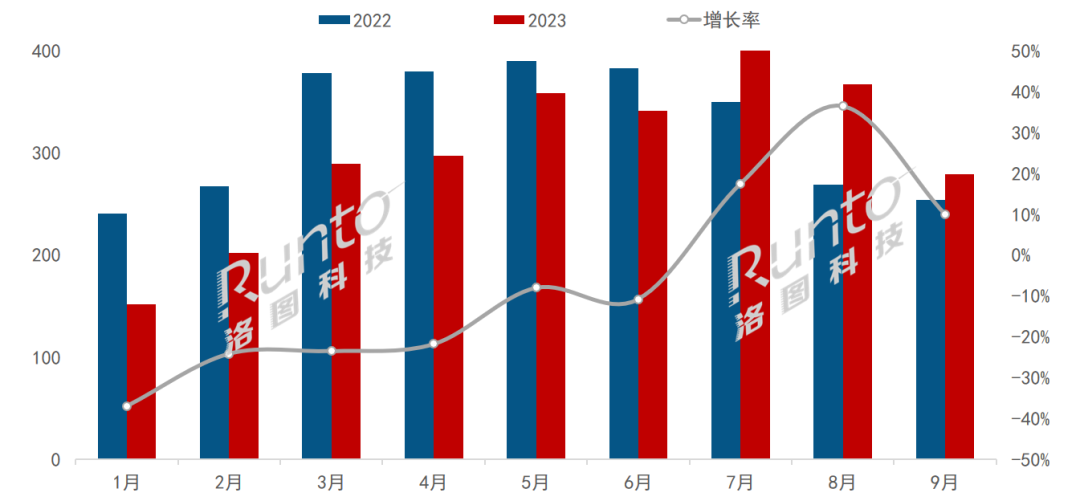

News from this site on November 6, according to the official public account of Runto Technology, Runto Technology today released the data of the "Global Commercial Display Panel Market Analysis Quarterly Report", which shows that in the third quarter of 2023, Global large-size interactive flat panel display panel shipments were 1.056 million pieces, an increase of 21.0% over the same period in 2022, and the shipment area was 1.641 million square meters, an increase of 18.7% over the same period in 2022.

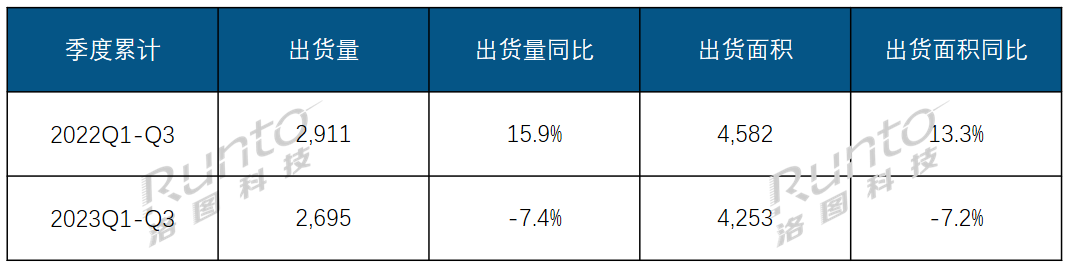

This site found that Luotu Technology stated that although the volume and area in the quarter both experienced a sharp increase of about 20%, due to the drag of the market in the first half of the year, the cumulative shipments in the first three quarters were lower than those in 2022. Still dropped by 7.4%, and the cumulative shipment area dropped by 7.2%.

Looking forward to the fourth quarter, the demand for stocking during the peak season has come to an end. Due to the unclear price trend of the overall large-size panels, panel purchase orders from machine manufacturers are also relatively cautious. Looking at the whole year, the core problem of the large-size interactive tablet market is still weak terminal demand. Luotu Technology predicts that the total shipment volume of panels will decline by about 10% year-on-year in 2022.

Luotu Technology stated that TV panels usually share the same generation production line with large-size interactive flat-panel display panels. According to data from Luotu Technology (RUNTO), in the third quarter of 2023, global large-size LCD TVs Panel shipment volume was 58.6M pieces, a year-on-year decrease of 3.7%; the shipment area reached 43.0M square meters, a year-on-year increase of 11.8%. The main reason for the change in shipment volume and area is that "panel manufacturers" balance supply "market price" strategy, and the year-by-year upgrade of the average size".

Panels used for commercial or public information display are different from TV panels. Since they do not consume much inside the factory, there are no depreciation and amortization considerations, and there is no need to bear the burden of stabilizing market prices. mission, so production and sales depend more on the demand of the complete machine market.

. In addition, since this year, due to the long-term unilateral increase in overall display panel prices, the large-size commercial display panel market has been stocking up to a certain extent before the third quarter. In addition, the third quarter is generally the traditional peak season. expectations, panel purchases and shipments improved significantly in the quarter.

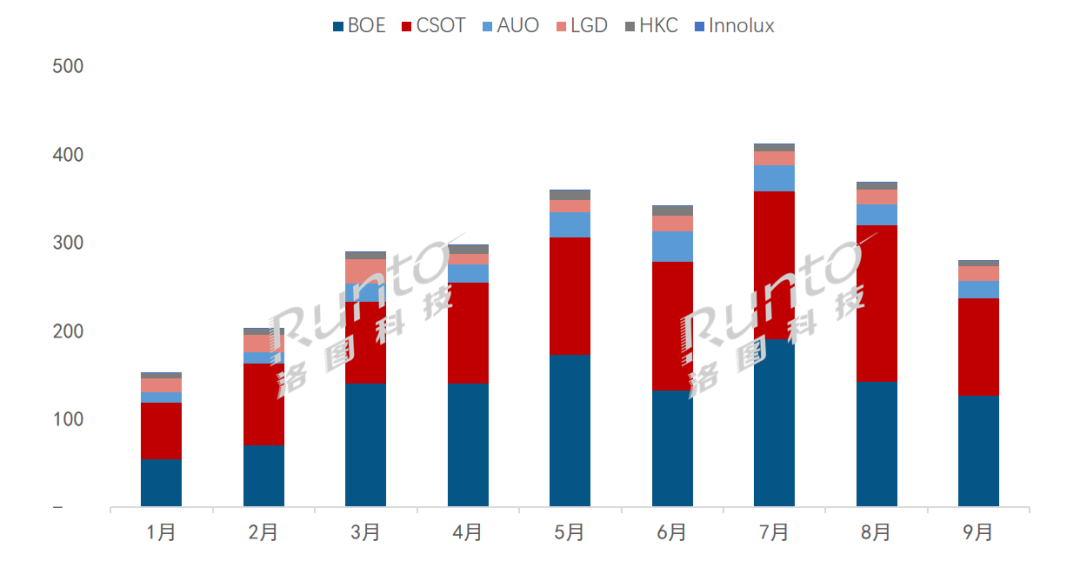

In terms of shipments of large-size interactive flat panel panels, in 2023 In the third quarter, only mainland panel manufacturers maintained growth in shipments, with increases of more than 35%.

Among them, the combined market share of BOE (BOE) and CSOT (China Star Optoelectronics) has reached more than 85%, an increase of nearly 19 percentage points compared with the same period in 2022. The shipments of the two The volume is between the two, with Gap producing about 4,000 pieces, and its market shares are 43.4% and 43% respectively. Among them, CSOT has benefited from the increase in the production of 86-inch panels in the T9 production line, and its market share has increased significantly.

In addition, Luotu Technology believes that the shipments of Taiwanese and Korean panel factories are declining.

Korean manufacturers are gradually withdrawing from the LCD business, with only LGD (LGD Display) mainly supplying 86-inch products from the 8.5 generation production line of the Guangzhou factory; Taiwanese manufacturers are adjusting their business planning and operating strategies , began to focus on new technologies and high-value products, and the shipment volume of Innolux (Innolux) has been basically negligible.

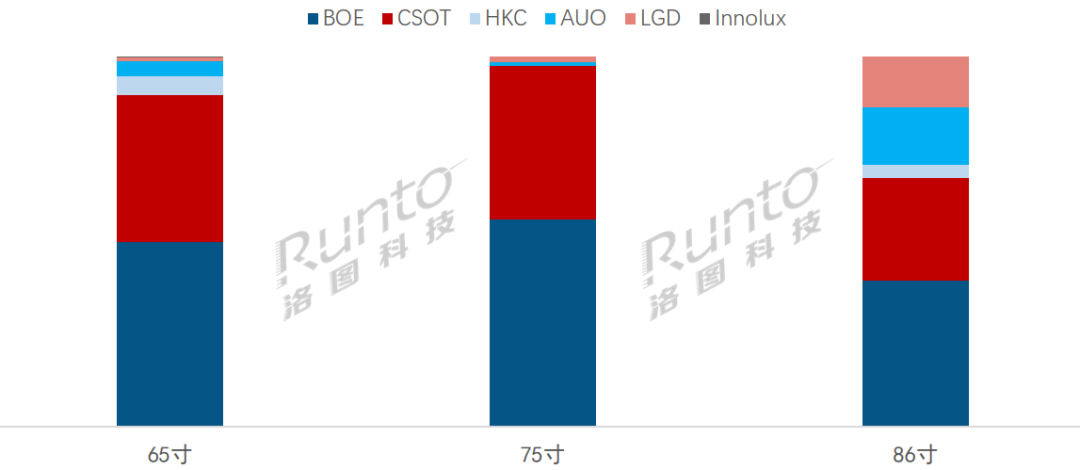

Luotu Technology claims that in the first three quarters of 2023, cumulatively , 86-inch accounts for 30.9%; 75-inch and 65-inch account for 29.7% and 30.2% respectively.

The main sizes of large-size interactive tablets are 86-inch, 75-inch and 65-inch. The three together account for more than 90% of the overall market. The 86-inch ranks first in shipments with a slight advantage.

In terms of size, BOE accounts for more than half of the market in 75-inch and 65-inch shipments, accounting for 50% and 55.9% respectively. Among 86-inch shipments, COST ranked first with a share of 39.5%.

Advertising statement: The external jump links (including but not limited to hyperlinks, QR codes, passwords, etc.) contained in the article are used to convey more information and save selection time. The results are for reference only. All articles on the site contain this statement.

The above is the detailed content of Luotu Technology: Global shipments of large-size interactive flat panels increased by 21% in the third quarter and are expected to fall by about 10% for the whole year. For more information, please follow other related articles on the PHP Chinese website!