web3.0

web3.0

Boring Ape parent company YugaLabs acquires Proof! Moonbird merges into Otherside metaverse

Boring Ape parent company YugaLabs acquires Proof! Moonbird merges into Otherside metaverse

Boring Ape parent company YugaLabs acquires Proof! Moonbird merges into Otherside metaverse

120bTC.coM reported that Yuga Labs, the parent company of the well-known NFT blue-chip project Boring Ape (BAYC), announced the acquisition of Proof, the publisher of "Moonbirds", and plans to integrate Moonbirds into its "Otherside" In the metaverse game.

In the future, Yuga Labs will fully own the works and copyrights of Proof’s series including PROOF Collective, Moonbirds, Oddities, Mythics and Grails.

Since 2022, Yuga Labs has rapidly grown in strength through a series of acquisitions, including the famous NFT brands "CryptoPunks" and "Meebit" owned by Larva Labs, as well as WENEW Labs created by artist Beeple and its NFT series 10KTF, Become one of the most visible studios in the NFT industry.

Refused to disclose the acquisition amount

Yuga Labs’ current CEO Daniel Alegre (former Activision Blizzard chief operating officer) said in a statement that as a company committed to promoting blockchain art, A culture and community development company, we are excited to see PROOF join the Yuga ecosystem.

The Moonbirds range has great potential and has a lot in common with the Otherside brand. We hope that PROOF Collective will become an important part of our current artistic and social engagement programme.

According to reports from The Block and Decrypt, when Yuga Labs was asked about the specific amount spent to acquire Proof, the company refused to disclose the relevant details.

Yuga plans to integrate the Proof team into its workforce. Yuga Labs stated in the statement: "Before Kevin Rose becomes an advisor to the company, he will go through a short transition period."

Kevin Rose, a well-known online entrepreneur and founder of the social news platform Digg, is also there The statement stated: "Proof is excited to bring Moonbirds to Otherside, and the combination of the two companies' resources will allow us to innovate faster and benefit more people."

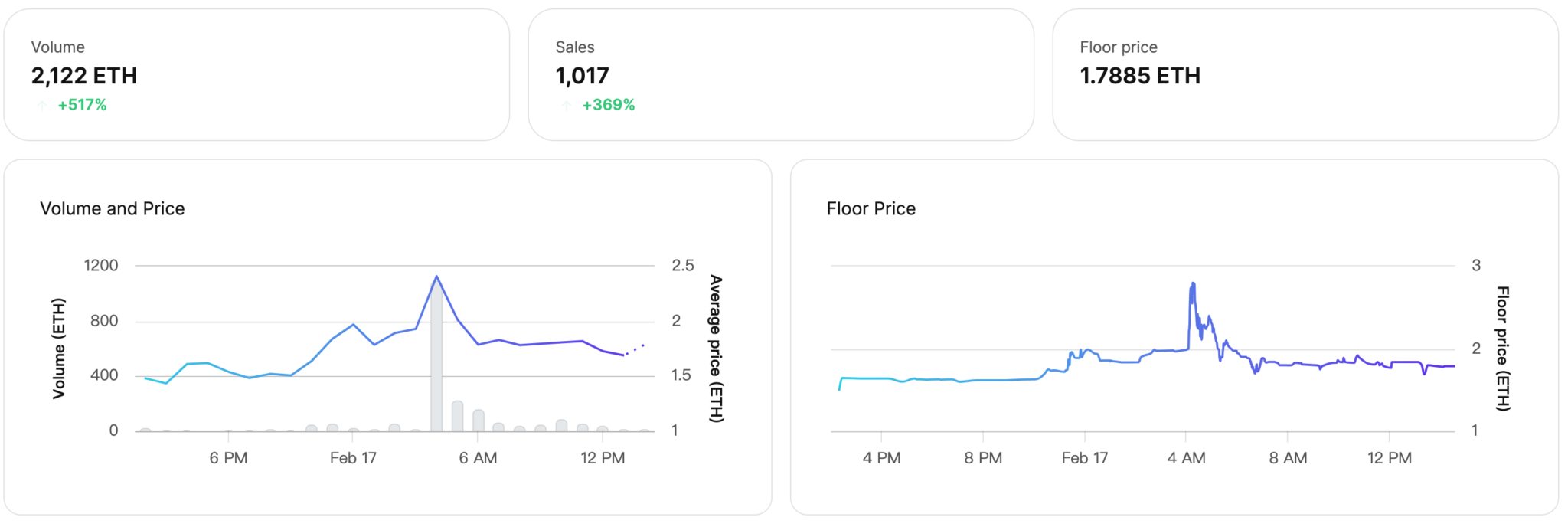

Mononbirds' trading volume surged 517% in the past 24 hours

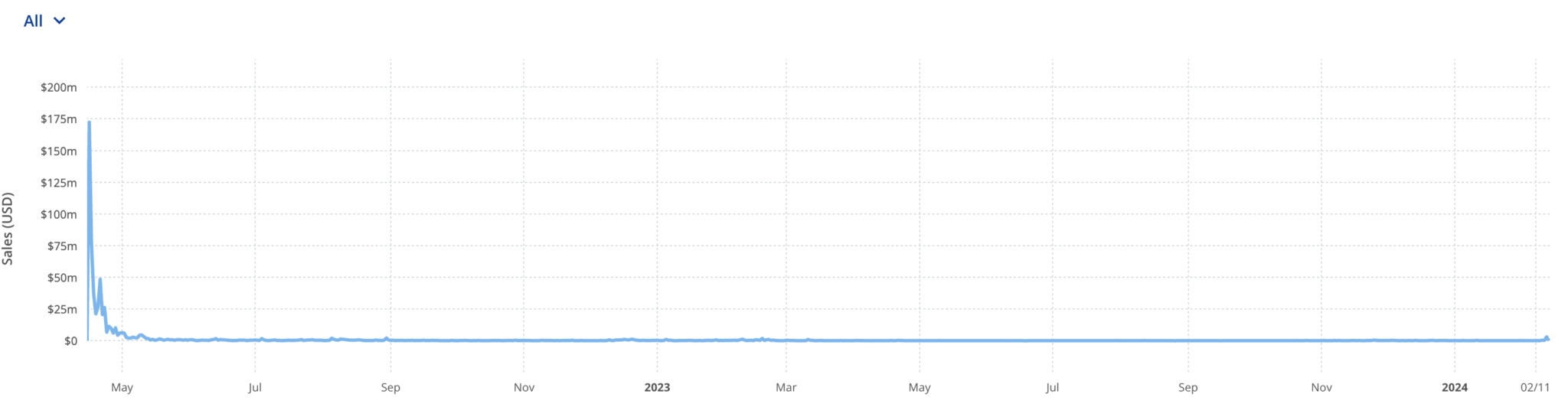

The market value of Moonbirds once exceeded US$500 million in April 2022, showing that it was "peaking right after its debut". Sales immediately fell to less than US$5 million per month, and it has still not improved. The floor price of Moonbirds has also plummeted by more than 95% from the peak of 40 ETH to currently only about 1.7885 ETH (nearly 5,000 US dollars)

After the news of Yuga Labs’ acquisition of Proof was announced at around 4 a.m. today, The floor price of Moonbirds once jumped more than 40%, reaching a maximum of 2.8 ETH (about 7,800 US dollars). The trading volume in the past 24 hours reached 2,122 ETH (5.91 million US dollars), a surge of nearly 517%.

Moonbirds sales continued to be sluggish after May 2022

Moonbirds floor prices once jumped by more than 40%

The above is the detailed content of Boring Ape parent company YugaLabs acquires Proof! Moonbird merges into Otherside metaverse. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

ArtGPT

AI image generator for creative art from text prompts.

Stock Market GPT

AI powered investment research for smarter decisions

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

What is Boundless(ZKC) coin? What is the future potential? ZKC token price forecast

Sep 17, 2025 pm 04:27 PM

What is Boundless(ZKC) coin? What is the future potential? ZKC token price forecast

Sep 17, 2025 pm 04:27 PM

In the active crypto market, the ZKC token issued by Boundless, a second-tier platform focusing on zero-knowledge proof technology, is expected to stabilize around $0.8 before and after listing. ZKC tokens launched WhalesPro's leading TGE pre-trading OTCDEX WhalesPro recently ushered in ZKC tokens, and its inflows continue to rise, with the cumulative total transaction volume exceeding US$307,000. The current ZKC quote on the platform is $0.705, a drop of nearly 12%. However, trading volume surged by more than 734% in 24 hours to $155,971. Buyer's orders are mainly large, with bidding ranges ranging from 0.8 to

What is a black swan event? A article understands the rare impact of the black swan event on cryptocurrency

Sep 11, 2025 pm 04:12 PM

What is a black swan event? A article understands the rare impact of the black swan event on cryptocurrency

Sep 11, 2025 pm 04:12 PM

Table of Contents What is a Black Swan Event? Characteristics of Black Swan Events Black Swan Events Examples of Black Swan Events Psychological Effects of Black Swan Events Why Black Swan Events are Important for Traders Risk Management Strategies Future Is the Impact of Future Risk Management Strategies Prepare for Black Swan Events Is Black Swan Events Good or Bad? Frequently Asked Questions about Cryptocurrency Black Swan Events What is the Black Swan Event simply? Can the black swan event be predicted? How can cryptocurrency investors protect themselves from the black swan event? Conclusion In financial markets, including cryptocurrencies, most price volatility can be explained by the normal pattern of supply and demand and investor sentiment. But sometimes, an unexpected extreme event occurs, no one predicts

Tokenized US stocks are soaring, is 'cryptocurrency brokers” subverting traditional brokers?

Sep 11, 2025 pm 04:30 PM

Tokenized US stocks are soaring, is 'cryptocurrency brokers” subverting traditional brokers?

Sep 11, 2025 pm 04:30 PM

The catalog subverts traditional brokerages? Who is the next Robinhood? "Crypto brokerage", the birth of a new species, the wave of "selling US stocks" has swept the entire cryptocurrency industry. According to incomplete statistics from the author, more than 30 crypto trading platforms on the market have begun to "sell US stocks", of which as many as 10 platforms with more than 10 million users. For example, Bybit (70 million users), Gate (30 million users), Kraken (15 million users), OKXWallet (55 million users), Phantom (1500

How long does it take to trade in Solana? Why faster than other cryptocurrencies? A detailed explanation of this article

Sep 11, 2025 pm 04:24 PM

How long does it take to trade in Solana? Why faster than other cryptocurrencies? A detailed explanation of this article

Sep 11, 2025 pm 04:24 PM

Table of Contents How Solana's architecture achieves fast trading Solana Average transaction time Solana transaction speed vs other blockchains Bitcoin Ethereum Binance Smart Chain (BSC) Why Solana's speed is so important to end users and developers Factors that affect Solana transaction speed 1. Network congestion 2. Verifier performance 3. Application load 4. Network failure and update 5. Finality and confirmation The future of Solana transaction speed 1. Continuous network upgrade 2. Overcoming current capacity 3. Better validator infrastructure 4. Ecosystem construction and optimization 5. Improve

What is Boundless(ZKC) coin? Is it worth investing? Boundless technology architecture, token economics and future prospects

Sep 17, 2025 pm 04:45 PM

What is Boundless(ZKC) coin? Is it worth investing? Boundless technology architecture, token economics and future prospects

Sep 17, 2025 pm 04:45 PM

Directory What is Boundless? Vision and Positioning Target Users and Value Technology Architecture Proof Network: Off-chain Generation Aggregation and Settlement: On-chain Verification PoVW Incentives: Pay for Verified Job Development and Interoperability Integration Path Performance and Security Discussion ZKC Token Economics Supply and Inflation Utility and Value Acquisition Ecosystem Partnership and Latest Progress Recent Milestones and Market Signals Developers and Infrastructure Responds Future Roadmap Verifier Capacity and Geographic Distribution Standardization and SDK Deepening Frequently Asked Questions Key Points Boundless aims to build "verifiable computing" into a cross-chain public service:

What is a stablecoin? How does it work? A list of the most well-known stablecoins

Sep 24, 2025 pm 01:54 PM

What is a stablecoin? How does it work? A list of the most well-known stablecoins

Sep 24, 2025 pm 01:54 PM

Directory What is a stablecoin? How does stablecoins work? The decentralized support of cryptocurrencies is based on traditional assets. The classification of stablecoins is supported by algorithms. The stablecoin with fiat currency collateral assets B. The stablecoin with cryptocurrency collateral assets C. Why does the algorithmic stablecoin have stablecoins? The most well-known stablecoins at a glance. Tether (USDT) BinanceUSD (BUSD) USDCoin (USDC) DAI (DAI) Stablecoins Pros and Cons. Stablecoins Controversy and Future Controversy Points: Future Trends: Conclusion: Stablecoins and their role in the cryptocurrency world. What are the common questions about stablecoins? What is the best stablecoin?

What is Somnia (SOMI) currency? Introduction to recent price trends and future outlook

Sep 17, 2025 am 06:18 AM

What is Somnia (SOMI) currency? Introduction to recent price trends and future outlook

Sep 17, 2025 am 06:18 AM

Directory What is Somnia (SOMI)? Price performance and market trends: Short-term volatility and long-term potential Technical advantages: Why can Somnia challenge the traditional Layer1? Future Outlook: 2025-2030 Price Forecast Conclusion: Somnia's Opportunities and SEO Content Opportunities Somnia (SOMI) is a high-performance Layer1 blockchain native token launched in September 2025. It has recently attracted much attention from the market due to its price fluctuations and technological innovation. As of September 12, 2025, Gate exchange data showed that SOMI price was temporarily at $1.28, although it had a pullback from the historical high of $1.90, it was still better than the main one.

What is high-frequency trading of cryptocurrency? How to operate? Analysis of the advantages and disadvantages of high-frequency trading and future development

Sep 24, 2025 pm 01:42 PM

What is high-frequency trading of cryptocurrency? How to operate? Analysis of the advantages and disadvantages of high-frequency trading and future development

Sep 24, 2025 pm 01:42 PM

Table of Contents What is high frequency trading How high frequency trading How high frequency trading does high frequency trading Benefits of high frequency trading HFT execution faster High turnover rate and order trading ratio High frequency trading has huge growth potential overseas High dominance Common HFT strategies How to use algorithms in high frequency trading Disadvantages of high frequency trading How to future high frequency trading The latest developments of cryptocurrency high frequency trading (2023-2025) Cryptocurrency high frequency trading (HFT) is the evolution and application of traditional financial fields strategies in the digital asset market. Below I will fully interpret its definition and fortune for you