web3.0

web3.0

Bitcoin long tutorial, short tutorial, and perpetual contract gameplay tutorial (taking Huobi HTX as an example)

Bitcoin long tutorial, short tutorial, and perpetual contract gameplay tutorial (taking Huobi HTX as an example)

Bitcoin long tutorial, short tutorial, and perpetual contract gameplay tutorial (taking Huobi HTX as an example)

In the cryptocurrency market, longing is an investment strategy that expects asset prices to rise. Through the Huobi HTX platform, we can easily achieve this operation. The following is a detailed tutorial on longing Bitcoin:

Bitcoin long tutorial

- First, log in to the Huobi HTX account . Make sure your account is authenticated with real name and has enough funds for transactions.

- Enter the trading interface . On the Huobi HTX homepage, select the "Contract Trading" option, and then select "Bitcoin Perpetual Contract".

- Select a leverage multiple . In the trading interface, you can choose a leverage multiple that suits you. Please note that the higher the leverage multiple, the greater the risk.

- Place an order long . In the "Open Position" option, select "Buy/Long" and enter the quantity and price you want to open. If you select a market order, the system will execute the order immediately at the current market price; if you select a limit order, you can set a target price, and the order will be executed only when the market reaches that price.

- Monitor and manage positions . After opening a position, you need to pay close attention to market trends and profit and loss of positions. Huobi HTX provides a variety of tools such as stop loss and take profit orders to help you manage risks.

Bitcoin Shorting Tutorial

Short is an investment strategy that expects asset prices to fall. The following is a detailed tutorial on shorting Bitcoin through the Huobi HTX platform:

- Log in to Huobi HTX account . Make sure your account is authenticated with real name and has enough funds for transactions.

- Enter the trading interface . On the Huobi HTX homepage, select the "Contract Trading" option, and then select "Bitcoin Perpetual Contract".

- Select a leverage multiple . In the trading interface, you can choose a leverage multiple that suits you. Please note that the higher the leverage multiple, the greater the risk.

- Place an order and short . In the "Open Position" option, select "Sell/Short" and enter the quantity and price you want to open. If you select a market order, the system will execute the order immediately at the current market price; if you select a limit order, you can set a target price, and the order will be executed only when the market reaches that price.

- Monitor and manage positions . After opening a position, you need to pay close attention to market trends and profit and loss of positions. Huobi HTX provides a variety of tools such as stop loss and take profit orders to help you manage risks.

Perpetual contract gameplay tutorial

Perpetual contracts are derivative contracts without expiration dates and are widely used in the cryptocurrency market. The following is a detailed tutorial on perpetual contract trading through Huobi HTX platform:

- Log in to Huobi HTX account . Make sure your account is authenticated with real name and has enough funds for transactions.

- Enter the trading interface . On the Huobi HTX homepage, select the "Contract Trading" option, and then select the perpetual contract you want to trade (such as Bitcoin perpetual contract).

- Select a leverage multiple . In the trading interface, you can choose a leverage multiple that suits you. Please note that the higher the leverage multiple, the greater the risk.

- Place an order and trade . In the "Open Position" option, select "Buy/Long" or "Sell/Long" and enter the quantity and price you want to open. If you select a market order, the system will execute the order immediately at the current market price; if you select a limit order, you can set a target price, and the order will be executed only when the market reaches that price.

- Monitor and manage positions . After opening a position, you need to pay close attention to market trends and profit and loss of positions. Huobi HTX provides a variety of tools such as stop loss and take profit orders to help you manage risks.

- Close the position . When you decide to end a trade, you can select the "Close Position" option to enter the quantity and price you wish to close the position. If you select a market order, the system will execute the order immediately at the current market price; if you select a limit order, you can set a target price, and the order will be executed only when the market reaches that price.

Advantages of Huobi HTX perpetual contract

The Huobi HTX platform offers a variety of advantages, making it an ideal choice for perpetual contract trading:

- High liquidity . Huobi HTX's perpetual contract market is highly liquid, ensuring that your orders can be executed quickly.

- A variety of leverage options . The platform provides a variety of leverage multiples to meet the needs of users with different risk preferences.

- Rich trading tools . Huobi HTX provides a variety of trading tools, such as stop loss and take profit orders, helping users better manage risks.

- Strong security measures . Huobi HTX adopts multi-level security measures to ensure the security of user funds and data.

Risk management in perpetual contract trading

Risk management is crucial when trading perpetual contracts. Here are some suggestions for risk management through Huobi HTX platform:

- Set stop loss and take profit orders . When opening a position, setting stop loss and take profit orders can help you automatically close positions when markets fluctuate, reducing losses or locking in profits.

- Choose the leverage multiple reasonably . Choose the right multiple of leverage based on your risk tolerance. The higher the leverage multiple, the greater the potential returns and risks.

- Diversify investment . Do not concentrate all funds in one position, diversifying investment can reduce overall risk.

- Continuously monitor the market . The market situation is changing rapidly, and continuously monitoring market trends and position profit and loss situations will help to adjust strategies in a timely manner.

Common terms explanations in perpetual contract trading

When trading perpetual contracts, understanding some common terms can help you better understand market dynamics:

- Open Position : refers to establishing a new trading position in the market.

- Close Position : refers to the end of an existing trading position.

- Long : refers to a trading strategy that expects asset prices to rise.

- Short : refers to a trading strategy that expects asset prices to fall.

- Leverage : refers to a tool that increases the scale of transactions by borrowing funds.

- Margin : refers to the initial capital used to open a position.

- Forced liquidation : When the loss of the position reaches a certain level, the platform will automatically close the position to prevent further losses.

Frequently Asked Questions

Q: What fees do you need to pay for perpetual contract transactions on Huobi HTX?

Answer: A transaction fee is required to conduct perpetual contract transactions on Huobi HTX. The specific fee rate depends on your trading volume and position holding situation. Usually, there will be handling fees incurred when opening and closing positions. In addition, if your position is forced to close, an additional forced closing fee may be required.

Q: If my position is forced to close, how much money will I lose?

A: If your position is forced to close, you may lose all margin, or even more. When a forced closing occurs, the platform will close your position at the market price. If the market price is not conducive to your position, you may face greater losses. Therefore, it is very important to set a stop loss order reasonably and choose the right leverage multiple.

Q: Does perpetual contract transactions on Huobi HTX support API transactions?

Answer: Yes, Huobi HTX supports API transactions. Users can automate transactions through API interfaces to achieve higher transaction efficiency and flexibility. Specific API documentation and usage tutorials can be found on the official website of Huobi HTX.

Q: When trading perpetual contracts on Huobi HTX, how to choose the right leverage multiple?

A: Choosing the right leverage multiple depends on your risk tolerance and trading strategy. Generally speaking, if you have strong confidence in the market, you can choose a higher leverage multiple, but you need to pay attention to risks. If you prefer a robust trade, you can choose a lower leverage multiple to reduce potential losses. It is recommended to conduct sufficient market analysis and risk assessment before trading.

The above is the detailed content of Bitcoin long tutorial, short tutorial, and perpetual contract gameplay tutorial (taking Huobi HTX as an example). For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Binance (BINANCE) contract to launch ALL 75x composite index U-standard perpetual contract

Aug 06, 2025 pm 06:48 PM

Binance (BINANCE) contract to launch ALL 75x composite index U-standard perpetual contract

Aug 06, 2025 pm 06:48 PM

Table of Contents About Binance ALL Comprehensive Index About Binance ALL Comprehensive Index Fixed-point adjustment component mechanism The newly launched U-standard perpetual contract with USDT quoted U-standard perpetual contract The Binance Contract is scheduled to officially launch the ALL75 times comprehensive index U-standard perpetual contract at 17:00 on August 6, 2025 (East Eighth District time). About Binance ALL Comprehensive Index Binance Exchange: Official Registration Official Download Binance ALL Comprehensive Index is designed to track the performance of all U-standard perpetual contracts denominated in USDT on the Binance Contract Platform, but the following types of contracts are not included: ETHBTC perpetual contracts quoted using USDC or other stablecoins U-standard delivery contracts All comprehensive index perpetual contracts are permanent

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Directory What is Cardano? Key Features of Cardano How does Cardano work? Why Cardano deserves to consider price and market performance history 2025 ADA forecast 2025, 2026 and 2027 Price forecasts 2040 and 2030 ADA price forecast Factors affecting ADA costs Chart analysis and technical outlook Cardano Forecast Table: Key points summary As an important force in the cryptocurrency industry, Cardano (ADA) provides cutting-edge blockchain solutions with a focus on sustainability, scalability and security. Cardano is co-founder of Ethereum.

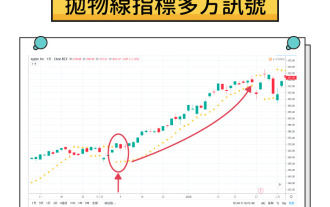

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

Contents Understand the mechanism of parabola SAR The working principle of parabola SAR calculation method and acceleration factor visual representation on trading charts Application of parabola SAR in cryptocurrency markets1. Identify potential trend reversal 2. Determine the best entry and exit points3. Set dynamic stop loss order case study: hypothetical ETH trading scenario Parabola SAR trading signals and interpretation Based on parabola SAR trading execution Combining parabola SAR with other indicators1. Use moving averages to confirm trend 2. Relative strength indicator (RSI) for momentum analysis3. Bollinger bands for volatility analysis Advantages of parabola SAR and limitations Advantages of parabola SAR

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Table of Contents Solana's Price History and Important Market Data Important Data in Solana Price Chart: 2025 Solana Price Forecast: Optimistic 2026 Solana Price Forecast: Maintain Trend 2026 Solana Price Forecast: 2030 Solana Long-term Price Forecast: Top Blockchain? What affects the forecast of sun prices? Scalability and Solana: Competitive Advantages Should you invest in Solana in the next few years? Conclusion: Solana's price prospects Conclusion: Solana has its excellent scalability, low transaction costs and high efficiency

Which blockchain does USDC stablecoin belong to? Which mainstream link networks do it support?

Aug 06, 2025 pm 10:45 PM

Which blockchain does USDC stablecoin belong to? Which mainstream link networks do it support?

Aug 06, 2025 pm 10:45 PM

USDC was first deployed on the Ethereum main network and adopted the ERC-20 standard. It currently supports more than ten mainstream blockchain networks including 1. Ethereum, 2. Polygon, 3. Arbitrum, 4. Optimism, 5. Solana, 6. Avalanche, 7. Base, 8. Stellar, 9. Tron, 10. Near, 11. Algorand, 12. Flow, etc. Each chain version is suitable for different scenarios. Users need to confirm the contract address through the Circle official website to ensure safe use.

Blockchain browser: a must-have tool for querying digital currency transaction information

Aug 06, 2025 pm 11:27 PM

Blockchain browser: a must-have tool for querying digital currency transaction information

Aug 06, 2025 pm 11:27 PM

Blockchain browser is a necessary tool for querying digital currency transaction information. It provides a visual interface for blockchain data, so that users can query transaction hash, block height, address balance and other information; its working principle includes data synchronization, parsing, indexing and user interface display; core functions cover querying transaction details, block information, address balance, token data and network status; when using it, you need to obtain TxID and select the corresponding blockchain browser such as Etherscan or Blockchain.com to search; query address information to view balance and transaction history by entering the address; mainstream browsers include Bitcoin's Blockchain.com, Ethereum's Etherscan.io, B

Binance Exchange Official Website Portal Binance Exchange App Official Mobile Version Portal

Aug 06, 2025 pm 11:30 PM

Binance Exchange Official Website Portal Binance Exchange App Official Mobile Version Portal

Aug 06, 2025 pm 11:30 PM

Founded in 2017 by Zhao Changpeng, Binance is the world's leading cryptocurrency trading platform, known for its high liquidity, low transaction rates and rich trading pairs. 1. The official website entrance is: [adid]fbd7939d674997cdb4692d34de8633c4[/adid]. Users in some regions need to use vp n or visit regional branch stations; 2. The official APP download method includes: through the official website/iOS download link [adid]9f61408e3afb633e50cdf1b20de6f466[/adid], or download the APK installation package [adid]758691fdf7ae3403db0d3bd

The top ten currency trading platforms in the world, the top ten trading software apps in the currency circle

Aug 06, 2025 pm 11:42 PM

The top ten currency trading platforms in the world, the top ten trading software apps in the currency circle

Aug 06, 2025 pm 11:42 PM

Binance: is known for its high liquidity, multi-currency support, diversified trading modes and powerful security systems; 2. OKX: provides diversified trading products, layout DeFi and NFT, and has a high-performance matching engine; 3. Huobi: deeply engaged in the Asian market, pays attention to compliance operations, and provides professional services; 4. Coinbase: strong compliance, friendly interface, suitable for novices and is a listed company; 5. Kraken: strict security measures, supports multiple fiat currencies, and has high transparency; 6. Bybit: focuses on derivative trading, low latency, and complete risk control; 7. KuCoin: rich currency, supports emerging projects, and can enjoy dividends with KCS; 8. Gate.io: frequent new coins, with Copy Tr