Novice popular science post: What is token economics?

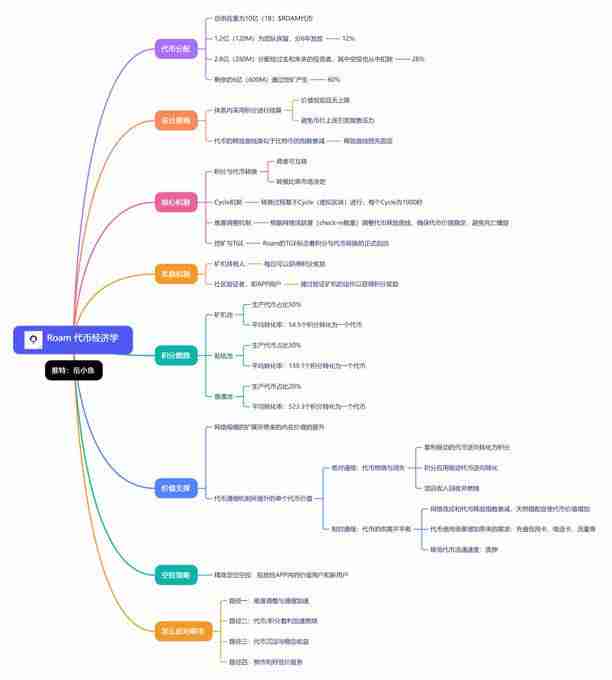

In-depth interpretation of the economics of tokens of Web3 project: Taking Roam as an example

A successful Web3 project cannot be separated from a carefully designed token economic model, which not only concerns the long-term sustainable development of the project, but also directly affects users' investment decisions. This article will explore the analytical framework of token economics in depth and conduct a specific analysis using the Roam project as an example.

The evaluation of the token economic model can be carried out from four key dimensions: token supply (supply side), token utility (demand side), token distribution (holder situation), and token governance (long-term ecology).

1. Token supply: control supply and stabilize value

To evaluate the supply of tokens, we need to pay attention to four core indicators:

- Maximum supply: Preset upper limit of total tokens.

- Flow volume: The number of tokens currently circulating in the market is affected by the team and investors' unblocking plan and ecological incentives.

- Current market value: Current price multiplied by circulation.

- Full dilute market value: Current price multiplied by the maximum supply to assess potential price risks. A highly valued project may have a complete dilution market value that is far beyond the industry benchmark and is difficult to maintain in the long run.

The impact of token destruction mechanism on supply is crucial: the destruction mechanism leads to deflation, and vice versa, inflation.

The total supply of Roam project is 1 billion (1B) $ROAM tokens, including:

- 120 million (120M) were allocated to the team and distributed within six years, reflecting the team's long-term development intention.

- 280 million (280M) are allocated to early and future investors (including airdrops), forming the initial circulation.

- The remaining 600 million (600M) are generated through mining to ensure continuous project participation and avoid "shortcoming".

The project party plans to repurchase tokens through business revenue, showing an overall deflation trend and enhancing token value support.

2. Token utility: empower tokens and create demand

Token utility determines the value and attractiveness of tokens, and can be divided into three aspects:

- Practicality: For example, Ethereum is a Gas fee payment tool and Bitcoin is a real-world payment method.

- Value accumulation: For example, obtaining income through pledge, or participating in governance voting.

- Meme and Narrative: Values based on Internet pop culture or concepts, such as Dogecoin.

Roam tokens are mainly used for their ecosystem services, including paying for network service fees, redeeming data or participating in other functions, and have practical application value, rather than simply "air coins".

3. Token distribution: Focus on fairness and concentration

There are two main ways to issue tokens:

- Fairly launch: For example, Bitcoin, without pre-allocation.

- Pre-mining and launching: For example, Ethereum, pre-allocated to teams or investors.

Roam adopts pre-mining model, which conforms to VC investment logic. Pay attention to the type of token holders and allocation ratio: centralized holdings in large institutions may bring risks; while the majority of tokens held by founding teams and long-term investors are more conducive to long-term development. The Web3 industry standard is to allocate at least 50% of the tokens to the community to dilute control of teams and investors. In addition, lock-in and release plans are also crucial to avoid a large number of tokens entering the market causing price declines.

4. Token governance: inspire participation and promote win-win results

The token governance mechanism is designed to inspire participants and ensure the long-term sustainable development of the project. The pledge mechanism is a common method, and its value improvement is reflected in:

- Lock in tokens to obtain passive income and set the minimum value of the token.

- Reduce market supply and increase token price.

Roam also provides pledge services, reducing the selling pressure after going online.

Summary: Analysis of Roam Token Economic Model

Roam's token economic model is designed reasonably, follows the principles of long-termism and is sustainable. Its success lies in: controlling supply, increasing demand and supplementing it with an effective governance mechanism.

An ideal token economic model should have:

- Reasonable pledge mechanism (such as Curve's VE model).

- Rich application scenarios.

- Steady growing business revenue (avoiding reliance on Ponzi model).

The token economic model is important, but the ultimate value still depends on the business value of the project itself. At present, the token economic model is still developing and changing, and we need to continue to pay attention to the emergence of new models. But the core analytical framework—supply, demand, distribution, governance—is still applicable.

The above is the detailed content of Novice popular science post: What is token economics?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

How to solve the complexity of WordPress installation and update using Composer

Apr 17, 2025 pm 10:54 PM

How to solve the complexity of WordPress installation and update using Composer

Apr 17, 2025 pm 10:54 PM

When managing WordPress websites, you often encounter complex operations such as installation, update, and multi-site conversion. These operations are not only time-consuming, but also prone to errors, causing the website to be paralyzed. Combining the WP-CLI core command with Composer can greatly simplify these tasks, improve efficiency and reliability. This article will introduce how to use Composer to solve these problems and improve the convenience of WordPress management.

How to solve SQL parsing problem? Use greenlion/php-sql-parser!

Apr 17, 2025 pm 09:15 PM

How to solve SQL parsing problem? Use greenlion/php-sql-parser!

Apr 17, 2025 pm 09:15 PM

When developing a project that requires parsing SQL statements, I encountered a tricky problem: how to efficiently parse MySQL's SQL statements and extract the key information. After trying many methods, I found that the greenlion/php-sql-parser library can perfectly solve my needs.

Accelerate PHP code inspection: Experience and practice using overtrue/phplint library

Apr 17, 2025 pm 11:06 PM

Accelerate PHP code inspection: Experience and practice using overtrue/phplint library

Apr 17, 2025 pm 11:06 PM

During the development process, we often need to perform syntax checks on PHP code to ensure the correctness and maintainability of the code. However, when the project is large, the single-threaded syntax checking process can become very slow. Recently, I encountered this problem in my project. After trying multiple methods, I finally found the library overtrue/phplint, which greatly improves the speed of code inspection through parallel processing.

How to solve complex BelongsToThrough relationship problem in Laravel? Use Composer!

Apr 17, 2025 pm 09:54 PM

How to solve complex BelongsToThrough relationship problem in Laravel? Use Composer!

Apr 17, 2025 pm 09:54 PM

In Laravel development, dealing with complex model relationships has always been a challenge, especially when it comes to multi-level BelongsToThrough relationships. Recently, I encountered this problem in a project dealing with a multi-level model relationship, where traditional HasManyThrough relationships fail to meet the needs, resulting in data queries becoming complex and inefficient. After some exploration, I found the library staudenmeir/belongs-to-through, which easily installed and solved my troubles through Composer.

Solve CSS prefix problem using Composer: Practice of padaliyajay/php-autoprefixer library

Apr 17, 2025 pm 11:27 PM

Solve CSS prefix problem using Composer: Practice of padaliyajay/php-autoprefixer library

Apr 17, 2025 pm 11:27 PM

I'm having a tricky problem when developing a front-end project: I need to manually add a browser prefix to the CSS properties to ensure compatibility. This is not only time consuming, but also error-prone. After some exploration, I discovered the padaliyajay/php-autoprefixer library, which easily solved my troubles with Composer.

How to optimize website performance: Experiences and lessons learned from using the Minify library

Apr 17, 2025 pm 11:18 PM

How to optimize website performance: Experiences and lessons learned from using the Minify library

Apr 17, 2025 pm 11:18 PM

In the process of developing a website, improving page loading has always been one of my top priorities. Once, I tried using the Miniify library to compress and merge CSS and JavaScript files in order to improve the performance of the website. However, I encountered many problems and challenges during use, which eventually made me realize that Miniify may no longer be the best choice. Below I will share my experience and how to install and use Minify through Composer.

Solve database connection problem: a practical case of using minii/db library

Apr 18, 2025 am 07:09 AM

Solve database connection problem: a practical case of using minii/db library

Apr 18, 2025 am 07:09 AM

I encountered a tricky problem when developing a small application: the need to quickly integrate a lightweight database operation library. After trying multiple libraries, I found that they either have too much functionality or are not very compatible. Eventually, I found minii/db, a simplified version based on Yii2 that solved my problem perfectly.

Solve caching issues in Craft CMS: Using wiejeben/craft-laravel-mix plug-in

Apr 18, 2025 am 09:24 AM

Solve caching issues in Craft CMS: Using wiejeben/craft-laravel-mix plug-in

Apr 18, 2025 am 09:24 AM

When developing websites using CraftCMS, you often encounter resource file caching problems, especially when you frequently update CSS and JavaScript files, old versions of files may still be cached by the browser, causing users to not see the latest changes in time. This problem not only affects the user experience, but also increases the difficulty of development and debugging. Recently, I encountered similar troubles in my project, and after some exploration, I found the plugin wiejeben/craft-laravel-mix, which perfectly solved my caching problem.