web3.0

web3.0

What is USAT? How does it work? Why does Tether want to launch the USAT stablecoin for the US market?

What is USAT? How does it work? Why does Tether want to launch the USAT stablecoin for the US market?

What is USAT? How does it work? Why does Tether want to launch the USAT stablecoin for the US market?

Table of contents

- What is the Tether USAT stablecoin and how does it work?

- Why is Tether going to launch the USAT stablecoin for the US market?

- Tether hires Trump's crypto adviser Bo Hines to lead USAT

- How is USAT different from USDT?

- Tether and Circle: The stakes of the stablecoin battle?

- What does Tether’s issuance of USAT in the United States mean for the future of stablecoins?

- Summarize

- Frequently Asked Questions about Tether (USAT)

- 1. What is a Tether USAT stablecoin?

- 2. How does Tether USAT work?

- 3. How is USAT different from USDT?

- 4. Who leads Tether USAT?

- 5. Is Tether USAT legal currency or FDIC underwriting?

- 6. Why did Tether launch USAT in the United States?

- 7. When was Tether USAT launched?

In a dramatic shift that could reshape the stablecoin industry, Tether released the USAT on September 12, 2025. USAT is a US dollar-pegged token that complies with U.S. regulations and is designed to meet the newly passed GENIUS Act requirements. Tether's USDT is the backbone of the digital asset economy, with a market capitalization of over $169 billion and daily transaction volumes surpass even leading credit card networks and global remittance giants.

With the launch of the USAT, the world's largest stablecoin issuer is showing that it is ready to comply with U.S. rules. According to the Tether website, USAT aims to achieve the “highest standards of transparency, compliance and financial resilience [new digital dollar]”.

Source: Tether

USAT is Tether's upcoming US-regulated, US dollar-backed stablecoin, designed for the US market and complies with domestic regulatory standards. Positioned as the basis of the next wave of business, trade and finance, USAT aims to bring stability and compliance to the U.S. digital economy. The move underlines Tether's determination to strengthen the U.S. leadership in the global digital asset field. As part of the broader Tether ecosystem, USAT sets a new benchmark for practical stablecoins by providing long-term value, robust governance and practical real-world use cases.

What is the Tether USAT stablecoin and how does it work?

Tether USAT is a US dollar-pegged stablecoin that complies with U.S. regulations and is designed to meet the requirements of the GENIUS Act, a new federal law regarding stablecoin issuers. Unlike Tether's flagship USDT, which operates offshore, the USAT is issued by federally licensed crypto bank Anchorage Digital Bank, whose reserves are hosted by Cantor Fitzgerald, one of Wall Street's major financial institutions. This structure is designed to ensure transparent, fully supported reserves and robust governance standards.

USAT works very similarly to other stablecoins: Each token is backed by current assets such as USD and short-term Treasury bills in a 1:1 ratio. Holders can use it for payments, transactions, remittances or fund management, while institutions obtain regulatory approval for digital trading options for USD. Unlike Bitcoin or Ethereum, the price of USAT does not fluctuate. It aims to remain parity with the US dollar and provide stability in the rapidly changing cryptocurrency market. USAT combines Tether’s global liquidity expertise with compliance features tailored for the U.S. market by operating on a regulated track and conducting trackable transactions.

Why is Tether going to launch the USAT stablecoin for the US market?

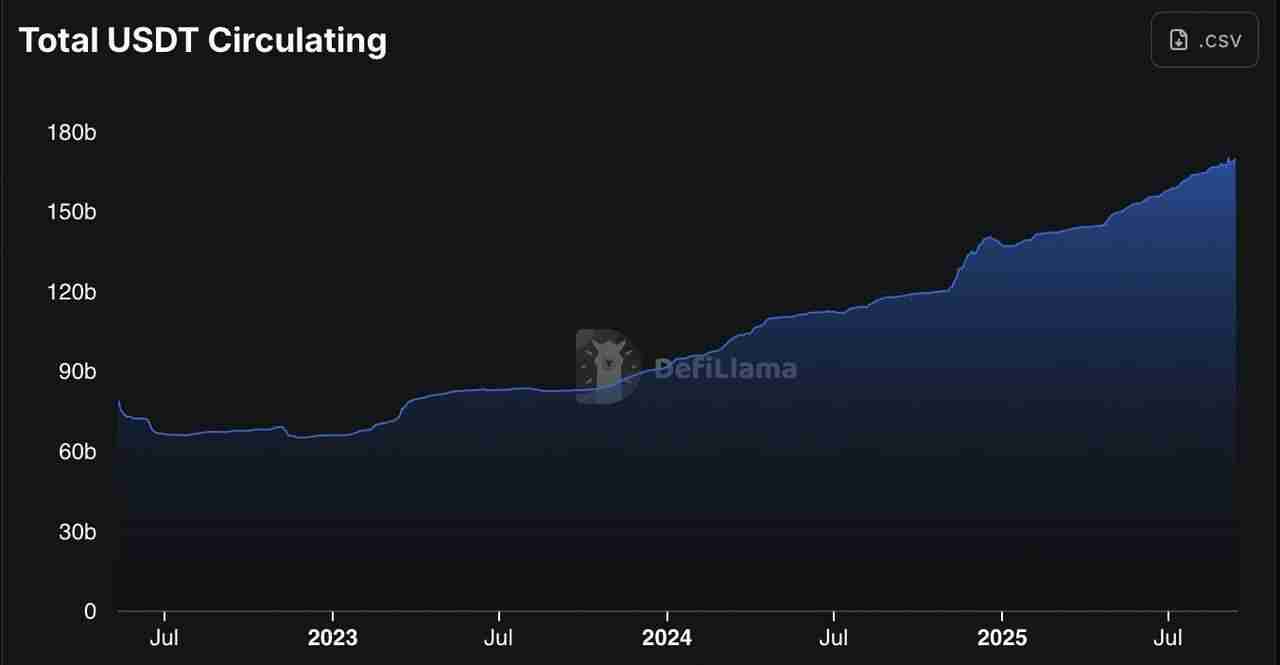

Source: Defillama

The timing of Tether launching the USAT is by no means accidental. The GENIUS Act is a comprehensive federal law designed to tighten regulation of stablecoin issuers, forcing offshore operators to either adapt or risk being excluded from the lucrative U.S. market. Tether's flagship token USDT has a market capitalization of more than US$170 billion, accounting for about 60% to 66% of the global stablecoin market.

USDT has been widely regarded as a digital dollar for emerging and developing markets, with current users reaching nearly 500 million. The main impact lies in serving traditional financial institutions with underserved banking, unbanked service providers and inadequate services that traditional financial institutions have historically excluded them due to high fees. Meanwhile, Tether Group also made headlines for its profitability, achieving more than US$13 billion in 2024 and is expected to achieve another success in 2025. By launching USAT, and being released by Anchorage Digital and hosted by Wall Street giant Cantor Fitzgerald, Tether is showing it is ready to comply with U.S. regulations.

Tether hires Trump's crypto adviser Bo Hines to lead USAT

Source: Rolling Stone

The spokesperson for USAT is Bo Hines, a 30-year-old former college athlete and policy insider in the Trump era. His political trajectory accelerated in 2025, when President Trump appointed him as a member of the President’s Digital Assets Committee and later on to the White House Digital Assets Advisory Committee.

Hines’ deep connection to governance and innovation makes him a reasonable candidate to guide USAT through the US regulatory maze. “I am honored to lead the launch of the USAT to create a US dollar-backed stablecoin regulated by the US and aim to strengthen the U.S. role in the global economy,” said Bo Hines, CEO-elect of Tether USAT. “By making compliance, transparency and innovation at the core of the USAT, we are ensuring that the US dollar remains the cornerstone of trust in the digital asset space.”

How is USAT different from USDT?

Unlike its overseas sister coins, the USAT is constructed to meet every requirement of the GENIUS Act, including transparent reserve requirements, strict governance standards, and custody by federal charter agencies. It is worth noting, however, that USAT is not a fiat currency, is not protected by the Federal Deposit Insurance Corporation (FDIC) and has no government support, which is the same warning that all private stablecoins apply. Through its partnership with Anchorage Digital and Cantor Fitzgerald, Tether demonstrates its determination to get rid of its reputation as “blind-operating.” If run properly, USAT could bridge the gap between Tether’s global liquidity and U.S. regulatory trust.

Tether and Circle: The stakes of the stablecoin battle?

Data source: Protos

The current stablecoin market value is over US$288 billion, dominated by two giants Tether and Circle. USDT dominated the transaction and payments sector, especially in developing economies with nearly 500 million lacking banking users; while USDC created trust among institutions with the advantages of regular audits and full compliance with U.S. regulation. By issuing USAT, Tether is launching a challenge directly at Circle's home court. Will this be a key step to turn the situation around, or will USDC’s reputation keep it ahead of the regulated market?

What does Tether’s issuance of USAT in the United States mean for the future of stablecoins?

Will USAT be the token that will eventually give Tether a legitimate position in the United States, or the beginning of a more intense competition with Circle? The current response is mixed. Supporters believe that USAT is a "important step in the hegemony of the US dollar", while skeptics worry that the market will become fragmented as a result.

If USAT succeeds, Tether's influence could expand from emerging markets to Wall Street, consolidating the dollar's digital hegemony globally. However, it depends heavily on whether it can win this transparency battle it has long shied away from.

Summarize

The launch of the USAT is not just a new stablecoin, it is also a turning point in the power struggle between offshore giants and U.S. regulators. For Tether, it was a well-thought-out gamble: first abide by the norms and then occupy the market. For the industry as a whole, this proves that the era of unregulated stablecoins is coming to an end. One thing is clear: Stablecoins dominate the cryptocurrency space more solid than ever before, and USAT may be the spark of the next stage of cryptocurrency development.

Frequently Asked Questions about Tether (USAT)

1. What is a Tether USAT stablecoin?

Tether USAT is a compliant USD pegged stablecoin launched in September 2025. It is issued by Anchorage Digital Bank and the reserve fund is escrowed by Cantor Fitzgerald to meet the requirements of the GENIUS Act.

2. How does Tether USAT work?

USAT maintains a 1:1 peg to the US dollar through current assets such as cash and short-term US Treasury bills as reserves. It provides American businesses and institutions with customized, regulated, transparent and traceable transactions.

3. How is USAT different from USDT?

USDT is an offshore stablecoin serving the global market, while USAT is designed specifically for compliance with the US GENIUS Act. Unlike USDT, USAT has federally licensed issuing agencies, regulated trustees, and stricter governance standards.

4. Who leads Tether USAT?

In 2025, former White House digital assets adviser Bo Hines was appointed CEO of Tether USAT. He is responsible for guiding the token to meet U.S. regulatory requirements and promoting institutional adoption.

5. Is Tether USAT legal currency or FDIC underwriting?

no. Like all private stablecoins, USAT is not a fiat currency, is not supported by the government, and is not covered by FDIC. Its value depends on transparent reserves and compliance with federal regulations.

6. Why did Tether launch USAT in the United States?

Tether introduced the USAT to comply with the GENIUS Act and to expand the U.S. market. This allows Tether to compete directly with Circle's USDC while also strengthening the role of the dollar in the digital economy.

7. When was Tether USAT launched?

Tether officially announced the launch of USAT on September 12, 2025, and plans to open the stablecoin to U.S. residents by the end of that year.

What is this article about USAT? How does it work? Why does Tether want to launch the USAT stablecoin for the US market? That’s all for the article. For more comprehensive introduction to USAT coins, please search for previous articles on this site or continue browsing the related articles below. I hope everyone will support this site in the future!

The above is the detailed content of What is USAT? How does it work? Why does Tether want to launch the USAT stablecoin for the US market?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

ArtGPT

AI image generator for creative art from text prompts.

Stock Market GPT

AI powered investment research for smarter decisions

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

What is a stablecoin? How does it work? A list of the most well-known stablecoins

Sep 24, 2025 pm 01:54 PM

What is a stablecoin? How does it work? A list of the most well-known stablecoins

Sep 24, 2025 pm 01:54 PM

Directory What is a stablecoin? How does stablecoins work? The decentralized support of cryptocurrencies is based on traditional assets. The classification of stablecoins is supported by algorithms. The stablecoin with fiat currency collateral assets B. The stablecoin with cryptocurrency collateral assets C. Why does the algorithmic stablecoin have stablecoins? The most well-known stablecoins at a glance. Tether (USDT) BinanceUSD (BUSD) USDCoin (USDC) DAI (DAI) Stablecoins Pros and Cons. Stablecoins Controversy and Future Controversy Points: Future Trends: Conclusion: Stablecoins and their role in the cryptocurrency world. What are the common questions about stablecoins? What is the best stablecoin?

What is high-frequency trading of cryptocurrency? How to operate? Analysis of the advantages and disadvantages of high-frequency trading and future development

Sep 24, 2025 pm 01:42 PM

What is high-frequency trading of cryptocurrency? How to operate? Analysis of the advantages and disadvantages of high-frequency trading and future development

Sep 24, 2025 pm 01:42 PM

Table of Contents What is high frequency trading How high frequency trading How high frequency trading does high frequency trading Benefits of high frequency trading HFT execution faster High turnover rate and order trading ratio High frequency trading has huge growth potential overseas High dominance Common HFT strategies How to use algorithms in high frequency trading Disadvantages of high frequency trading How to future high frequency trading The latest developments of cryptocurrency high frequency trading (2023-2025) Cryptocurrency high frequency trading (HFT) is the evolution and application of traditional financial fields strategies in the digital asset market. Below I will fully interpret its definition and fortune for you

What is ARAI (AA) currency? Is it worth investing? AA Token Price Forecast 2025

Sep 24, 2025 pm 01:45 PM

What is ARAI (AA) currency? Is it worth investing? AA Token Price Forecast 2025

Sep 24, 2025 pm 01:45 PM

Table of Contents 1. ARAI project overview 2. Basic information of AA tokens 3. AA token price performance 4. AA token price prediction 5. Factors affecting the price of AA tokens 6. How to trade AA tokens on Gate and participate in activities? 7. Investment risks and precautions Future Outlook Today, as the crypto market is constantly looking for new hot spots, ARAI (AA) has been a project that combines AI and Web3, and its recent performance has been eye-catching. Its token AA has increased its price by more than 40.13% in the past 24 hours, with transaction volume reaching US$53.96 million. It works with Google

What is MemeCoin? How does it work? The most famous meme coins

Sep 24, 2025 pm 01:48 PM

What is MemeCoin? How does it work? The most famous meme coins

Sep 24, 2025 pm 01:48 PM

Table of Contents Definition: What is a meme coin? Why do meme coins exist? What's special about meme coins? How does meme coins work? The most well-known meme coins overview Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), Bonk (BONK) FLOKI (FLOKI) Meme Coin (MEME) Meme Coin Opportunities and Risks How to Buy Meme Coins? Conclusion: The future of meme coins in the crypto world What are the common questions about meme coins? What is the best meme coin? What is the prediction of meme coins? What should you consider when purchasing meme coins? What role does market capitalization play in meme coins? Meme coins are usually popular on the Internet

What is Xterio(XTER) coin? XTER token function, price forecast 2025-2030

Sep 22, 2025 pm 07:51 PM

What is Xterio(XTER) coin? XTER token function, price forecast 2025-2030

Sep 22, 2025 pm 07:51 PM

Directory What is Xterio? Xterio's vision and core technology Powerful financial support and partners XTER token functions and uses XTER token market data analysis Factors affecting XTER price XTER token price forecast 2025 price forecast Long-term price forecast (2026-2030) Risks and opportunities for investing in XTER Potential Opportunity Risk Warning Summary In the field of blockchain gaming (GameFi), Xterio is making its mark as a decentralized gaming infrastructure and distribution platform that combines AAA games with on-chain rewards and ownership models. Its native

What is a Fully Dilution Valuation (FDV) in Cryptocurrencies? Analysis of FDV pointer, the difference between FDV and market value

Sep 22, 2025 pm 07:39 PM

What is a Fully Dilution Valuation (FDV) in Cryptocurrencies? Analysis of FDV pointer, the difference between FDV and market value

Sep 22, 2025 pm 07:39 PM

Table of Contents What is a Fully Dilution Valuation (FDV) in Cryptocurrency? Why is there an FDV? How did it form? Example of calculation of the difference between market value (MC) and fully diluted valuation (FDV): What impact will ABC token have on the price of the currency? 1. Token unlocking brings selling pressure 2. Increased market supply may lead to a price drop 3. Low circulation leads to valuation distortion What high FDV coins are there in the market? 1.WLD (Worldcoin) 2.APT (Aptos) 3.ARB (Arbitrum) 4.TRUMP (OfficialTr

What is BIP? Why are they so important to the future of Bitcoin?

Sep 24, 2025 pm 01:51 PM

What is BIP? Why are they so important to the future of Bitcoin?

Sep 24, 2025 pm 01:51 PM

Table of Contents What is Bitcoin Improvement Proposal (BIP)? Why is BIP so important? How does the historical BIP process work for Bitcoin Improvement Proposal (BIP)? What is a BIP type signal and how does a miner send it? Taproot and Cons of Quick Trial of BIP ConclusionAny improvements to Bitcoin have been made since 2011 through a system called Bitcoin Improvement Proposal or “BIP.” Bitcoin Improvement Proposal (BIP) provides guidelines for how Bitcoin can develop in general, there are three possible types of BIP, two of which are related to the technological changes in Bitcoin each BIP starts with informal discussions among Bitcoin developers who can gather anywhere, including Twi

What is Polymarket? Latest news on the potential issuance of Polymarket tokens

Sep 24, 2025 pm 01:33 PM

What is Polymarket? Latest news on the potential issuance of Polymarket tokens

Sep 24, 2025 pm 01:33 PM

Directory What is Polymarket? Comprehensive overview of the key features of Polymarket speculation about the issuance of Polymarket tokens Polymarket tokens may offer features compared to the dYdX token issuance of financing rounds with Polymarket’s growing valuation Why investors are confident about Polymarket’s key partnerships to drive Polymarket growth with Stocktwits’ collaboration with Chainlink’s integration into the U.S. market with compliance regulatory milestones Polymarket tokens’ potential uses are the most