“We are in the iPhone moment of artificial intelligence.” This is what Jen-Hsun Huang said when NVIDIA released the NVIDIA DGX Cloud artificial intelligence cloud service. With the emergence of ChatGPT, large-scale models have become increasingly popular, and it has also become a reflection of the entire artificial intelligence market in 2023.

At present, if any technology company has not moved out its own large-scale model, or expressed its ambition to build a large-scale model, I am afraid that it is a bit non-mainstream in the industry.

In April this year, Kunlun Wanwei CEO Fang Han unveiled his own large language model-Tiangong 3.5. This is one of the few large-scale Chinese language models that has been tested internally, following Baidu Wenxinyiyan, Alibaba Tongyi Qianwen, and 360 Zhinao.

At the scene, Tiangong 3.5 demonstrated functions such as writing weekly reports, writing recruitment positions, writing code, and answering strange questions. Frankly speaking, after seeing the power of ChatGPT, as well as Baidu Wenxinyiyan and Alibaba Tongyi Qianwen’s preconceptions, netizens don’t have much novelty about Tiangong 3.5.

A user who has taken the actual test praised, "I barely passed the liberal arts, but in scenarios such as mathematics and logical reasoning, there is a big gap between Tiangong 3.5 and ChatGPT."

Despite this, Kunlun Wanwei gained rapid success in the capital market thanks to the "east wind" of ChatGPT. The stock price rose from around 15 yuan/share at the beginning of the year to a maximum of 70.66 yuan/share on May 8, which was a price increase of at least two times. This time, the market value increased sharply by more than 60 billion yuan.

However, if we take a closer look at Kunlun Technology’s business development and related technology reserves over the years, that is, returning to the fundamentals and support behind the stock price, the signs of Kunlun Technology’s instability are obvious.

01 Rushing: from one concept to another

When it comes to Kunlun Wanwei, few people can figure out what it does: games, software, content, P2P, live broadcast, metaverse, social platform, new energy...

To a large extent, it is like a rotating plate. Whichever concept is popular and which subject matter is popular, we will rush towards it.

In 2007, Zhou Yahui resigned from Thousand Oaks Century and founded Kunlun Wanwei to focus on web game development. In the following years, until it was listed on the Shenzhen Stock Exchange in early 2015, games were the company's absolute responsibility, accounting for 97% of its revenue.

But soon after the IPO raised 1.3 billion yuan, Zhou Yahui became "dishonest" and began to work hard to extend the boundaries.

According to incomplete statistics, Kunlun Wanwei made the following diversified actions from 2015 to 2020:

◆ In 2015, when domestic mutual funds were surging, Kunlun Wanwei invested intensively in many P2P companies including Qudian, Suishou Technology, Yinke.com, etc., and even ended the deal personally in August 2017 to self-defense. It has funds of 500 million yuan to establish a wholly-owned subsidiary and obtain an online small loan license.

◆ In 2016, it acquired 61.53% of the shares of the same-sex dating platform Grindr and 51% of the shares of the chess and card leisure culture and competition platform Xianlai Interactive Entertainment for US$93 million and 1.02 billion yuan respectively. It also teamed up with Qihoo 360 to invest heavily. It acquired Norwegian browser manufacturer Opera for US$1.23 billion; in the same year, seizing the dividends of the live broadcast economy, it spent US$68 million to establish a relationship with Inke.

◆ In 2017, he led the investment in new Internet content brand Xinshixiang’s Series B financing exceeding 100 million yuan.

◆ In 2018, 150 million yuan was invested in the K12 online education brand "Growth Protection" Series B, and 30 million US dollars was invested in Star Group as a strategic investment.

◆ In 2019, US$50 million was invested in Pony AI, an autonomous driving brand.

◆ In 2020, it invested US$70 million in Didi.

In addition, if you look at the ownership structures of companies such as Kuaikan Comics, Dada, 8H Mattress, and Ruhan E-commerce, you can also see the presence of Kunlun Wanwei. It can be said that "capital buyers" have gradually replaced the original game developers and become Kunlun Worldwide's new label. This is also true. The contribution of games to Kunlun Wanwei's revenue in 2022 has dropped to 15%.

After 2021, the Yuanverse, new energy, and AIGC (a production method that automatically generates content with AI technology) that are sought after by the market are Kunlun Wanwei’s new bets.

In 2021, Kunlun Wanwei wrote in its financial report: "Opera's game browser and game engine will further deepen the integration and accelerate the layout of the metaverse", attracting the attention of the Shenzhen Stock Exchange; in 2022, based on a new round of energy Taking advantage of the revolutionary opportunity, the company increased its investment in "Green Vanadium New Energy" and obtained 60% of the other party's equity; by 2023, it will be a vigorous large-scale AI model.

It is not difficult to see that Kunlun Wanwei is very accurate in every step of "taking advantage of hot spots" and "chasing the wind" in lightning style, and often achieves good results. For example, the Metaverse in 2021 and this year's large model, no matter how effective they are in implementation, whether they can contribute to performance, anyway, the secondary market has "respected the first to rise".

However, an embarrassing point that cannot be ignored is that large models regard algorithms, computing power, pattern design, data processing, model application and other technologies as the first driving force. When searching Kunlun Wanwei in Qichacha, there are only 7 Patent information, 39 software copyrights, and no patents related to them were found.

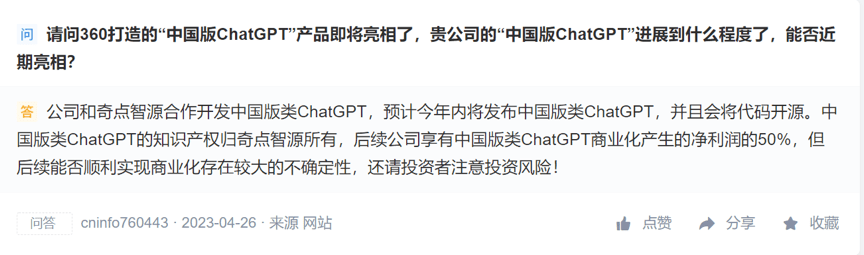

According to Qi Finance, Tiangong 3.5 is jointly built by Kunlun Wanwei and Singularity Intelligence, with the latter being the real technology provider. According to the agreement signed by the two parties: "The intellectual property rights of the Chinese version of ChatGPT belong to Singularity, and Kunlun Wanwei will enjoy 50% of the net profits generated from future commercialization."

Picture source: Interactive Easy

Picture source: Interactive Easy

In other words, 50% of the surplus generated by Kunlun Wanwei will be given to Singularity Intelligence. At the same time, the disadvantages of over-reliance on investment income are emerging on the performance side.

02 Investment cannot achieve “acceleration” of performance, and growth is questionable

With more business, will there be more profits? This does not seem to be the case with Kunlun Wanwei.

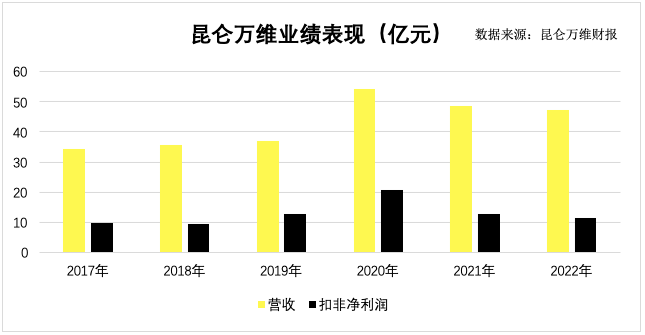

From 2017 to 2022, through continuous financial consolidation, Kunlun Wanwei has completed the transformation of a game company into a global Internet platform, embracing core flagship games such as Opera, StarMaker, Ark Games, and Xianlai Interactive Entertainment series. Application, revenue increased from 3.436 billion yuan to 4.736 billion yuan. However, in terms of profit scale, except for the investment income of 3.362 billion yuan obtained from the sale of Grindr shares in 2020, and the profits of that year soared, the remaining years have been relatively flat.

In 2022, Kunlun Wanwei achieved revenue of 4.736 billion yuan, a year-on-year decrease of 2.35%; realized attributable net profit of 1.154 billion yuan, a decrease of 25.49% year-on-year in 2021, and a decrease of 10.89% from 1.295 billion yuan in 2019, which was only 1.295 billion yuan. 1.006 billion yuan in 2018, an increase of 14.61%.

In other words, acquisitions mainly bring size, not growth. This is more intuitive starting from the deduction of non-net profits. From 2017 to 2022, this indicator ranged from 989 million yuan to 1.154 billion yuan, with a compound growth rate of only 2.6% during the period, indicating that the growth of the main business has almost stagnated.

Regarding the decline in net profit in 2022, Kunlun Wanwei said, "It is mainly due to the company taking the initiative to adopt a more prudent investment strategy after studying and judging the macro environment, resulting in a year-on-year decrease in investment-related income."

The financial report shows that Kunlun Wanwei’s investment income in 2022 was 141 million yuan, a decrease of 91.53% from 1.665 billion yuan in the same period last year, to about 1.5 billion yuan.

This impact is undoubtedly huge for Kunlun Wanwei, which relies on investment to make money.

Looking further, from 2017 to 2021, Kunlun Wanwei’s investment income accounted for 31%, 46%, 47%, 67%, and 107.7% of the current net profit respectively. Since 2018, investment income has maintained more than half of Kunlun Wanwei’s profits.

Entering 2023, there are no signs of improvement in performance.

In the first quarter of 2023, Kunlun Wanwei’s revenue increased by 2.04% year-on-year to 1.217 billion yuan, but due to investment income, it only recorded 91 million yuan, a year-on-year decrease of 66.54%, resulting in a significant shrinkage of 43.33% in attributable net profit to 212 million yuan Yuan; excluding non-net profit plummeted 59.68% year-on-year to 166 million yuan, which shows the weakness of the main business.

At the moment when big models are being launched, lagging performance will obviously delay a lot of things.

According to the estimate of "How much computing power does ChatGPT require" released by Guosheng Securities, the cost of training GPT-3 once is about US$1.4 million. For some larger LLMs (large language models), the training cost ranges from US$2 million to US$2 million. Between US$12 million. Based on ChatGPT’s average number of unique visitors in January of 13 million, the corresponding chip demand is more than 30,000 NVIDIA A100 GPUs, with an initial investment cost of approximately US$800 million and a daily electricity bill of approximately US$50,000.

Based on the current situation of Kunlun Wanwei and the huge cost of large models, it is still a big question mark whether Tiangong 3.5 can reach the final commercialization step.

It is worth noting that as of the end of the first quarter of 2023, the company has approximately 1.3 billion yuan in short-term turnover funds on its books.

Furthermore, the huge goodwill accumulated through continuous acquisitions over the past many years is like a "Sword of Damocles" always hanging over Kunlun Wanwei's head. As of the end of the first quarter of 2023, Kunlun Wanwei's goodwill assets reached 3.894 billion yuan, which is several times the annual net profit. Once a thunderstorm occurs, the power will definitely be considerable.

Learning from the past makes people wonder how sincere Kunlun Wanwei’s high-profile “All in AI” is? But purely from the performance of the capital market, Kunlun Worldwide's goal should have been achieved. This stock price "SHOW" is eye-catching and exciting enough, but it is also dangerous enough for investors.

The above is the detailed content of Betting on large models, how sincere is Kunlun Wanwei's 'All in AI” initiative?. For more information, please follow other related articles on the PHP Chinese website!