The growth in market value of stablecoins is similar to the increase in money supply in the traditional financial system. The increase in stablecoin market capitalization means more funds flow into the cryptocurrency market, which provides additional liquidity and facilitates trading activity on various chains. In short, the market cap of stablecoins is one of the important catalysts for the start of a bull run in the cryptocurrency market.

According to monitoring data from @whale_alert, Tether, the largest stablecoin issuer, issued an additional 1 billion USDT on the Ethereum network yesterday afternoon. In response to this, the chief technology officer replied on X that this is an additional US$1 billion in Tether (USDT) inventory on the Ethereum network. It should be noted that this is an authorized but not yet issued transaction, and this amount will be used as inventory for the next issuance request and on-chain exchange.

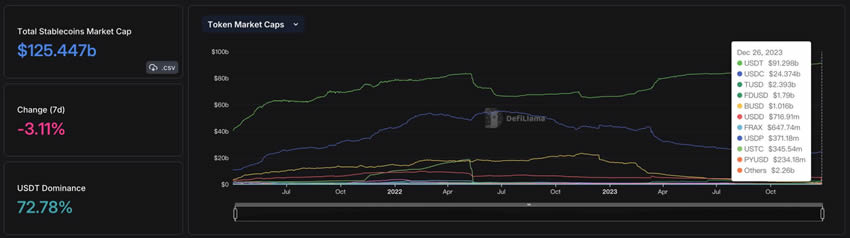

According to DeFiliama data, the current total market value of stablecoins is approximately US$125 billion, of which USDT accounts for 72.78%, reaching approximately US$91.2 billion. In the past month, the market value of USDT has increased by 2.83%, showing a growing trend. These data deserve our attention.

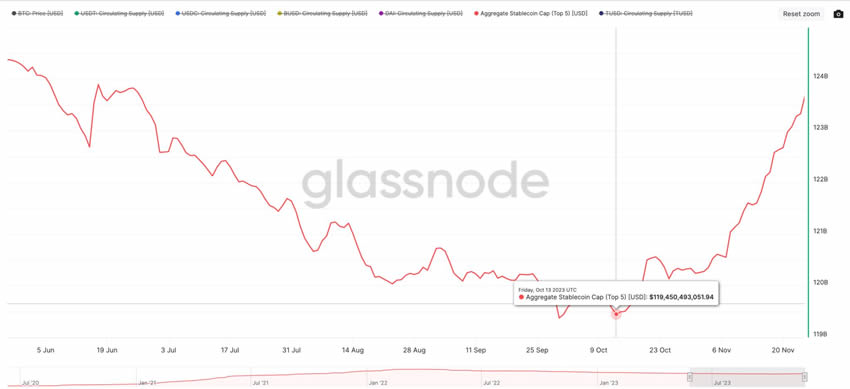

According to data, the market value of stablecoins reversed in mid-October and increased by approximately 3.36% in the past 2 and a half months, equivalent to an increase of approximately $5.6 billion. Although the data of Glassnode and Defiliama are slightly different, they both show the growth trend of market capitalization.

Stablecoin market capitalization growth

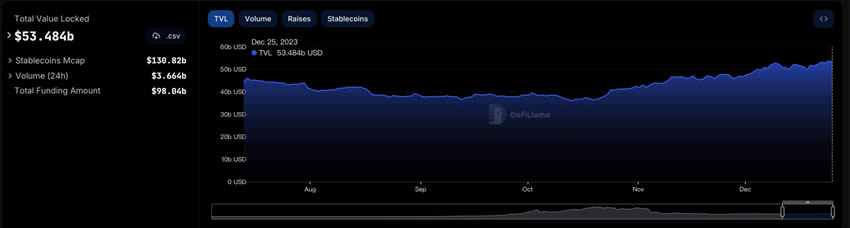

In the past, stablecoins often It is a pioneer in the Defi field. With the influx of stablecoins, the total locked-up volume of DeFi protocols and public chains will also increase.

According to data from DefiLlama, the amount locked in DeFi protocols on various chains was less than US$36 billion in mid-October this year, compared with the high of US$178 billion in November 2021. It can be said to have dropped by more than 80%. However, with the main pull of Ethereum, the locked-up amount of DeFi in various chains has returned to US$53.4 billion so far, an increase of 48% since mid-October.

Signs of funds returning to DeFi

The public chain track has also seen obvious growth. Sui’s total locked-up volume reached 1 It continued to grow after reaching US$200 million, and now exceeds US$200 million. In addition, Layer2Blast’s total locked-up volume continues to hit new highs. According to DeBank data, the total value of assets locked in the Blast contract address has exceeded $1 billion, with most of the assets including $920 million worth of ETH deposited in the Lido protocol, and more than 100 million DAI deposited in MakerDAO.

The above is the detailed content of Ethereum market circulation increased by 1 billion USDT! Are there signs of recovery in the Defi industry?. For more information, please follow other related articles on the PHP Chinese website!