Will the Solana ETF be approved in 2025? SOL ETF debuts at DTCC

Solana ETF: Can it be approved this year? What impact will it have on the market?

After the approval of Bitcoin and Ethereum spot ETFs, the market's attention turned to the next potential ETF target: Solana. Several companies have submitted applications for Solana ETF, which has sparked heated discussions on the possibility that SOL spot ETF will be approved this year.

Latest progress in Solana ETF

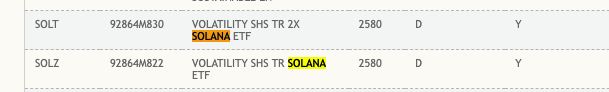

Recently, Volatility Shares' two Solana futures ETFs have been included in the US Securities Centralized Custody and Settlement Company (DTCC), indicating that the Solana ETF ecosystem has entered a critical stage and has also increased the expectation of SOL spot ETF approval. DTCC plays a central role in global financial markets, and its list means that these products are ready to be traded in traditional markets.

The approval of SOL spot ETF will attract institutional investment and enhance Solana's market liquidity and stability. But the final decision of the SEC depends on factors such as the regulatory environment and cryptocurrency market performance.

Main applicants

VanEck, Volatility Shares and other companies have submitted Solana ETF applications to the SEC. VanEck's application defines SOL as a commodity, not a securities, which is contrary to the SEC's previous recognition of SOL. Volatility Shares applied for Solana futures ETFs with different leverage multiples.

Matthew Sigel, head of digital assets research at VanEck, believes that SOL's functions are similar to Bitcoin and Ethereum, and its decentralization, high practicality and economic viability make it a commodity. He also announced VanEck's application on Twitter:

I am excited to announce that VanEck just filed for the FIRST Solana exchange-traded fund (ETF) in the US.

Some thoughts on why we believe SOL is a commodity are below.

Why did we file for it?

A competitor to Ethereum, Solana is open-source blockchain software designed to…pic.twitter.com/XwwPy8BXV2— matthew sigel, recovering CFA (@matthew_sigel)June 27, 2024

Bloomberg ETF analysts believe that Volatility Shares' application indicates the possibility of spot Solana ETF approval. The SEC has recently acknowledged the Solana ETF applications of several issuers, indicating that the approval process has progressed. However, it should be noted that listing of DTCC does not mean that the fund can trade immediately.

Probability of approval this year?

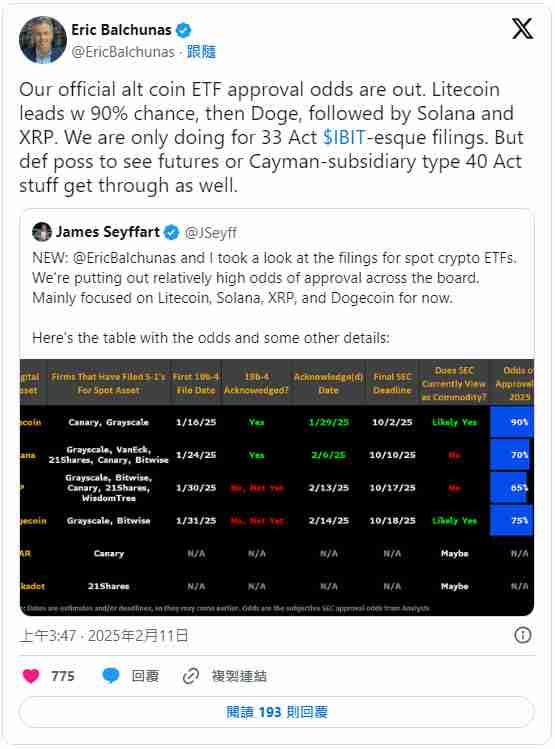

SEC approved several Bitcoin spot ETFs in January 2024, and then approved the Ethereum spot ETF. Bloomberg ETF analysts predict that the probability of Solana spot ETF being approved by the end of 2025 is 70%.

The approval of the Solana ETF will mark the further development of the integration of blockchain and traditional finance, but the biggest obstacle is still a legal issue. The SEC previously identified SOL as an unregistered securities and SOL lacks a mature futures market.

Market maker GSR believes that Solana has strong market demand and a highly decentralized network, which is expected to attract ETF issuers. They predict that if SOL's inflows reach 5% of Bitcoin, its price could rise more than triple. JPMorgan analysts expect the approved Solana ETF spot could attract $3 billion to $6 billion in assets in the first year.

SOL future price trend

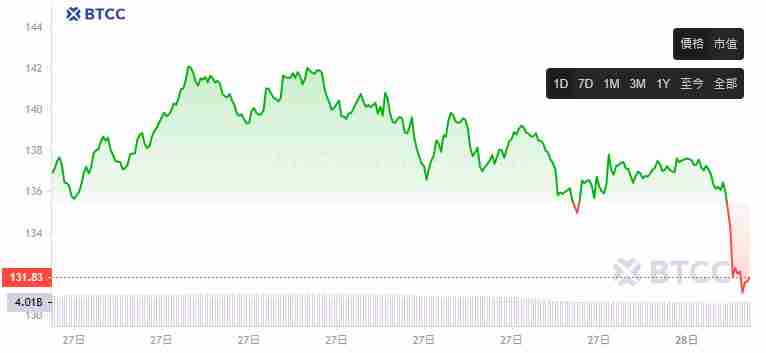

As of February 28, 2025, the SOL price was $137.85. SOL currently ranks sixth in market value, with a 24-hour trading volume of $9.6 billion.

Summary

The approval of the Solana ETF and its time will have a significant impact on the price of Solana and the overall cryptocurrency market. Although facing challenges such as legal and market maturity, its potential market opportunities and institutional investment attractiveness cannot be ignored.

The above is the detailed content of Will the Solana ETF be approved in 2025? SOL ETF debuts at DTCC. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

ArtGPT

AI image generator for creative art from text prompts.

Stock Market GPT

AI powered investment research for smarter decisions

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

What is a stablecoin? How does it work? A list of the most well-known stablecoins

Sep 24, 2025 pm 01:54 PM

What is a stablecoin? How does it work? A list of the most well-known stablecoins

Sep 24, 2025 pm 01:54 PM

Directory What is a stablecoin? How does stablecoins work? The decentralized support of cryptocurrencies is based on traditional assets. The classification of stablecoins is supported by algorithms. The stablecoin with fiat currency collateral assets B. The stablecoin with cryptocurrency collateral assets C. Why does the algorithmic stablecoin have stablecoins? The most well-known stablecoins at a glance. Tether (USDT) BinanceUSD (BUSD) USDCoin (USDC) DAI (DAI) Stablecoins Pros and Cons. Stablecoins Controversy and Future Controversy Points: Future Trends: Conclusion: Stablecoins and their role in the cryptocurrency world. What are the common questions about stablecoins? What is the best stablecoin?

What is high-frequency trading of cryptocurrency? How to operate? Analysis of the advantages and disadvantages of high-frequency trading and future development

Sep 24, 2025 pm 01:42 PM

What is high-frequency trading of cryptocurrency? How to operate? Analysis of the advantages and disadvantages of high-frequency trading and future development

Sep 24, 2025 pm 01:42 PM

Table of Contents What is high frequency trading How high frequency trading How high frequency trading does high frequency trading Benefits of high frequency trading HFT execution faster High turnover rate and order trading ratio High frequency trading has huge growth potential overseas High dominance Common HFT strategies How to use algorithms in high frequency trading Disadvantages of high frequency trading How to future high frequency trading The latest developments of cryptocurrency high frequency trading (2023-2025) Cryptocurrency high frequency trading (HFT) is the evolution and application of traditional financial fields strategies in the digital asset market. Below I will fully interpret its definition and fortune for you

Huawei HarmonyOS 6 system cancels the 'NEXT' suffix: It will be native Hongmeng in the future

Sep 24, 2025 pm 04:12 PM

Huawei HarmonyOS 6 system cancels the 'NEXT' suffix: It will be native Hongmeng in the future

Sep 24, 2025 pm 04:12 PM

The latest news on September 18th, Huawei HarmonyOS6 has launched multiple rounds of preview version push for developers, and has recently opened the experience qualification to some users who have tried it out for the first time. According to user feedback, the current system name no longer displays the "NEXT" suffix, and it is officially renamed to HarmonyOS6.0. Huawei initially proposed the name HarmonyOSNEXT for the first time at the developer conference in August 2023, aiming to mark the Hongmeng system entering a new stage of development and realizing true native self-development. HarmonyOSNEXT's most core breakthrough is to completely adopt the underlying system architecture developed independently, completely remove the Linux kernel and Android AOSP code, and only run applications based on the HarmonyOS kernel.

What is ARAI (AA) currency? Is it worth investing? AA Token Price Forecast 2025

Sep 24, 2025 pm 01:45 PM

What is ARAI (AA) currency? Is it worth investing? AA Token Price Forecast 2025

Sep 24, 2025 pm 01:45 PM

Table of Contents 1. ARAI project overview 2. Basic information of AA tokens 3. AA token price performance 4. AA token price prediction 5. Factors affecting the price of AA tokens 6. How to trade AA tokens on Gate and participate in activities? 7. Investment risks and precautions Future Outlook Today, as the crypto market is constantly looking for new hot spots, ARAI (AA) has been a project that combines AI and Web3, and its recent performance has been eye-catching. Its token AA has increased its price by more than 40.13% in the past 24 hours, with transaction volume reaching US$53.96 million. It works with Google

iPhone 17 starts with the first release: Pro-level screen is placed, and it feels very stuck when changing back to 16.

Sep 24, 2025 pm 02:57 PM

iPhone 17 starts with the first release: Pro-level screen is placed, and it feels very stuck when changing back to 16.

Sep 24, 2025 pm 02:57 PM

On September 17, the iPhone 17 series review was officially lifted, and the Huangjia Review immediately released the first launch experience of the series. This time, the iPhone 17 has launched four models, namely iPhone 17, iPhone 17 Pro, iPhone 17 ProMax and the newly unveiled iPhone Air. Among them, the standard version of iPhone 17 has undergone a significant upgrade, and is equipped with a high-end screen that was previously only available in the Pro series for the first time. The new phone is equipped with a 6.3-inch ProMotion adaptive high refresh rate screen, with a peak brightness of up to 3,000 nits, and a second-generation anti-reflective super-ceramic crystal glass panel. The core display parameters have been fully matched with the iPhone 17P.

What is MemeCoin? How does it work? The most famous meme coins

Sep 24, 2025 pm 01:48 PM

What is MemeCoin? How does it work? The most famous meme coins

Sep 24, 2025 pm 01:48 PM

Table of Contents Definition: What is a meme coin? Why do meme coins exist? What's special about meme coins? How does meme coins work? The most well-known meme coins overview Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), Bonk (BONK) FLOKI (FLOKI) Meme Coin (MEME) Meme Coin Opportunities and Risks How to Buy Meme Coins? Conclusion: The future of meme coins in the crypto world What are the common questions about meme coins? What is the best meme coin? What is the prediction of meme coins? What should you consider when purchasing meme coins? What role does market capitalization play in meme coins? Meme coins are usually popular on the Internet

What is BIP? Why are they so important to the future of Bitcoin?

Sep 24, 2025 pm 01:51 PM

What is BIP? Why are they so important to the future of Bitcoin?

Sep 24, 2025 pm 01:51 PM

Table of Contents What is Bitcoin Improvement Proposal (BIP)? Why is BIP so important? How does the historical BIP process work for Bitcoin Improvement Proposal (BIP)? What is a BIP type signal and how does a miner send it? Taproot and Cons of Quick Trial of BIP ConclusionAny improvements to Bitcoin have been made since 2011 through a system called Bitcoin Improvement Proposal or “BIP.” Bitcoin Improvement Proposal (BIP) provides guidelines for how Bitcoin can develop in general, there are three possible types of BIP, two of which are related to the technological changes in Bitcoin each BIP starts with informal discussions among Bitcoin developers who can gather anywhere, including Twi

What is Polymarket? Latest news on the potential issuance of Polymarket tokens

Sep 24, 2025 pm 01:33 PM

What is Polymarket? Latest news on the potential issuance of Polymarket tokens

Sep 24, 2025 pm 01:33 PM

Directory What is Polymarket? Comprehensive overview of the key features of Polymarket speculation about the issuance of Polymarket tokens Polymarket tokens may offer features compared to the dYdX token issuance of financing rounds with Polymarket’s growing valuation Why investors are confident about Polymarket’s key partnerships to drive Polymarket growth with Stocktwits’ collaboration with Chainlink’s integration into the U.S. market with compliance regulatory milestones Polymarket tokens’ potential uses are the most