The cryptocurrency market suffered another heavy setback today. Although Bitcoin's own decline has narrowed to less than 1%, the altcoin sector has experienced a collective dive in the short term with BTC. SOL, PEPE, ORDI, ARB Representative altcoins in different tracks such as TIA and TIA have all recorded declines of more than 10% or even 20%.

Although the current secondary market can be described as "turbulent", for ordinary investors, in addition to direct transactions, there is actually another relatively slow but more stable operating mode ——Use stablecoins through major DeFi protocols to achieve a relatively low-risk, high-yield interest-generating strategy.

In the following, Odaily Planet Daily will combine its own operating experience to recommend multiple stablecoin interest-earning strategies on multiple networks. Although these strategies are quite simple at the operational level, they are generally applicable. Achieve stable returns of 10% or even 20%, and some strategies can also synchronize with some underlying networks or DeFi protocols that have not issued coins to achieve "one fish to eat more".

It needs to be emphasized that No DeFi protocol can completely avoid contract risks. Some DeFi protocols will also face certain liquidity risks, combination risks, etc. due to their business models, so When you choose to implement a specific strategy, you must understand the specific risks in advance, and try not to "put your eggs in the same basket."

Operation method: Purchase USDe directly on the Ethena official website , and then redeemed into sUSDe through staking;

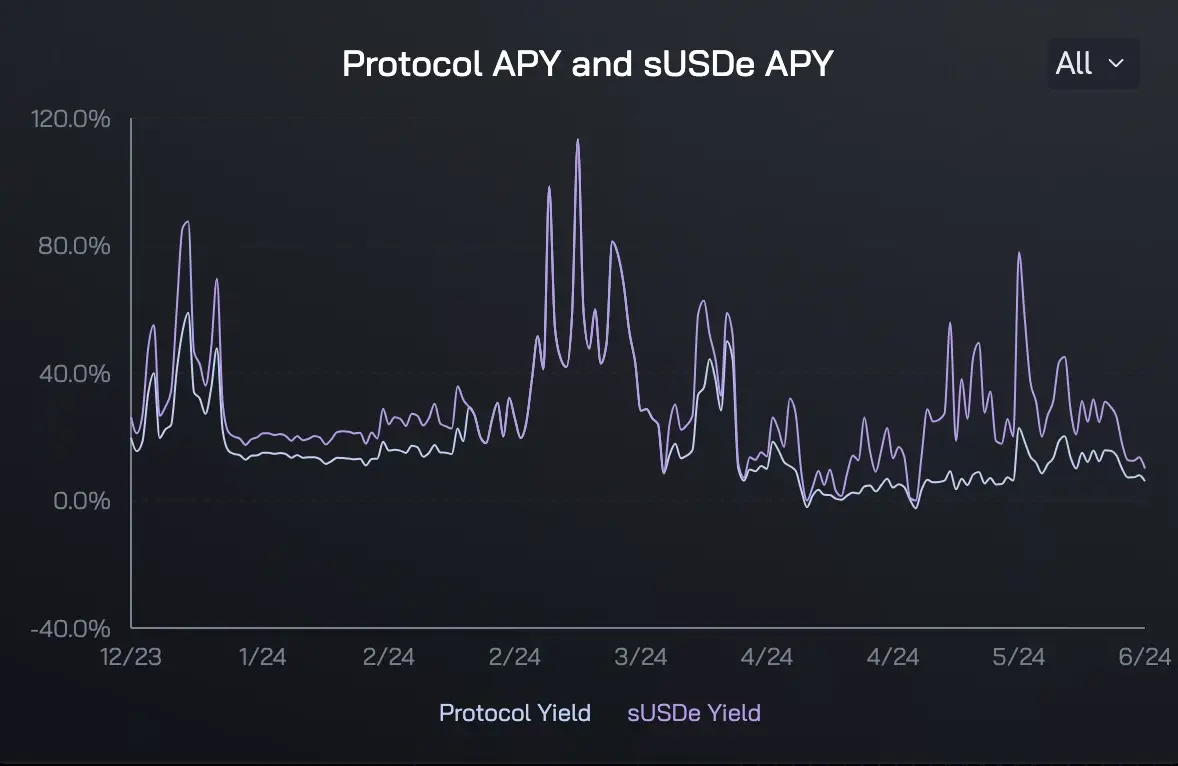

Real-time yield: 17.5%;

Income composition (the types of reward tokens that can be obtained ): Appreciation of sUSDe (can be exchanged for more USDe);

Other potential earnings: ENA second phase airdrop;

Remarks: Ethena’s sUSDe It is the highest APY profit opportunity among large-scale (billion-dollar) stablecoin mining pools in the current cryptocurrency market, much higher than tokenized treasury bond products such as MakerDAO's sDAI. The real-time APY of sUSDe will vary depending on the market's leverage conditions, but based on past volatility records, it has always been stable at a high level. In addition, through sUSDe, you can also accumulate Ethena’s second-phase airdrop certificate sats (accumulation efficiency is low, but the advantage is stable income), thereby obtaining ENA’s next airdrop.

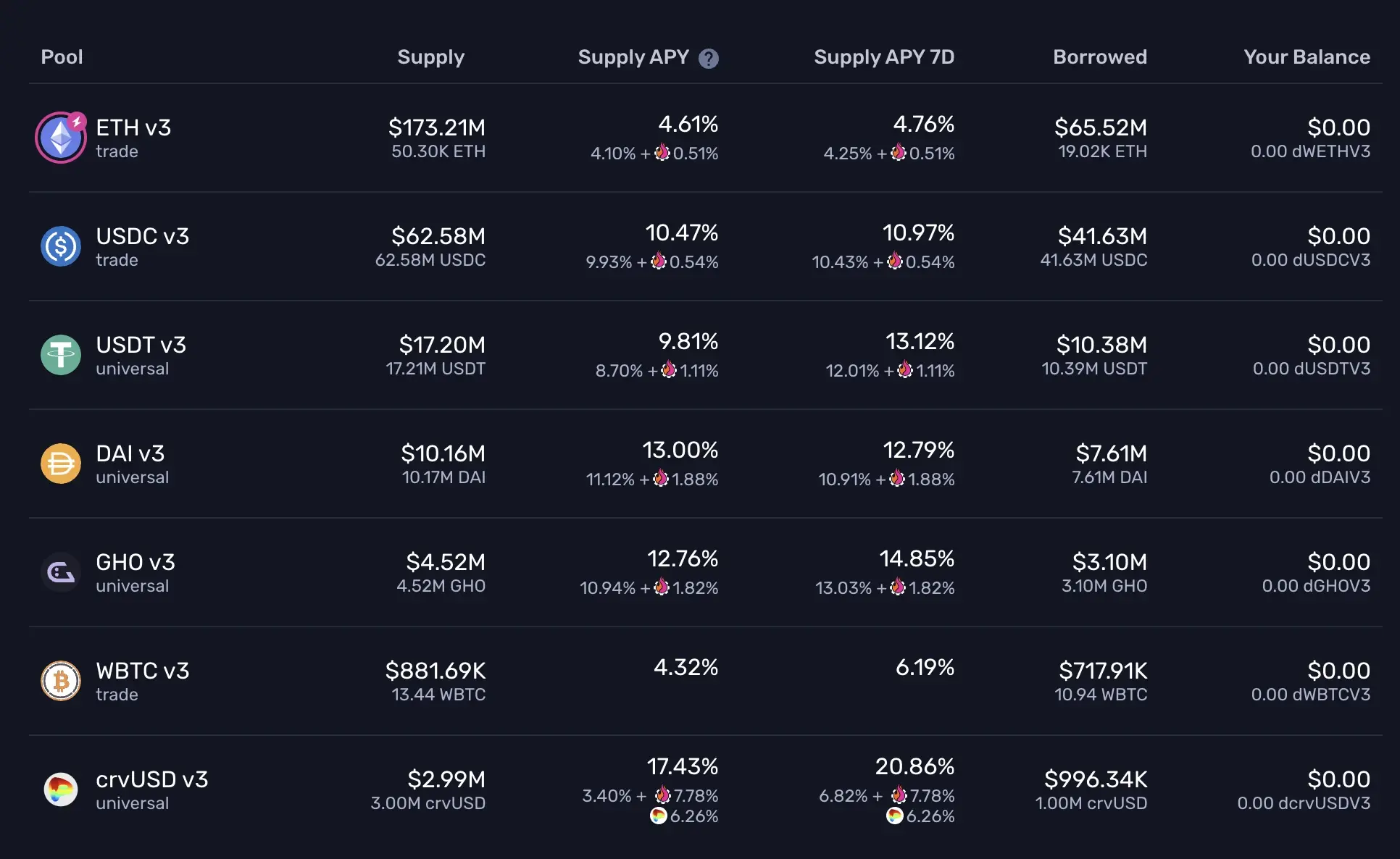

How to operate: Deposit through Earn on the Gearbox official website Various types of stable coins;

Real-time yield: except for USDT, generally greater than 10%;

Revenue composition: Stable coins are Mainly, supplemented by a small amount of GEAR incentives;

Note: Gearbox, as a leveraged lending protocol, actually supports a higher-yield leveraged gameplay (Farm), but this operation is not suitable for ordinary users There is a certain operating threshold, so here we recommend a relatively simple deposit method (Earn, which is essentially a loan deposit). The reason why this mining pool is recommended is that Gearbox’s revenue structure is mainly composed of stable coins, so its actual revenue will be relatively more stable and there will be no significant shrinkage in actual revenue due to the collapse of incentive tokens.

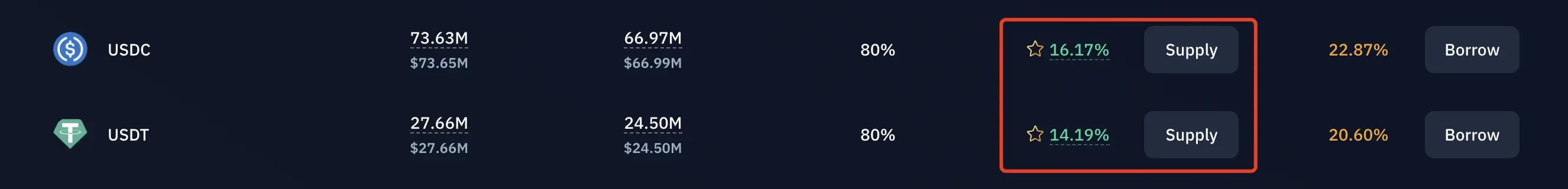

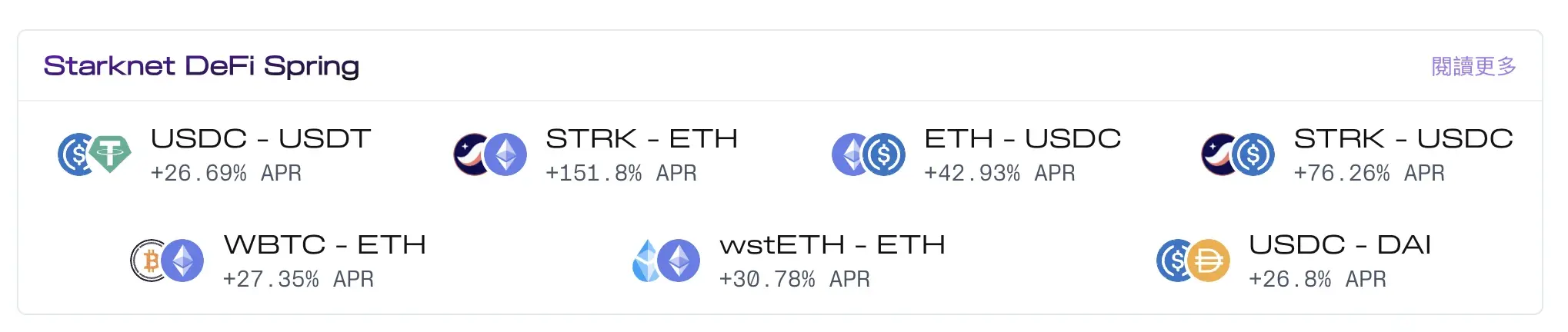

操作方式:在zkLend及Nostra上存入 USDT 或 USDC 生息;

实时收益率:20% 左右;

收益构成:STRK 为主,稳定币原生收益为辅;

备注:基础款借贷协议,类似于 Solana 上的 marginfi 和 Kamino,但收益构成却主要由 STRK 的激励构成(这一点与 Ekubo 类似),看好 STRK 后市表现的用户可酌情参与。

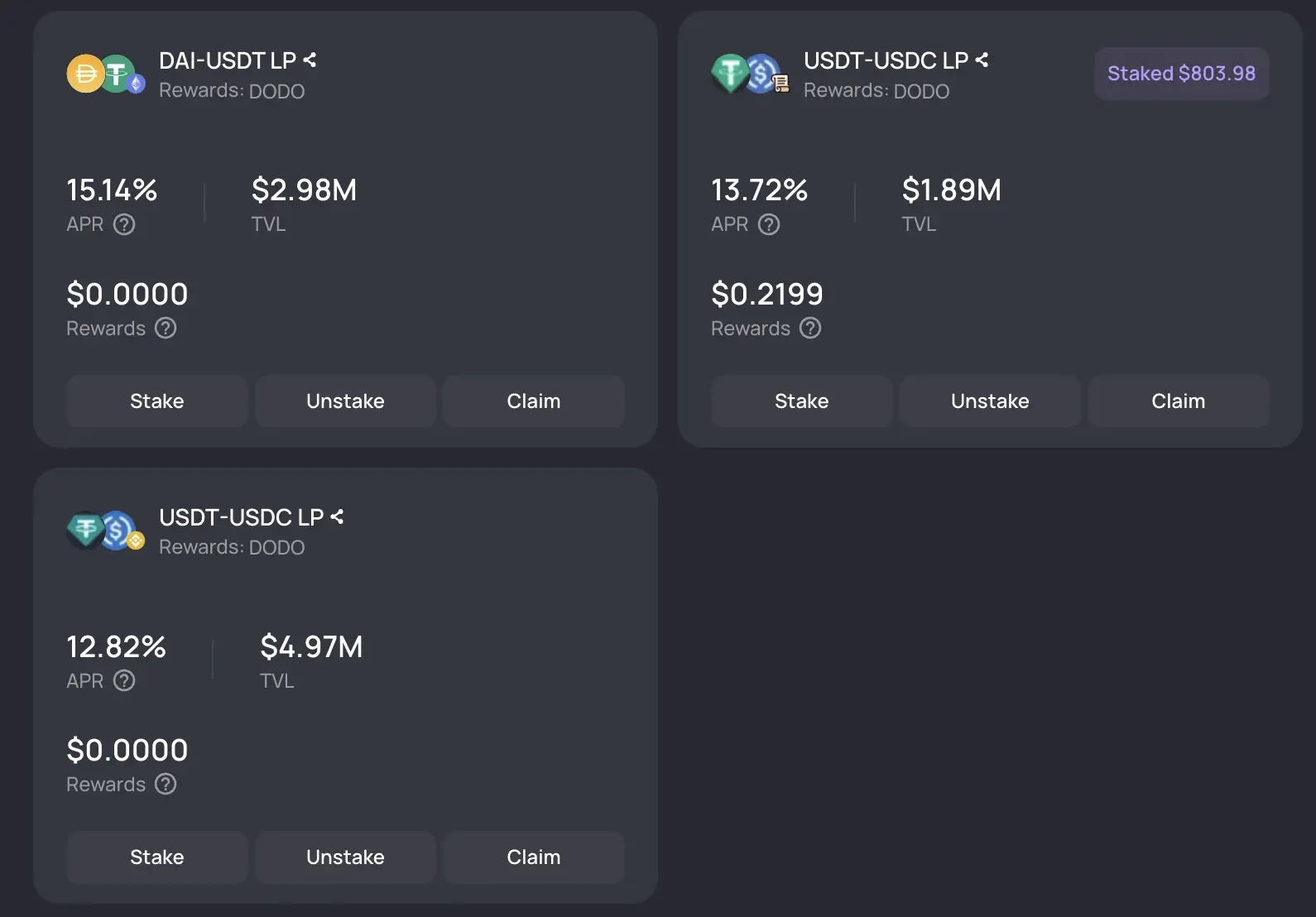

操作方式:在DODO官网利用 DAI、USDT、USDC 等组成交易对,参与做市;

实时收益率:12% - 15%;

收益构成:DODO 为主,稳定币原生收益为辅;

其他潜在收益:Scroll 空投激励;

备注:随着各大 Layer 2 接连发币,尚未发币的 Scroll 也迎来了更多的关注及流动性。综合 Scroll 上的各大 DeFi 协议来看,DODO 作为老牌 DEX 在安全性方面相对值得信赖,且受益于 DODO 自身的流动性激励计划,其稳定币交易对也有着较高的 APY 表现,因此推荐用户将其作为交互 Scroll 的一大阵地。

操作方式:在Echelon上存入各种稳定币生息;

实时收益率:11% - 17%;

收益构成:稳定币原生收益加 APT 激励收益;

其他潜在收益:Echelon 空投收益;

备注:Echelon 是当前 Aptos 上 TVL 排名第二的借贷协议,仅次于 Aries Markets,但或许是由于入选了 Aptos 激励计划,当前该平台的综合 APY 要显著高于后者。此外,Echelon 当前已上线了积分计划,这也意味着当下参与该协议还有着一定的潜在空投预期。

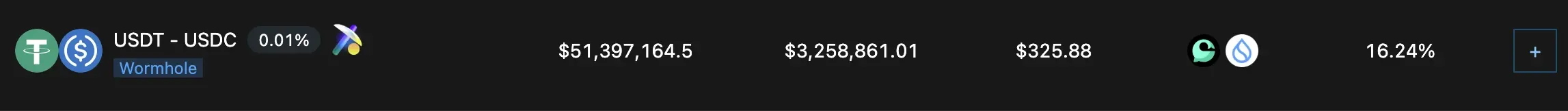

操作方式:在 Cetus 上利用 USDT、USDC 等组成交易对,参与做市;

实时收益率:16.28%;

收益构成:SUI 激励为主,CETUS 和稳定币原生收益为辅;

备注:Sui 之上最大的 DEX 协议,收益主要来源于 Sui 给予的生态激励。

以上即为我们当前比较推荐的部分稳定币生息策略。

出于风险控制以及复刻难度的考虑,上述策略仅覆盖了一些较为简单的 DeFi 操作,所涉及的也只是一些较为基础的质押、存款、LP 等操作,但可获取的潜在收益还是要普遍高于交易所内的被动理财生息。对于当下不知该如何进行二级市场操作,且又不想让稳定币白白闲置的用户而言,可酌情考虑上述策略。

最后需要再次强调的是,DeFi 世界是一个永远伴随着风险的黑暗森林,各位在操作前请务必事先了解风险,DYOR。

The above is the detailed content of Don't want to suffer the pain of falling again? Receive this guide to adding value to stablecoins of major mainstream chains.. For more information, please follow other related articles on the PHP Chinese website!