XRP Price Prediction

In the dynamic and ever-changing world of cryptocurrencies, Ripple (XRP/USD) stood out, especially on December 29, when it crossed key technical levels. Currently trading at $0.6223, XRP has experienced a slight decline of 1.59% in the past 24 hours, but this has not dampened the enthusiasm of the market.

In the dynamic and ever-changing world of cryptocurrencies, Ripple (XRP/USD) stands out, especially on December 29, when it crosses key technical levels. Currently trading at $0.6223, XRP has experienced a slight decline of 1.59% in the past 24 hours, but this has not dampened the enthusiasm of the market.

With a staggering 24-hour trading volume of over $1.31 billion, Ripple remains the focus of investors’ attention.

Ranked sixth on CoinMarketCap, XRP’s strong market capitalization of approximately $33.68 billion is driven by a large circulating supply of 5.413 billion (maximum supply is 100 billion), reflecting its strong presence in the digital currency market obvious presence.

XRP Price Prediction

Ripple’s technical outlook consists of key levels guiding its market trajectory. XRP’s immediate key support point is at $0.6265, becoming a key node for future price trends.

Resistance levels are set at $0.6368, $0.6475, and $0.6577, which may pose obstacles to upward momentum. Conversely, support levels are found at $0.6132, $0.6001, and $0.5871, providing support for potential declines.

The relative strength index (RSI) is 46, indicating that the market is slightly bearish, but it has not entered the oversold zone.

The 50-day exponential moving average (EMA) at $0.6265 is a key indicator that prices below this level could signal a bearish trend. However, XRP currently sits below this threshold, indicating a potential shift in momentum.

? Ripple (XRP/USD) analysis: The transaction price was $0.6223, down 1.59%. ? Support is located at $0.6265. Resistance levels: $0.6368, $0.6475, $0.6577. Support: $0.6132, $0.6001, $0.5871. The RSI is at 46, below the 50 EMA. ?

Watch for price movement above $0.6265, which may be a bullish signal. #XRP #CryptoTrading pic.twitter.com/NhkCTXcBQk— Arslan Ali (@forex_arslan) December 29, 2023

One notable chart pattern is XRP at the 50 EMA The price moved lower, forming resistance around $0.6270.

This dynamic is balanced by the presence of an ascending channel, indicating that while there may be room for a decline to around $0.6065, there is also potential for a rebound.

Ripple Price Chart – Source: Tradingview

Overall, XRP is showing a bearish trend at sub-$0.6265 levels, with downside to the next Support horizontal space.

However, overall market conditions and the presence of an ascending channel also suggest that if XRP is able to break out of support, a reversal and an uptrend could occur.

Investors and market participants will pay close attention to these levels and indicators in response to the dynamics and evolving landscape of the Ripple market.

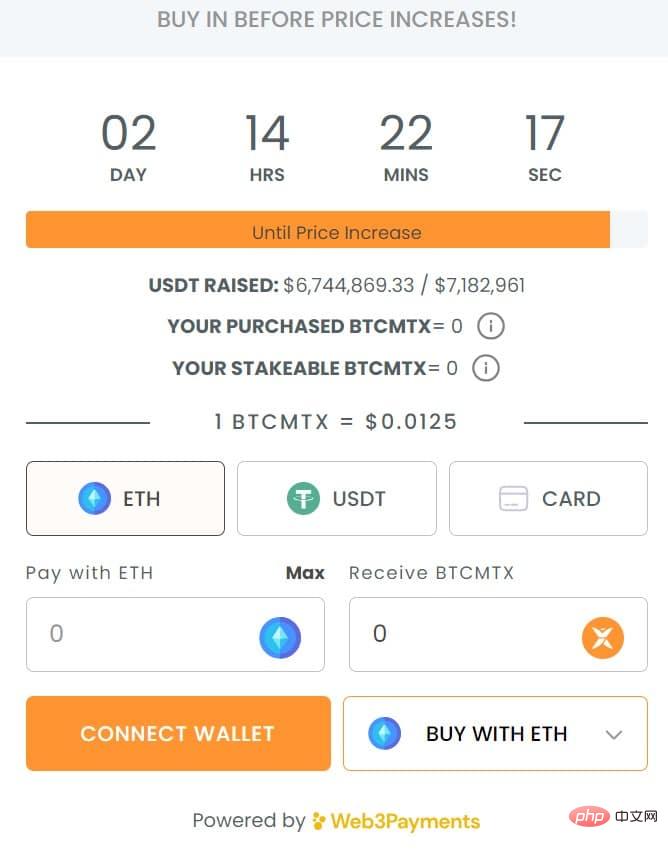

Act Quickly Before Prices Surge: Bitcoin Mining Trix Presale Closes to $7M

The cryptocurrency space is witnessing significant interest in innovative altcoins and DeFi platforms . Amid this trend, Bitcoin Minetrix (BTCMTX), a pioneering staking mining platform, is making a splash with its ongoing pre-sale. The platform has successfully raised $6.7 million, approaching its $7.1 million goal.

Bitcoin Mining Trix stands out with its unique proposal in the cryptocurrency world. By staking BTCMTX tokens, users can mine real Bitcoin, providing a simplified method of Bitcoin mining. This innovative method allows you to earn Bitcoin through BTCMTX and passive income through BTCMTX.

As the pre-sale continues to attract attention, the current price of the BTCMTX token is a competitive $0.0125. However, time is running out, with only two days and 14 hours left before the next round of planned price increases.

This countdown provides potential investors with an urgent opportunity to join this entrepreneurial project at the current favorable price.

To seize this opportunity and become part of this exciting project, interested parties should quickly visit Bitcoin Minetrix’s official website.

The platform’s pre-sale phase offers investors a unique opportunity to invest in a promising crypto project at an early stage, which could lead to significant returns as the platform prepares for its anticipated launch .

The above is the detailed content of XRP Price Prediction. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

ArtGPT

AI image generator for creative art from text prompts.

Stock Market GPT

AI powered investment research for smarter decisions

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Bitcoin (BTC) price cycle is 'increasingly longer”, with the latest forecast saying $124,000 is not the top

Sep 17, 2025 am 06:48 AM

Bitcoin (BTC) price cycle is 'increasingly longer”, with the latest forecast saying $124,000 is not the top

Sep 17, 2025 am 06:48 AM

Key points of the catalog: Bitcoin breaks through key resistance and strengthens the order book liquidity pattern suggests upward direction. Latest analysis shows that after Bitcoin (BTC) successfully breaks through and stands firm in the key resistance area, bulls are accumulating momentum to hit new historical highs. Key points: Data shows that after Bitcoin returns to $114,000, there is still room for this bull market to rise. Historical cycle comparison shows that if the current top appears at $124,000, this bull market will last too short and do not conform to the typical pattern. The order flow and liquidity distribution provide "structural guidance" for the direction of BTC prices. Bitcoin (BTC) is currently showing strong upward inertia, and analysts generally believe it is "difficult to easily reach the top." As key technical positions are broken, market sentiment turns to optimism. famous

BTC is 'digesting future market trends ahead of time': 5 most noteworthy Bitcoin points this week

Sep 20, 2025 pm 01:39 PM

BTC is 'digesting future market trends ahead of time': 5 most noteworthy Bitcoin points this week

Sep 20, 2025 pm 01:39 PM

Table of Contents As traditional financial markets recover, Bitcoin volatility has risen significantly. The Fed's interest rate cut expectation has become the focus of the market. The peak of Bitcoin bull market may be "only a few weeks left". Binance has seen a large-scale buy signal. ETFs continue to absorb newly mined BTC. Bitcoin (BTC) investors are closely following market trends as crypto assets enter the Fed's key interest rate decision window. At the beginning of this week, bulls need to break through the important resistance level of $117,000 to continue their uptrend. Global attention is focused on Wednesday's Federal Reserve meeting, and it is generally predicted that it will usher in the first rate cut in 2025. A past accurate BTC price model shows that all-time highs may be born in the next few weeks. Binance Order Book reveals signs of large buying influx over the weekend. Last week, the amount of BTC purchased by institutions through ETFs reached miners

What is FOMC? How does it affect cryptocurrency? Explain the article in detail

Sep 20, 2025 pm 02:06 PM

What is FOMC? How does it affect cryptocurrency? Explain the article in detail

Sep 20, 2025 pm 02:06 PM

Table of Contents What is the Federal Open Market Committee What does the Federal Open Market Committee do? Why is the Federal Open Market Committee important How does the Federal Open Market Committee affect cryptocurrency traders How does the FOMC affect cryptocurrency Fed interest rate changes What is the monetary policy why is the important How does the investor sentiment change FOMC policy impact scenario What happens in hawkish scenarios (more tighter policies, such as raising Fed interest rates) What happens in a dovish scenario (loose policies, such as lowering Fed interest rates) What happens in neutral situations What other key economic indicators are prepared for economic data release monitoring consensus forecast analysis historical response tracking Fed policy FOMC events

Pump.fun sets off a live coin distribution craze: four popular projects quickly count

Sep 20, 2025 pm 01:12 PM

Pump.fun sets off a live coin distribution craze: four popular projects quickly count

Sep 20, 2025 pm 01:12 PM

Catalog BagworkKINDSTREAMERBUNCOINCLIPpump.fun once again became the focus of the market. This time, not only was its token PUMP listed on the well-known Korean exchange Upbit and its increase in the past week was nearly 60% (Odaily Planet Daily will analyze the fundamental changes of Pump.fun in another in-depth article), but also the unexpected popularity of its live broadcast function. According to GMGN statistics, in the Pump.fun Live's "Graduation" sector, there have been 39 tokens with a market value of more than one million US dollars. The following are the popular projects in the recent Pump.fun live broadcast section compiled by Odaily Planet Daily. Odaily's warm reminder: Me

Good news: China's largest currency holding company plans to increase its position in Bitcoin through additional issuance of US$500 million in stocks

Sep 20, 2025 pm 01:03 PM

Good news: China's largest currency holding company plans to increase its position in Bitcoin through additional issuance of US$500 million in stocks

Sep 20, 2025 pm 01:03 PM

Key information of the catalog: NextTechnology has become the 15th largest enterprise-level Bitcoin holder in the world. Strategy has firmly ranked first in the global corporate currency holding list with 636,505 BTC. NextTechnologyHolding - China's listed company with the most Bitcoin holdings, plans to raise up to US$500 million through the public issuance of common shares to further increase its holdings in BTC and support other companies' strategic layout. Key information: NextTechnology plans to raise $500 million for financing

What is a stablecoin? How does it work? A list of the most well-known stablecoins

Sep 24, 2025 pm 01:54 PM

What is a stablecoin? How does it work? A list of the most well-known stablecoins

Sep 24, 2025 pm 01:54 PM

Directory What is a stablecoin? How does stablecoins work? The decentralized support of cryptocurrencies is based on traditional assets. The classification of stablecoins is supported by algorithms. The stablecoin with fiat currency collateral assets B. The stablecoin with cryptocurrency collateral assets C. Why does the algorithmic stablecoin have stablecoins? The most well-known stablecoins at a glance. Tether (USDT) BinanceUSD (BUSD) USDCoin (USDC) DAI (DAI) Stablecoins Pros and Cons. Stablecoins Controversy and Future Controversy Points: Future Trends: Conclusion: Stablecoins and their role in the cryptocurrency world. What are the common questions about stablecoins? What is the best stablecoin?

What is high-frequency trading of cryptocurrency? How to operate? Analysis of the advantages and disadvantages of high-frequency trading and future development

Sep 24, 2025 pm 01:42 PM

What is high-frequency trading of cryptocurrency? How to operate? Analysis of the advantages and disadvantages of high-frequency trading and future development

Sep 24, 2025 pm 01:42 PM

Table of Contents What is high frequency trading How high frequency trading How high frequency trading does high frequency trading Benefits of high frequency trading HFT execution faster High turnover rate and order trading ratio High frequency trading has huge growth potential overseas High dominance Common HFT strategies How to use algorithms in high frequency trading Disadvantages of high frequency trading How to future high frequency trading The latest developments of cryptocurrency high frequency trading (2023-2025) Cryptocurrency high frequency trading (HFT) is the evolution and application of traditional financial fields strategies in the digital asset market. Below I will fully interpret its definition and fortune for you

What is USDH currency? How does it work? Full analysis of Hyperliquid new stablecoin

Sep 17, 2025 pm 04:39 PM

What is USDH currency? How does it work? Full analysis of Hyperliquid new stablecoin

Sep 17, 2025 pm 04:39 PM

Source: Polymarket On Friday, September 5, 2025, Hyperliquid, which currently occupies an absolute leading position in decentralized derivatives exchanges, announced that it is seeking to issue a "Hyperliquid-first, consistent with Hyperliquid's interests and compliant US dollar stablecoin" and invites the team to submit proposals. The launch of the new stablecoin USDH of Hyperliquid has triggered fierce competition among market makers. Major players such as Paxos, Sky and FraxFinance have all joined the competition to issue USDH, but the lesser-known NativeMarkets is at the forefront. As adoption increases, liquidity supply