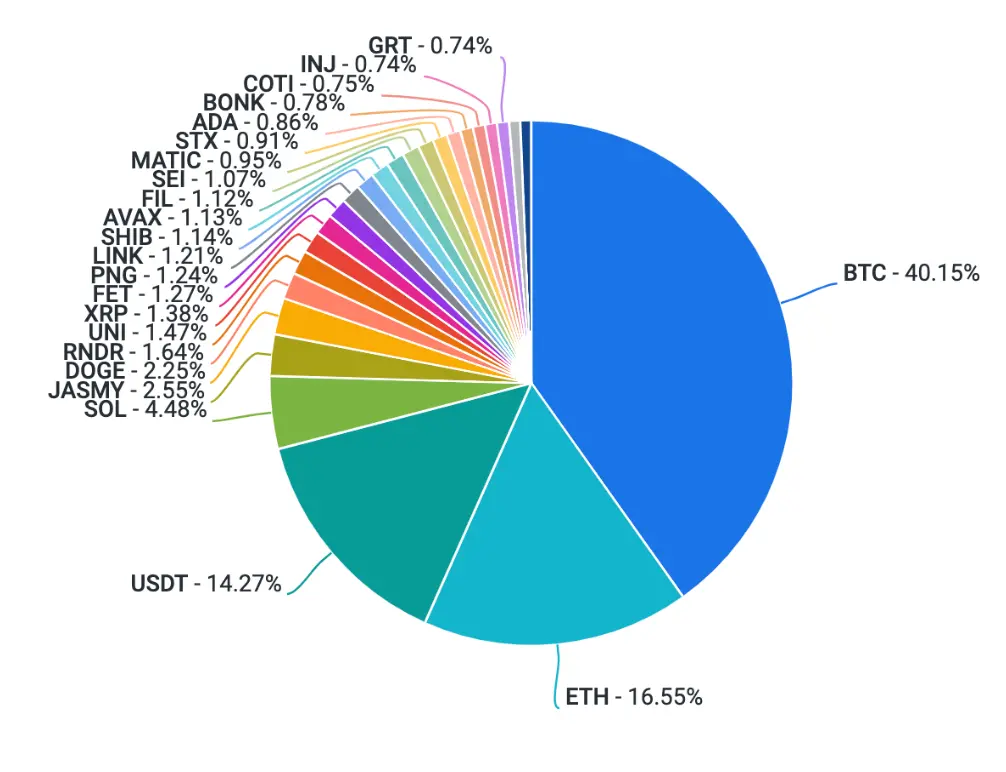

Coinbase platform trading volume (asset ratio)

Institution

General

Coinbase

Europe

亚洲

The above is the detailed content of Coinbase: Is the strong momentum in the crypto market sustainable?. For more information, please follow other related articles on the PHP Chinese website!