This year’s hot AI model is accelerating the creation of unicorns.

Artificial intelligence company Mobvoi plans a public offering and intends to list on the Hong Kong Stock Exchange, the news was disclosed on May 30. This is the first company in China to rush for an IPO under the banner of general artificial intelligence. Its emergence is the result of the big model boom.

Mobvoi was founded in 2012 and is a senior player in the artificial intelligence track. Li Zhifei, the founder of Mobvoi, is a senior natural language scientist and former Google scientist. His entrepreneurial direction initially focused on the field of voice interaction.

This technology-based artificial intelligence company has been looking for practical application scenarios that can be commercialized for the past ten years. From voice interaction solutions, to various smart hardware, to the blooming AIGC tools, now it wants to take advantage of the big model to land in the capital market as soon as possible and grab the first AIGC shares.

Go out and ask, a company that claims to be "one of the few AI companies in Asia that has the ability to build general large-scale models." In 2020, this company developed the universal large model UCLAI, and upgraded it to "Sequence Monkey" this year, successfully seizing the hot spot of large models.

In 2022, Mobvoi’s revenue was 500 million yuan, of which AIGC solution revenue was 39.86 million yuan. With an AIGC business revenue of less than 40 million yuan, Mobvoi has become "China's highest-revenue AI company focusing on AIGC technology."

An industry insider commented that this phenomenon of "the dwarf pulling out the general" was born because AIGC is an emerging track, and most of the companies in this track are not profitable. In the prospectus, the normal operation is to add attributives before the company name and use titles such as "first" and "most".

If you label yourself "general artificial intelligence", go out and ask, what is the quality?

what for?

Mobvoi is an artificial intelligence company. Before introducing its business, let us first talk about the two trends it has stepped into.

The first is general artificial intelligence. The so-called "universal" means that it can show intelligence in a variety of scenarios and tasks, not just for specific scenarios. The biggest keyword in this year's wave of AI craze is "universal", which is regarded as a symbol of the industry's turning point.

The second is AIGC. AIGC is a form of content generation preceded by PGC (Professional Content Generation) and UGC (User Content Generation). AIGC's content is generated by AI and is considered a major change in the way content is produced.

According to the above-mentioned industry insiders, in fact, the business that Mobvoi did in the past was not directly related to the above two concepts. But because founder Li Zhifei’s research field is natural language processing, and OpenAI’s large model broke through from this area, and they have many similarities in technology, Mobvoi was pushed to the forefront.

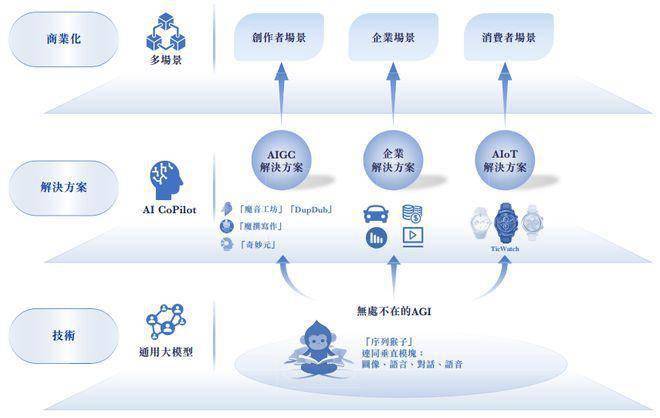

According to Mobvoi’s latest introduction, the company’s business model consists of a three-tier architecture.

The basic logic is: develop the underlying technology with general artificial intelligence as the core, then launch various solutions based on this technology base, such as AIGC, and finally find specific scenarios for commercialization.

Let’s look at the underlying technology first. Mobvoi first started as a voice search engine, and its advantage lies in voice recognition technology. Based on this, it developed technologies such as ASR (automatic speech recognition), TTS (text-to-speech) and NLP (natural language processing), forming the prototype of AI CoPilot.

It was not until 2020 that Mobvoi developed the general large model UCLAI, and then upgraded it to "Sequence Monkey" this year by taking advantage of hot spots. Its series of products are based on this model.

These technologies ultimately require specific products to be implemented, so Mobvoi has launched three major solutions based on the underlying technology - AIoT, AIGC, and enterprise services, corresponding to the three major target customers - C-end consumers, creators, enterprise.

AIoT’s products are mainly wearable devices and smart homes, and its flagship product is AI smart watches.

Since the launch of the first smart watch TicWatch 1 in 2015, it has now developed into the fifth generation. According to the disclosure in the prospectus, the TicWatch series has been sold to more than 100 countries and regions, with more than 1 million units sold since 2020. Mobvoi has launched wireless smart headphones, smart rearview mirrors, smart speakers and other products, in addition to smart watches.

The AIGC solution serves content creators, such as those who edit videos, do live broadcasts, post on social media, etc. They can use some AI tools to improve efficiency.

Mobvoi's products in this area include: AI dubbing assistant "Magic Sound Workshop" and its overseas version "DupDub", which mainly use AI to dub short video creators; AI writing assistant "Magic Writing", The initial function was to help correct, proofread, and polish articles, and later it could automatically generate articles; the AI digital human "Wonderful Yuan", launched in March last year, can clone the image and voice of a real person and generate a digital human for live broadcast.

There are two major parts of the enterprise solution, one is AI voice interaction, and the other is intelligent customer service. For example, it provides in-vehicle voice interaction systems to automobile manufacturers and provides AI customer service to insurance companies. Mobvoi said that since 2020, more than 2 million cars have been pre-installed with its in-vehicle voice interaction solution.

Overall, Mobvoi is essentially a technology development company. The test it faces is firstly whether the technology is leading, and secondly whether it can find a good landing scenario.

Now, Mobvoi is sprinting for an IPO, claiming that it is a general artificial intelligence technology company, conveying a message to the outside world: the technology it masters is universal, so it has broad application scenarios.

But, is this really the case?

How to make money?

No matter how beautiful the story is, it must ultimately rely on data to speak for itself.

In the prospectus, Mobvoi mentioned general artificial intelligence and AIGC many times, but these concepts have not brought much revenue at present.

Before 2022, the company’s main source of revenue will be the composition of AIoT solutions. In 2020 and 2021, AIoT contributed 220 million yuan and 340 million yuan in revenue, accounting for 83% and 85% of total revenue respectively. You can simply understand that this is a company that sells smart devices (especially smart watches).

However, Mobvoi is not just about selling hardware, its ultimate goal is to sell software through hardware. Mobvoi has developed apps such as Yuanchuangxiu, Xiaowen Sleep, Xiaowen Health and Xiaowen Sports, all of which are based on voice interaction technology. You may often see the "Xiaowen" personal virtual assistant among its products.

This is a major selling point of Mobvoi hardware products and also expands the source of income.

Another major revenue segment of Mobvoi is AI software solutions, including AIGC and enterprise business, which has been mentioned previously. By 2022, this revenue segment will surpass AIoT for the first time, accounting for 60.6%. Among them, enterprise business income has grown rapidly.

In 2020, Mobvoi’s AI enterprise solution revenue was only 44.78 million yuan, and in 2021 it was only 52.7 million yuan. It increased sharply to 263 million yuan in 2022, mainly contributed by automobile customers.

This business is obviously more profitable than AIoT. It has driven Mobvoi's gross profit margin to increase from 30% and 37.5% in 2020 and 2021 to 67.2% in 2022.

AIoT and enterprise business are currently the pillar businesses of Mobvoi. AIGC Solutions prefers to highlight features in its prospectus that account for a small proportion of revenue and appear to be promising.

Since the second half of last year, AIGC applications such as AI painting, AI poetry writing, and AI composition have been sought after in the industry. Although the commercialization prospects are not particularly clear, technology giants are rushing to deploy them.

The biggest advantage of Mobvoi is its early layout. In 2020, AIGC has contributed revenue to Mobvoi. Although the amount is only 496,000 yuan, this at least proves its business potential. AIGC's revenue will increase to 6.82 million yuan in 2021 and further increase to 39.86 million yuan in 2022. It can be seen from this that 2022 is the year of AIGC’s outbreak.

However, AIGC now accounts for only 8% of Mobvoi’s total revenue, which is still not a big deal.

What the outside world is optimistic about is the growth prospects brought about by the explosion of AIGC. According to CIC Consulting estimates, China's AIGC market size will reach 400 million yuan in 2022. Based on this calculation, Mobvoi will occupy 10% of the market share in 2022. CIC Consulting predicts that China's AIGC market will reach 32.6 billion yuan in 2027, with a compound annual growth rate of 136.3%.

If Mobvoi can stabilize its current market share, it will also be a very tempting cake.

As for the general large models that the industry really cares about, Mobvoi is still in the story-telling stage.

After upgrading "Sequence Monkey", Mobvoi developed two AIGC solution pipelines - AI Painting Assistant Yanshu and AI Writing Assistant Qiwen. The former can realize the mutual conversion of text and pictures, and the latter can create content. However, these two pipelines are still in the testing phase and have not yet generated any revenue.

What are the risks?

Unlike most AI companies, Mobvoi did not easily suffer financial losses of more than one billion. The company was profitable in 2020, but suffered losses of 276 million yuan and 670 million yuan in 2021 and 2022 respectively. After adjustments, excluding interfering factors such as changes in the book value of preferred shares, the net profit in 2022 will still be 109 million yuan.

However, this does not mean that Gomovo is financially sound.

The scale of going out to ask questions is still too small. The annual revenue of 500 million yuan is a drop in the bucket compared to many technology companies. Plus, its cash reserves aren't very generous.

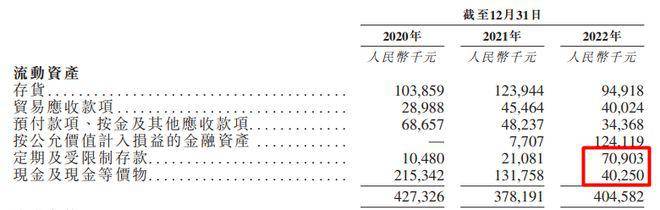

At the end of 2020, 2021 and 2022, the balance of cash and cash equivalents on Mobvoi's accounts were 215 million yuan, 132 million yuan and 40.25 million yuan respectively. Even if time deposits are included, by the end of 2022, the disposable funds will only be 110 million yuan.

With such a financial background, we really don’t have the confidence to enter large-scale AI models and compete with giants such as Google, OpenAI, and Baidu.

The bigger risk is whether Mobvoi’s commercialization capabilities are sustainable.

In 2022, Mobvoi’s revenue increased by 26%, which is a pretty good growth rate. If you take it apart, you will find that there is a problem - customers are too concentrated.

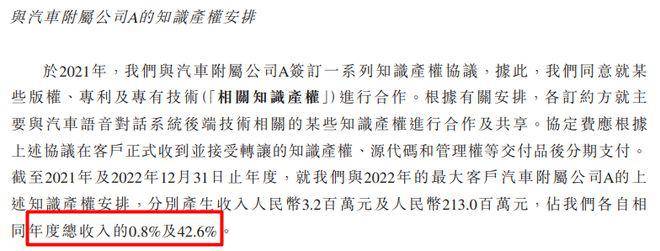

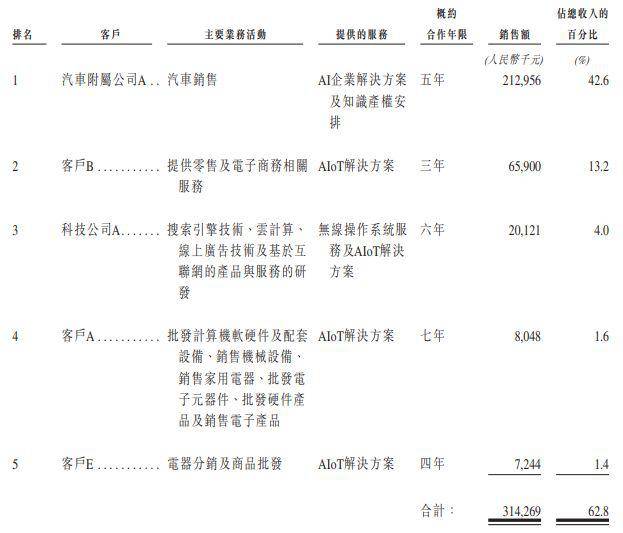

In 2021, Mobvoi reached a cooperation with an automobile manufacturer to obtain income by sharing intellectual property rights, which mainly involves the development of back-end technology for voice dialogue systems. In 2022, only this one customer contributed 213 million yuan in revenue to Mobvoi, accounting for 42.6% of its annual revenue.

A single customer's revenue share is too large, which is a big risk.

From 2020 to now, the revenue of the largest customer accounts for the proportion of Mobvoi's total revenue, from 8.8% to 24.1%, and then to 42.6%; the revenue proportions of the top five customers are 22.4%, 37.0% and 62.8%.

Some investors question how certain it is that the company can expand new customers and maintain steady revenue growth.

When Li Zhifei started his business in the early years, Google, Li Zhifei’s former employer, had great support for Mobvoi. Not only real money investment, but also a lot of business from Mobvoi. According to Mobvoi’s prospectus, Google holds 13.26% of its shares, and Volkswagen Group is also a shareholder.

If we sort through the list of the top five customers in the past three years, we will find that most customers still use AIoT solutions. However, the importance of this business in Mobvoi is declining, its revenue share is decreasing, and its gross profit margin is declining (from 30.2% in 2020 to 26.4% in 2022).

The old growth engine is beginning to lose its strength, and the new growth engine has not yet been built. Mobvoi faces considerable transformation pressure.

The only thing we can look forward to is that Mobvoi has predicted the explosive trend of general large models earlier and has made certain technical reserves. As the potential of the industry increases, Mobvoi will be the first to benefit from it.

However, AI large models have been regarded by more and more people as a major trend in the future. When the industry reaches a consensus, it means more intense competition, and the first-mover advantage may soon be wiped out.

When you go out to ask questions, you must first ask yourself whether you can win this tough battle.

Source: Shenran

The above is the detailed content of Going out to ask about IPO, does the story of the big AI model make sense?. For more information, please follow other related articles on the PHP Chinese website!