web3.0

web3.0

What are Maker and Taker? How to calculate the handling fee? A list of handling fees on popular exchanges

What are Maker and Taker? How to calculate the handling fee? A list of handling fees on popular exchanges

What are Maker and Taker? How to calculate the handling fee? A list of handling fees on popular exchanges

Table of contents

- What are Maker and pending orders? How to calculate Maker Fee

- Maker Fee Calculation Formula

- Is it necessary to use a limit order a Maker?

- What are Taker and Eat Order? How to calculate Taker Fee

- Taker Fee Calculation Formula

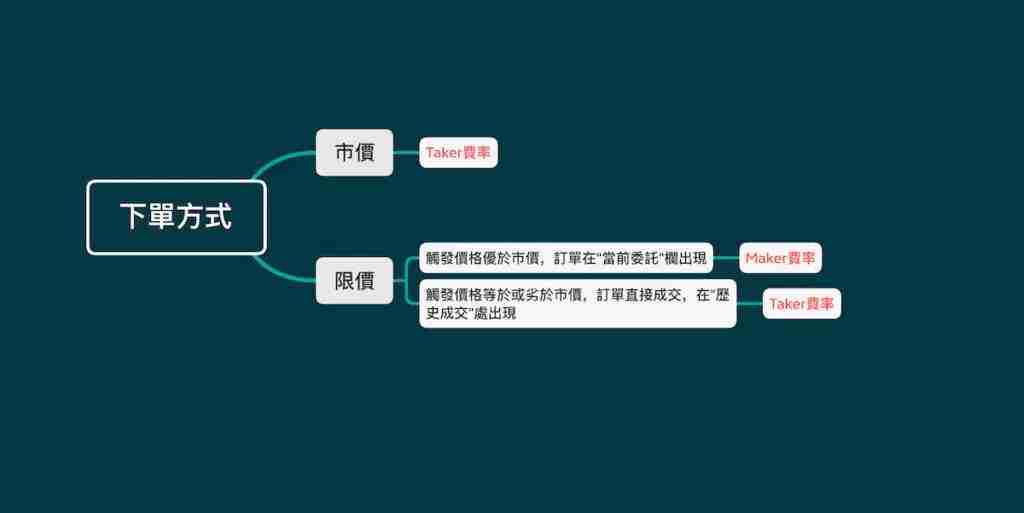

- How to determine whether you are a Maker or Taker

- Lazy Pack – Maker/taker fees for each virtual currency exchange

- Spot maker/taker fee lazy pack

- Contract maker/taker fee lazy pack

- How to reduce Maker/Taker transaction fees

- Can you make money by placing an order?

- Lazy Pack – Exchange organization that provides negative Maker handling fees

- What is the "Maker" function?

Many novice users who are new to the encryption world have heard of the words Maker and Taker, but in fact they may not know much about their specific scenarios. In addition, some users also have various doubts about the conversion between Maker and Taker. For example: I was Maker when I was placing an order, but why did I become Taker when I finally made a deal?

- Maker is the person who creates depth for exchanges, and Maker orders appear in the order book and will not be sold immediately.

- Taker is someone who eats the depth of the exchange. Taker orders will be traded immediately and will not appear in the order book.

- Maker fees are usually lower than Taker fees, and some exchanges even offer negative Maker rates, that is, you can earn a handling fee after Maker orders are completed.

- Users can switch between Maker and Taker identities through different order functions. This order is Maker, so the order you place can be Taker. Even in the same order, it is Maker when opening a position, and it can be Taker when closing the position.

What are Maker and pending orders? How to calculate Maker Fee

Maker is a pending order, also known as a liquidity provider. Specifically, it means that a user posts a certain quantity and price order, but there is no matching order in the market. Then this entrusted order will always be placed on the exchange's trading, waiting for other users to complete the transaction, which is equivalent to providing liquidity to the entire market, so it is called Maker.

To put it simply, Maker is actually the person who puts limit orders and waits for transactions. They provide market depth and are passive transactions. A limit order refers to a user buying or selling at the price of the digital currency specified by him, and the transaction can be completed when the market price fluctuates to the price set by the user.

So, let’s give an example to explain in detail how to make a Maker:

Taking using USDT to make the Maker to buy CET in the CET/USDT spot market as an example, the operation is roughly divided into the following steps:

- Assume that the latest transaction price of the CET/USDT market is 0.076502, and the current selling price is 0.076502, as shown in the figure;

- Select the [Price Limit] entrust type to [Always Valid];

- Set [buy price] and [buy volume], assuming that when the CET price fluctuates to 0.076430, buy 500;

- Confirm [Transaction Volume] and finally click [Buy CET].

After the commission is successfully set up, the order will be sent to the market and is in the position of buying 1. When the market price of CET fluctuates to 0.076430, the order will be gradually traded, realizing the entrusting strategy of makingr's price limit buying, while the same is true for the price limit selling.

Maker Fee Calculation Formula

The calculation formula of Maker Fee (only-party handling fee) is: transaction volume × Maker handling fee

- Example 1: User A traded an order worth USDT in the form of a pending order. The Maker fee charged by the exchange he used was 0.1%, so the handling fee for this order = 100 × 0.1% = 1 USDT

- Example 2: User B traded an order worth USDT in the form of a pending order. The Maker fee charged by the exchange he used is - 0.1%, so the handling fee for this order = 100 × - 0.1% = - 1 USDT. This thought that User B earned a USDT handling fee through this transaction.

Is it necessary to use a limit order a Maker?

The answer is no. The basis for judging whether it is a Maker is whether your order has created depth for the exchange. It can be simply understood as whether your order is immediately traded. When the limit price set by your order is exactly equal to the best market price, or even worse than the best price, then the limit order will be automatically sold at the best market price. The handling fee at this time is calculated in Take r, not Maker.

For example, if you place an order of USDT of 30,000 USDT, you can sell 1 Bitcoin, but the current market optimal price is 20,000. At this time, the exchange will not really buy your Bitcoin at a price of USDT of 30,000 USDT per card, but will be sold at USDT of 20,000 USDT of the market optimal price. The method for calculating the handling fee you need to give at this time is not 20,000 × Maker handling fee, but 20,000 × Taker handling fee.

What are Taker and Eat Order? How to calculate Taker Fee

Taker is a order taken, also known as a liquidity consumer. It means that users actively place a certain number of orders by checking the existing order prices in the exchange market, and immediately trade with existing orders posted, consuming liquidity in the market.

Simply put, Taker refers to the person who immediately places an order and queues up to make a deal and takes away the market depth, which is an active deal.

How to set up Taker? Let's give examples:

Take the use of USDT as a Taker to buy CET in the CET/USDT spot market as an example. The operation is roughly as follows:

- Assume that the latest transaction price of the CET/USDT market is 0.075433, and the current selling price is 0.075507, as shown in the figure;

- Select the [Price Limit] entrust type to [Always Valid];

- Set [buy price] and [buy volume], the purchase price is the current selling price of 0.075507, and the purchase volume is 99 CET;

- Confirm [Transaction Volume] and finally click [Buy CET];

After the commission is successful, the order will also be delivered to the market. Since the purchase quantity is less than the selling quantity, the order will be sold immediately at a price of 0.075507, realizing the entrusting strategy of Taker's price limit buying, and the same is true for Taker's price limit selling.

Taker Fee Calculation Formula

The calculation formula for Taker Fee (eating single-party handling fee) is: transaction volume × Taker handling fee

- Example 1: User A traded an order worth USDT in the form of a market price. The Taker fee charged by the exchange he used was 0.2%, so the handling fee for this order = 100 × 0.2% = 2 USDT

How to determine whether you are a Maker or Taker

Lazy Pack – Maker/taker fees for each virtual currency exchange

Spot maker/taker fee lazy pack

For ordinary users, the lowest spot handling fees are Binance, Kucoin, Bybit and Bitget.

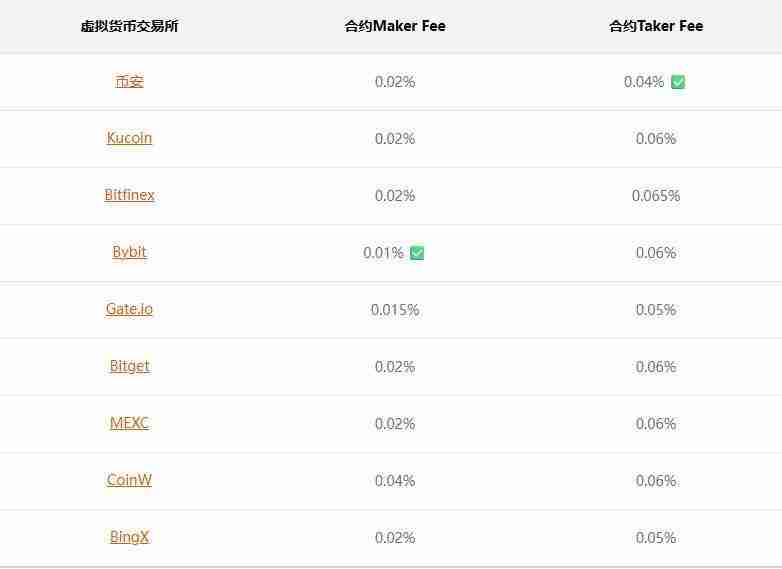

Contract maker/taker fee lazy pack

For ordinary users, Binance and Bybit have the lowest contract fees.

How to reduce Maker/Taker transaction fees

If you want to reduce the handling fee when trading virtual currencies, there are usually the following methods:

- Register through discount invitation link – Discount code lazy packs on major virtual currency exchanges

- Use platform coins to deduct handling fees

- Become a virtual currency exchange VIP

Can you make money by placing an order?

Someone should have noticed that in Example 2 of the Maker fee calculation method, the Maker fee with a negative number is listed. This is not a typo of the author, but a negative Maker rate that is real in this charging structure.

It can be imagined that if there are many people who place orders on an exchange, the number of orders is large, and the price difference of orders is small, then when a new user enters this virtual currency exchange, will he feel: "Well, the transaction volume of this exchange is large, and I can buy the coins I want quickly and conveniently, which should be trustworthy."

Therefore, many exchanges that adopt the Maker/Taker fee structure will make the Maker's fee rate lower than Taker's fee rate. Even setting the Maker fee to a negative number means that when you place an order and complete a transaction, not only do you not have to give a handling fee, but the exchange will also give you the handling fee in turn.

However, not all users can settle the handling fee at a negative Maker rate. Major virtual currency exchanges will require users to enjoy the discount of negative Maker rates after reaching a certain transaction volume, which is also one of the privileges of VIPs.

Lazy Pack – Exchange organization that provides negative Maker handling fees

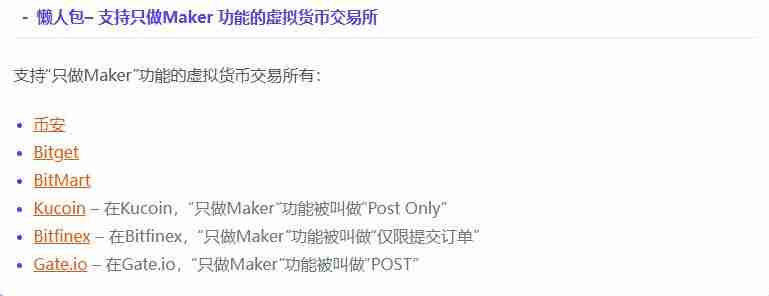

What is the "Maker" function?

"Maker only" is an advanced feature in limited orders. It can ensure that your order must appear in the order book and will not match the orders already in the order book, thus ensuring that your transaction fee must be a lower Maker rate.

Generally speaking, there are two purposes for using "Maker only":

- Guaranteed handling fees are lower Maker rates;

- Avoid losses caused by operating errors.

The first point is easy to understand, the Maker rate is usually lower than the Taker rate. Here we will explain the second point below. As we said above, sometimes our price limit trigger price will be set intentionally or unintentionally worse than the market's best price. If it is intentional, it's okay, but if we lose more or less 0 unintentionally, we will suffer losses after the order is executed. So when using the "Maker only" function, if you set up buying a virtual currency at a price higher than the current market price, the system will automatically cancel your order when you place an order, thus avoiding you buying a certain currency at a high price.

Similar functions vary in the names of each virtual currency exchange. Please refer to the lazy bag below for details.

Here's what Maker and Taker are? How to calculate the handling fee? This is the article about the list of handling fees on popular exchanges. For more comprehensive interpretations of Maker and Taker, please search for previous articles on this site or continue browsing the related articles below. I hope everyone will support this site in the future!

The above is the detailed content of What are Maker and Taker? How to calculate the handling fee? A list of handling fees on popular exchanges. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Cryptocurrency IDO platform top5

Aug 21, 2025 pm 07:33 PM

Cryptocurrency IDO platform top5

Aug 21, 2025 pm 07:33 PM

The best IDO platforms in 2025 are pump.fun, Bounce, Coin Terminal, Avalaunch and Gate Launchpad, which are suitable for Meme coin speculation, community-driven auctions, high-return pursuits, Avalanche ecological investment and fair participation of novices. The choice needs to combine investment goals, risk tolerance and project preferences, and focus on platform review and security.

What is Polkadot (DOT currency)? Future development and price forecast of DOT

Aug 21, 2025 pm 07:30 PM

What is Polkadot (DOT currency)? Future development and price forecast of DOT

Aug 21, 2025 pm 07:30 PM

What is the directory DOT (Poker Coin)? The origin of Polkadot DOT (Polkadot) The operating principle of Polkadot has 5 major features, aiming to establish the Polkadot ecosystem (Ecosystem) 1. Interoperability 2. Scalability 3. Community Autonomy 4. No Fork Upgrade 5. NPOS Consensus Protocol Polkadot Key Features DOT Ecosystem Polkadot Vision: Connecting Everything Polkadot's Future Development Polkadot Price Forecast Polkadot 2025 Price Forecast Polkadot 2026-203

How to register on Ouyi Exchange? Ouyi Exchange Registration Process 2025

Aug 22, 2025 pm 07:33 PM

How to register on Ouyi Exchange? Ouyi Exchange Registration Process 2025

Aug 22, 2025 pm 07:33 PM

OKX is a world-renowned digital asset trading platform, providing users with safe, stable and reliable digital asset trading services, and supporting a variety of mainstream and emerging digital assets. First, download the Ouyi App through the official link, click the download button to get the installation package, allow necessary permissions during installation and continue to install, open the application to register an account, use your mobile phone number or email address to set a password and complete verification, and finally perform identity authentication to ensure account security.

What is Bitcoin? How to trade and mine? The complete and latest guide to Bitcoin investment

Aug 21, 2025 pm 06:30 PM

What is Bitcoin? How to trade and mine? The complete and latest guide to Bitcoin investment

Aug 21, 2025 pm 06:30 PM

Bitcoin transactions need to be completed through the exchange, and the steps include registration and certification, recharge, selecting transaction pairs to place orders, setting risk control and withdrawing coins; pledge is used to participate in mining through ASIC equipment, mostly in the form of mining pools; investment advice is to learn the basics, choose a reliable platform, formulate strategies, control warehouses and disperse, and pay attention to market and security.

What websites are there for cryptocurrency airdrop information aggregation?

Aug 21, 2025 pm 07:36 PM

What websites are there for cryptocurrency airdrop information aggregation?

Aug 21, 2025 pm 07:36 PM

Cryptocurrency airdrop information aggregation websites include Airdrop Alert, One Click Airdrop Tracker, Free Airdrop.io and CoinMarketCap airdrop sectors. These platforms integrate full-network airdrop projects and provide functions such as classification screening, task guidance and participation progress tracking to help users efficiently obtain free tokens.

What is Base God (TYBG Coin)? TYBG Token Economics and Price Forecast

Aug 22, 2025 pm 07:27 PM

What is Base God (TYBG Coin)? TYBG Token Economics and Price Forecast

Aug 22, 2025 pm 07:27 PM

Base God (TYBG) is a community-driven meme coin on the Base platform, with no team and roadmap, with a maximum supply of 125 billion coins, close to fully diluted, with price forecasts ranging from $0.00005 to $0.001. Most expectations in 2025 are in the range of $0.00005–$0.00007. It is aggressively predicted that it can reach $0.000414 in 2030 and may reach $0.00147 in 2040. However, as a meme coin without fundamental support, it has large fluctuations, high risks, and depends on community sentiment. It is recommended to trade through Sushiswap V2 (Base), Uniswap V3 (Base) or Aerodrome. Be cautious when participating.

Tokens pronunciation How to pronounce tokens What is tokens

Aug 21, 2025 pm 07:03 PM

Tokens pronunciation How to pronounce tokens What is tokens

Aug 21, 2025 pm 07:03 PM

Tokens are digital vouchers issued on a blockchain that can represent assets, permissions, or ownership. They rely on the underlying blockchain operation, such as the Ethereum network, and are divided into functional, securities, governance and non-homogeneous tokens (NFTs). Functional tokens are used to access services, securities represent investment rights, governance grants voting rights, and NFTs identify unique digital assets. Users can obtain tokens through exchange purchases, participate in projects or airdrops, and manage them through exchanges or personal digital accounts to achieve decentralized asset control.

The computer's system tray icon is messy, how to organize it?

Aug 21, 2025 pm 08:12 PM

The computer's system tray icon is messy, how to organize it?

Aug 21, 2025 pm 08:12 PM

Hide the system tray icon without affecting the program operation, only removes the visual display; 2. Completely clean up and disable non-essential startup items through the task manager; 3. Resolve the mess and uninstall the software and develop the habit of canceling the bundling and checking during installation, so as to achieve the dual goals of visual refreshing and resource optimization.